After a year marked by economic uncertainty, policy shifts, and a historic government shutdown, America's small businesses are entering 2026 with strength and resolve. According to the latest edition of the Comerica Small Business Pulse Index™, 80% of surveyed small business owners are confident in their future success, and nearly 8 in 10 (79%) expect sales growth in the coming year – underscoring the sector's adaptability amid challenging conditions.

"Small businesses have navigated a year filled with challenges, from tariffs and inflation to a prolonged government shutdown – yet their optimism remains unwavering," says Larry Franco, Comerica Bank Executive Vice President and National Director of Retail & Small Business Banking. "This spirit speaks volumes about the adaptability and determination of America's entrepreneurs as they prepare for growth in 2026."

The infographics featured on this page are available for download and may be used by media outlets, journalists, and other third parties. Please ensure proper attribution to Comerica Bank and the Comerica Small Business Pulse Index™ when sharing or publishing.

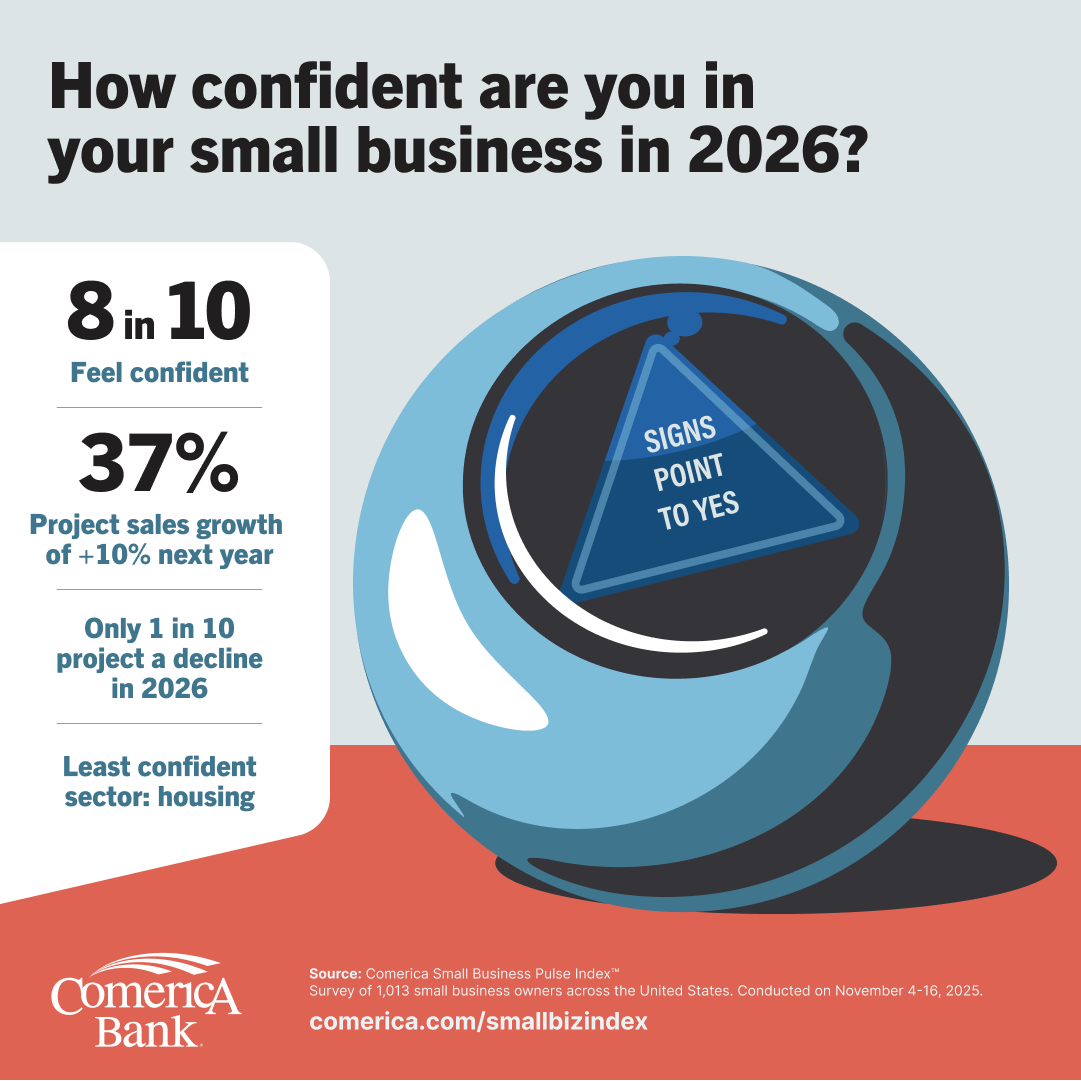

Confidence holds strong

80% of respondents are somewhat or very confident about their business outlook for the next 12 months. Confidence peaks in the South (83%) and among technology firms (93%), health care (90%), and businesses with 10 or more employees (88%). Housing and real estate firms report the lowest confidence at 67%.

