- Home

- Insights

Insights

Comerica Small Business Pulse Index™

Small Business Pulse - Q4 2025

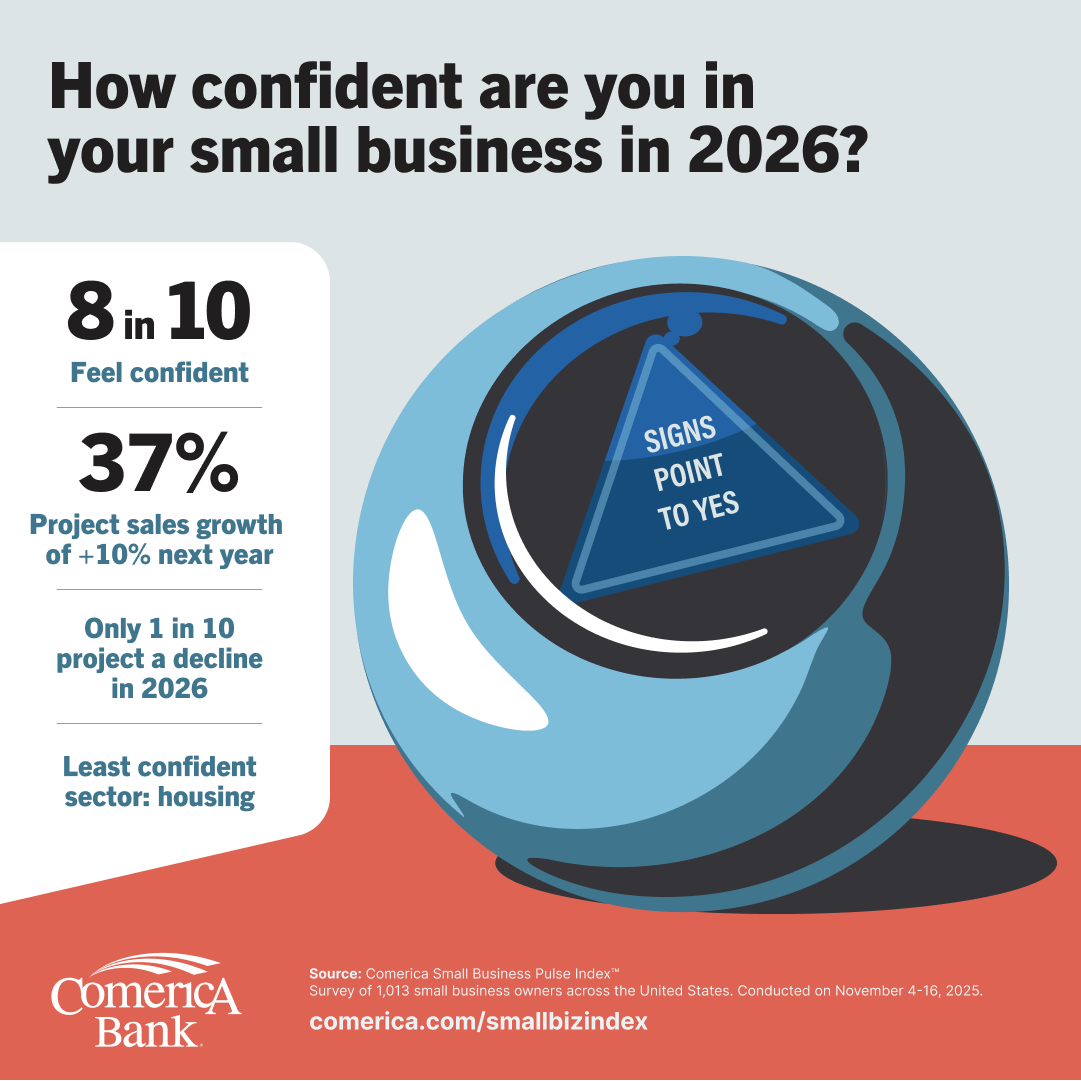

After a year marked by economic uncertainty, policy shifts, and a historic government shutdown, America's small businesses are entering 2026 with strength and resolve. According to the latest edition of the Comerica Small Business Pulse Index™, 80% of surveyed small business owners are confident in their future success, and nearly 8 in 10 (79%) expect sales growth in the coming year – underscoring the sector's adaptability amid challenging conditions.

Celebrity estate series

Featured Contributors

Bill Adams

SVP, Chief Economist

Comerica Bank

Comerica Bank

Bill leads Comerica's Economics Department, providing research and analysis that impact the bank's key markets, as well as business leaders and policy makers throughout the country.

Lisa R. Featherngill

CFP®

SVP, National Director of Strategic Wealth and Business Advisory

Comerica Wealth Management

SVP, National Director of Strategic Wealth and Business Advisory

Comerica Wealth Management

She leads a team of experienced and credentialed wealth planning specialists who develop customized solutions for business owners and high-net-worth individuals.

Melissa J. Linn

CFP®

SVP, Senior Wealth Strategist

Comerica Wealth Management

SVP, Senior Wealth Strategist

Comerica Wealth Management

She specializes in having strategic conversations with clients to maximize opportunities and minimize unintended consequences.

Janelle Walker

CEPA®

SVP, Private Wealth Regional Managing Director

Comerica Wealth Management

SVP, Private Wealth Regional Managing Director

Comerica Wealth Management

Janelle Walker is Senior Vice President, Private Wealth Regional Managing Director, where she directs all management activities, while managing a highly-credentialled team of Private Wealth Management professionals in north and central Texas.

Latest articles

Economic Weekly by Bill Adams and Waran Bhahirethan

FX Commentary and Calendar