Preview of the Week Ahead

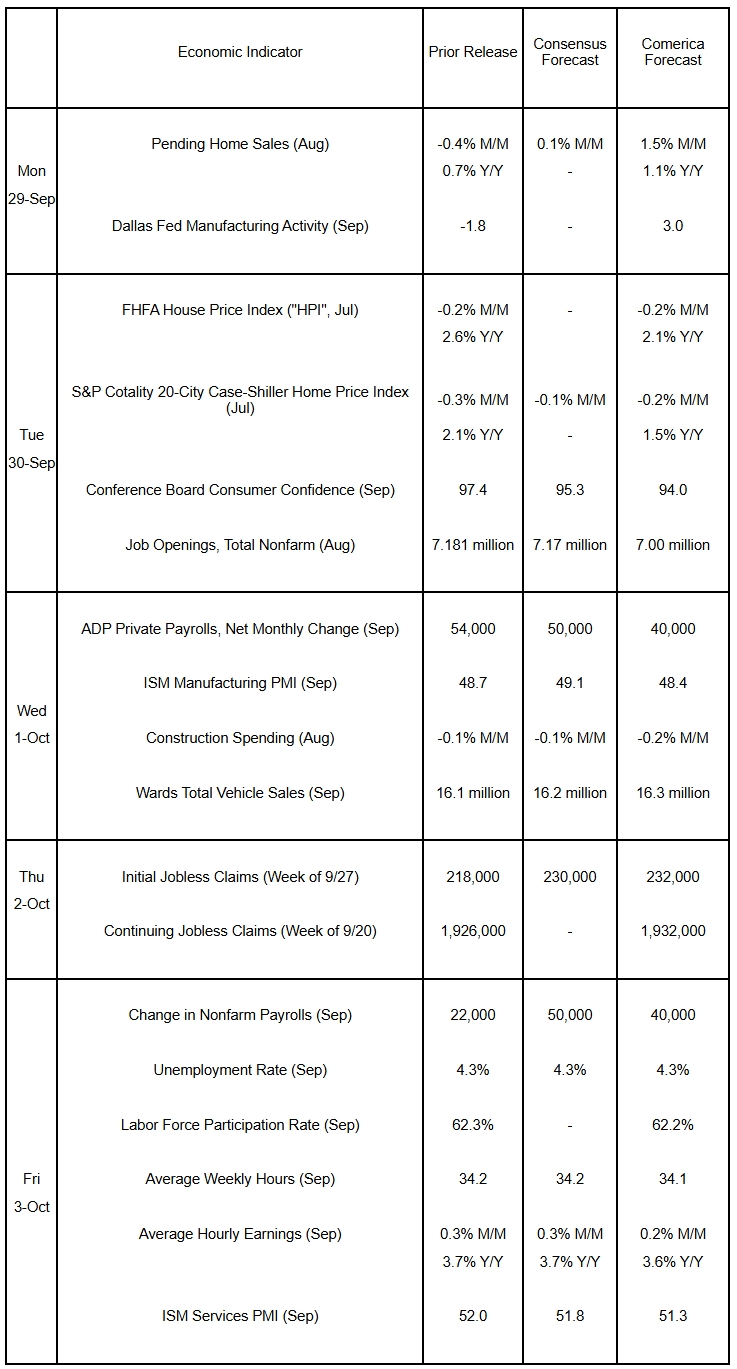

The September jobs report is forecast to show another month of modest employment growth, holding the unemployment rate steady. The labor force participation rate, the average workweek, earnings, and job openings likely eased. The ISM PMIs are forecast to show the manufacturing sector in continued contraction but the services sector in expansion. Led by a steep decline in homebuilding, construction spending is forecast to fall for the tenth month running. House prices probably edged lower again in July, with a further slowdown in annual house price increases. Pending home sales likely rebounded as mortgage rates fell.

The Week in Review

Second quarter economic growth was revised up to a 3.8% annualized increase in the third estimate of real GDP, well above the 3.3% prior estimate. Stronger consumer spending, especially expenditures on services, was behind the upward revision. Business investment in equipment and intellectual property products, such as software, rose robustly, partially offset by a decline in investment in structures, which fell sharply for the sixth consecutive quarter. Government spending moved lower as federal nondefense spending plummeted for the second consecutive quarter. Imports plunged as tariff frontrunning unwound. As a result, net exports made a large contribution to growth last quarter. The GDP Price Index decelerated to 2.1% annualized from 3.6% annualized in the first quarter.

Home sales were mixed last month. Existing home sales essentially stalled in August at a weak annualized rate of 4.0 million, while sales of new homes soared unexpectedly by 20% to an annualized pace of 800,000. Given elevated mortgage rates and homebuilders’ reports of lackluster buyer traffic, the sharp increase in new home sales is surprising, and could be revised down in future releases. Listings of existing and new homes for sale declined. Months of supply of new home listings fell, while months’ supply of existing listings held steady. Median prices of both existing and new homes rose 2.0% from a year earlier.

Personal income rose 0.4% last month, while Personal Consumption Expenditures (PCE) rose 0.6%, both a tenth of a percent above the consensus forecast. Adjusted for inflation, spending was up a strong 0.4% for the second consecutive month. Consumer expenditures on durable goods continues be the key driver of household spending. The personal saving rate eased to year-to-date low of 4.6% in August from 4.8% in July, but was revised considerably higher from 2022 to the present as revisions raised estimates of capital incomes over that period. Matching the consensus expectation, the headline and core PCE Price Indices—the Fed’s preferred measure of inflation—rose by 0.3% and 0.2% respectively on the month and were up 2.7% and 2.9% respectively from a year earlier, little changed from July. There has been limited passthrough of tariff costs to consumer inflation in the year through August.

The University of Michigan’s final reading of Consumer Sentiment for September retreated to 55.1 from 58.2 in August; after April and May, it was the lowest since mid-2022. Weaker expectations accounted for most of September’s decline. Consumers’ year-ahead inflation expectations eased slightly to 4.7%, while longer-term inflation expectations moved up for the second month running, to 3.7%.

For a PDF version of this publication, click here: Comerica Economic Weekly, September 29, 2025(PDF, 244 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.