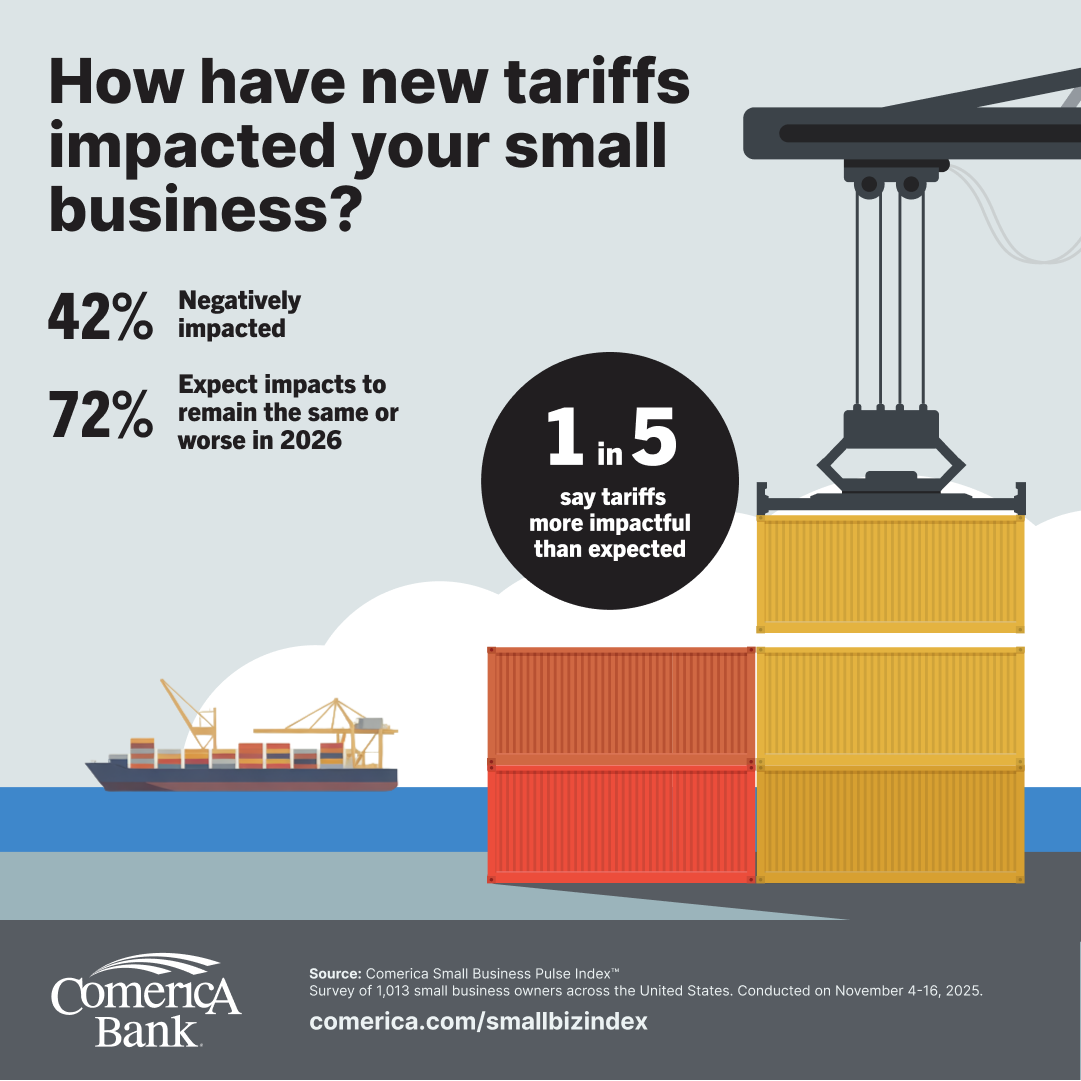

Tariff impact

42% of surveyed small businesses report negative effects from tariffs introduced in 2025, with manufacturing and retail sectors hardest hit. Most expect these impacts to persist or worsen in 2026.

Tariff adjustments

With 42% of responding small businesses reporting negative effects from tariffs introduced in 2025, owners took or are considering decisive steps to protect their operations.

