Preview of the Week Ahead

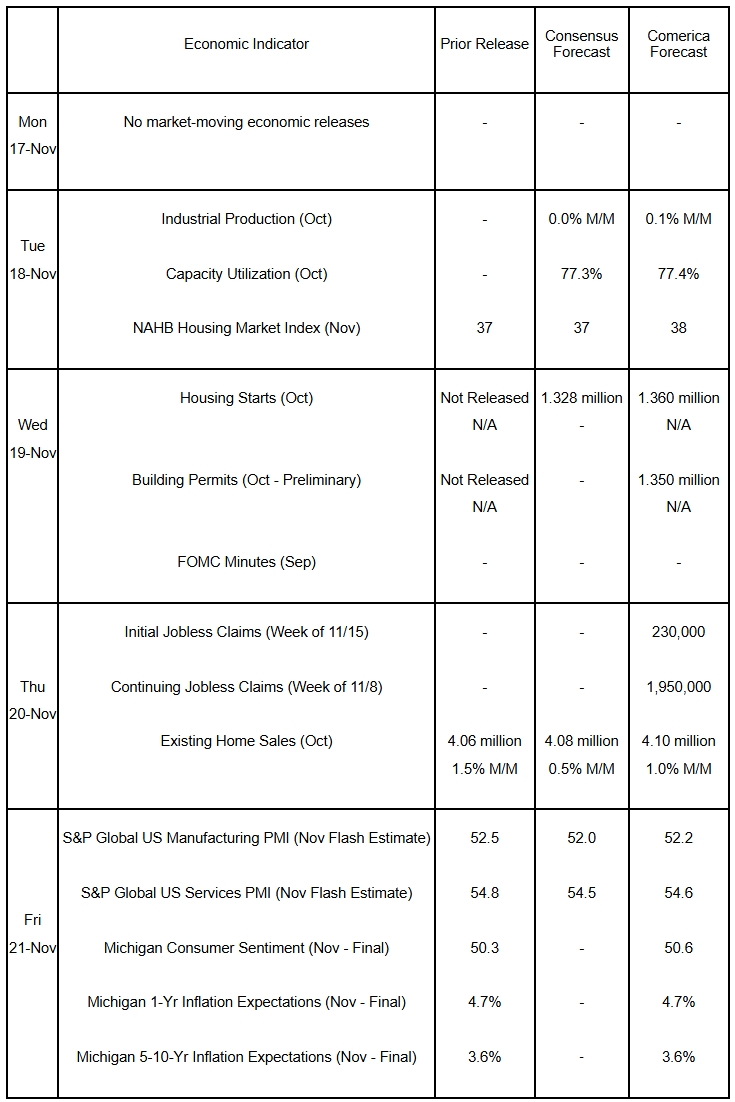

Financial markets will closely scrutinize the minutes of the FOMC’s October meeting this week amidst growing divisions among policymakers about their best path forward. Currently, financial markets place the odds of the Fed cutting rates again in December at around 50-50, as several of the FOMC’s voting members have signaled their preference for pausing the cutting cycle. Given stresses in short-term funding markets in recent weeks, financial markets are also likely to closely parse assessments of financial conditions from the Fed staff economists and policymakers, looking for signs of when the Fed will restart growth of the balance sheet. Besides the minutes, the largest event is the long-delayed September jobs report, which the BLS will release on November 20. Comerica’s preview of this release is posted on Comerica’s website here. Other scheduled (but likely delayed) releases include industrial production and capacity utilization, which probably rose modestly in October. Building permits and housing starts likely registered an annualized rate of around 1.350 million last month. Homebuilder sentiment is expected to have shown a small uptick. The decline in mortgage rates last month probably boosted sales of existing homes. The flash estimates of PMI surveys from S&P Global are forecast down slightly in November, but the University of Michigan’s consumer survey likely improved as the government shutdown ended.

The Week in Review

Alternate data sources available during the government shutdown suggest slower economic growth in the fourth quarter. The Dallas Fed’s Weekly Economic Index, a proxy for real GDP, rose 2.0% from a year earlier in the week ended November 8th. The latest estimate is a leg down from the index’s 13-week moving average of 2.3%. The Chicago Fed estimates that retail and food services sales, excluding sales at auto dealerships, rose by 0.4% in October; new car and light truck sales fell 6.5%, per Ward’s. Cox Automotive estimates that used-vehicle retail sales rose 3.4%.

Hiring fell 0.8% in October from September, according to the LinkedIn Workforce Report, and was down 5.8% from a year earlier. By industry, the largest year-over-year declines were in government administration, down 16%, oil, gas and mining, down 13%, and education, holding companies, and utilities, all down 11%. LinkedIn’s economics team estimates that U.S. employers added a modest 40,000 payroll jobs in October, an estimate that includes government employment. Initial claims for unemployment insurance edged down to 226,000 in the week ended November 8th from 228,000 in the prior week, according to Bloomberg’s analysis of state-level filings. They estimate continuing jobless claims retreated to 1.94 million in the week ended on November 1st from 1.96 million in the prior week. These levels of initial and continued claims suggest private layoffs remained low during the shutdown.

The NFIB Small Business Optimism Index fell by 0.6 points in October to a six-month low of 98.2, but held slightly above its historical average. Weak sales and a sharp decline in profits drove the index lower. Lower sales and profits are not deterring small business owners’ hiring plans, though. Small business owners once again cited labor quality as the biggest problem their businesses face.

For a PDF version of this publication, click here: Comerica Economic Weekly, November 17, 2025(PDF, 188 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.