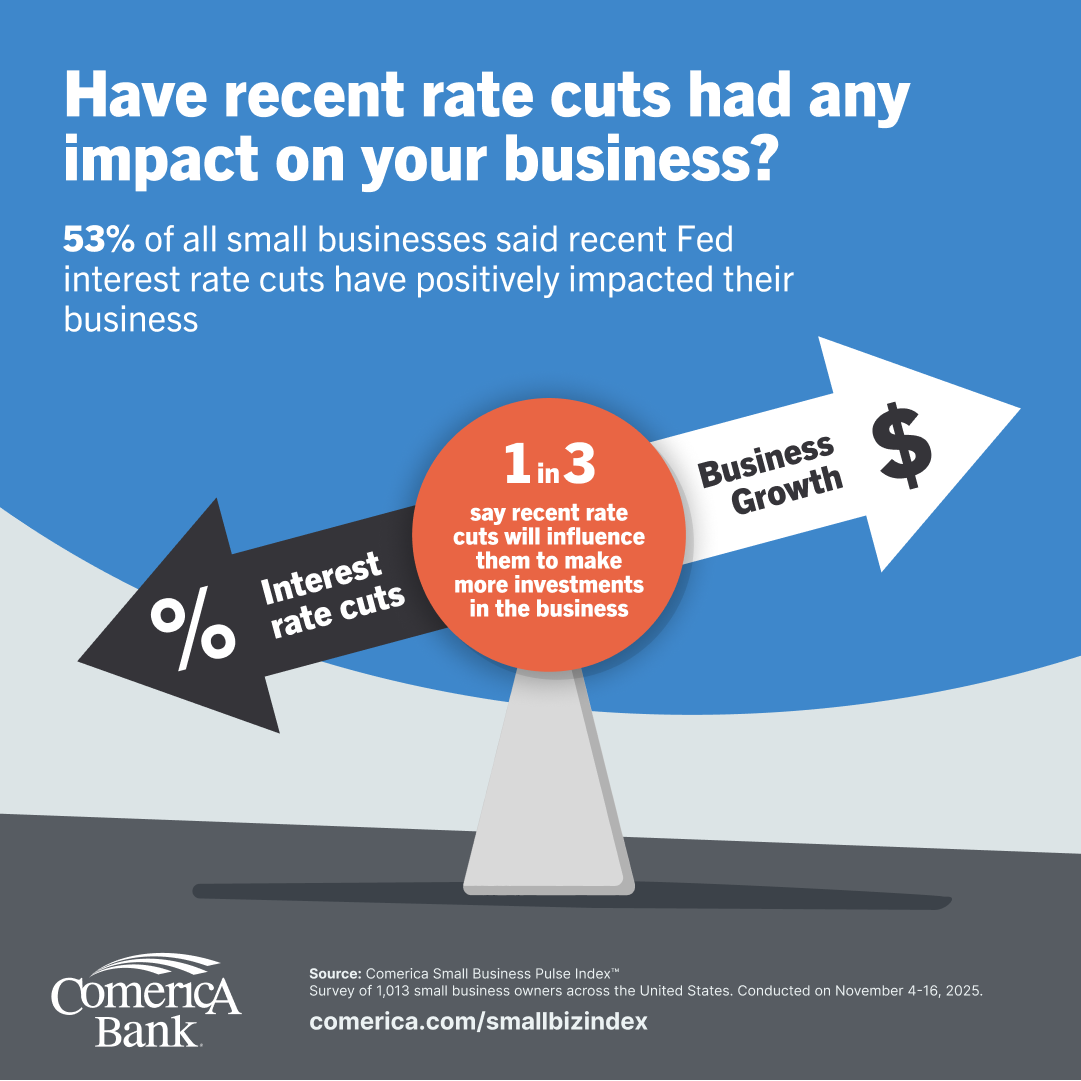

"Policy shifts, from tariffs to interest rate cuts, are reshaping how small businesses operate," added Franco. "While trade challenges have driven rising costs and supply chain disruptions, many owners are responding with creativity and leveraging lower borrowing costs to invest and innovate, signaling a proactive approach to growth in 2026."

Interest rate relief

More than half (53%) of respondents say recent Federal Reserve rate cuts have positively impacted their business, prompting 1 in 3 to invest more or take calculated risks heading into 2026.

Sales growth expectations

79% of respondents anticipate revenue growth in 2026, with an average projected increase of 7.9%. Technology and construction firms lead in optimism, while sole proprietors and retail businesses show more caution.

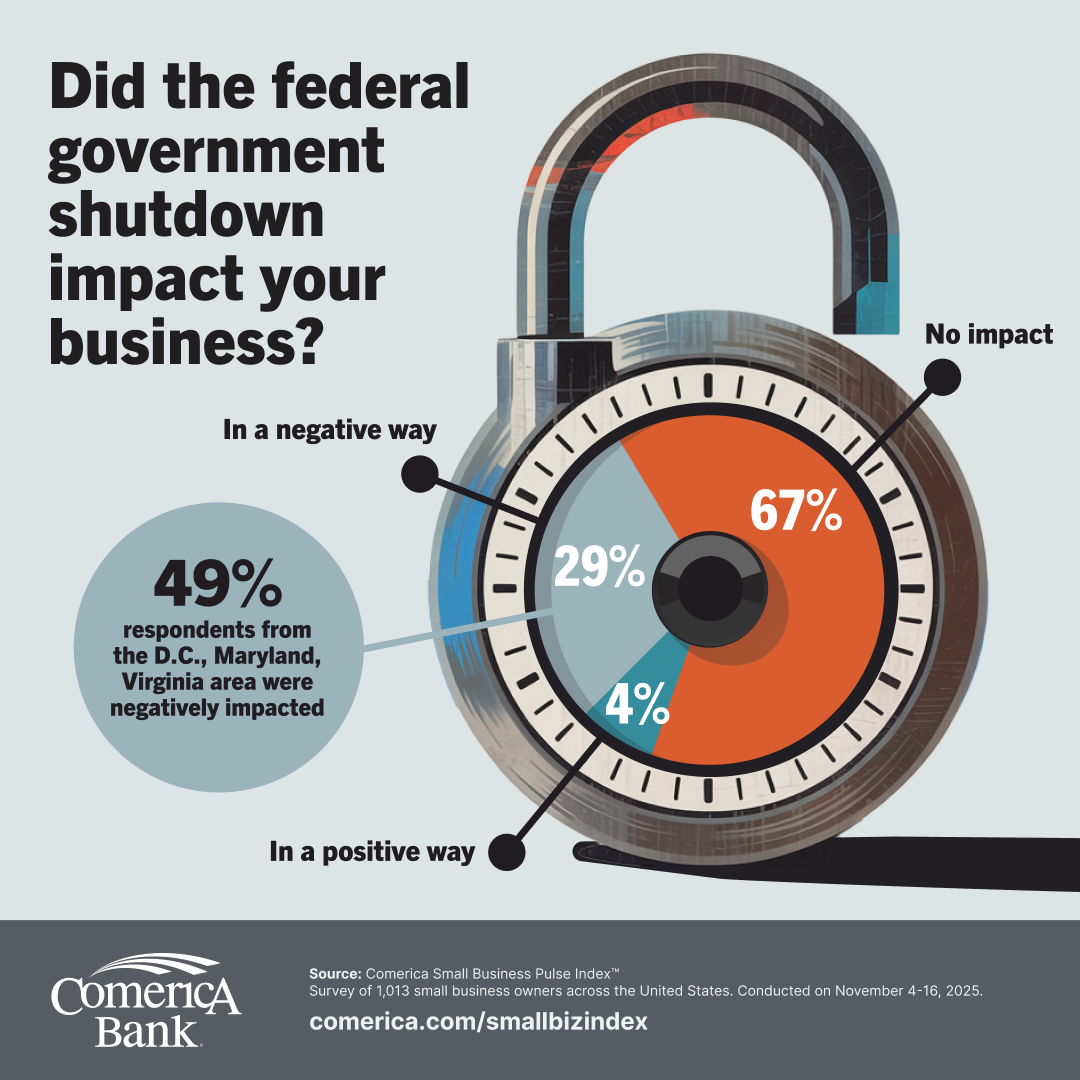

A temporary setback

The 43-day federal government shutdown that ended Nov. 13, 2025, left its mark on Main Street. Nearly 3 in 10 surveyed small businesses (29%) reported negative impacts, with the hardest hit areas coming in the D.C.-Maryland-Virginia region (49%), the leisure and hospitality sector (38%), and among firms with 25 or more employees (36%).

Despite these challenges, two-thirds of all respondents said they were unaffected, underscoring the adaptability of many small businesses even amid prolonged policy uncertainty.

About the Comerica Small Business Pulse Index™

The Comerica Small Business Pulse Index™ is a diffusion index designed to track the state of small business confidence over time. Survey responses are ranked and assigned numeric scores from 0 (Most negative) to 100 (Most positive). The index is an equal-weighted average of survey responses measuring Own Business Confidence, Business Conditions Expectations, Sales Growth Expectations, and Capex Plans. The index and its components are not adjusted for seasonality.

The national survey of 1,013 small business owners, conducted Nov. 4-16, 2025, highlights strong optimism among larger firms and technology-driven businesses while exposing persistent concerns over tariffs and inflation.