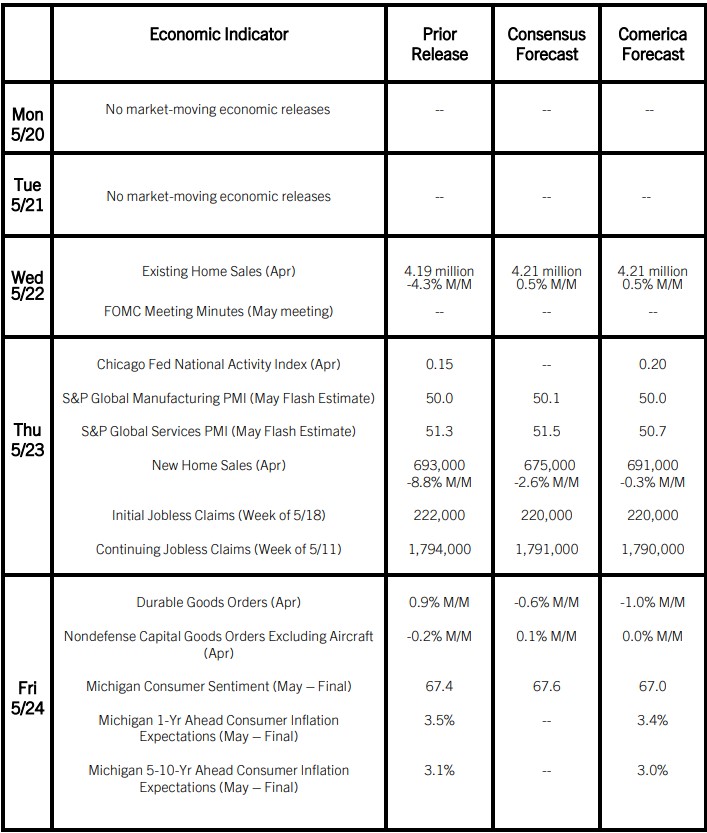

Preview of the Week Ahead

The minutes of the Fed’s May 1 Open Market Committee decision will likely show a range of opinions among FOMC members about the outlook for inflation. Some Committee members likely still think inflation is on course to gradually slow this year, as high interest rates reduce inflation of shelter costs and bring down durable goods prices, while others are concerned inflation will continue to run higher for longer than the optimists expect. Those varying forecasts will in turn drive a range of opinions about whether the Fed should cut rates this year and by how much. FOMC members who are more optimistic about inflation slowing are also more inclined to see interest rate cuts as appropriate.

Existing home sales likely edged higher in April as listings increased, while new home sales likely edged down after an above-trend print in March. Median prices of new and existing home sales likely registered similar year-over-year increases in April as in March.

The Week in Review

Inflation data released last week were mixed. The Consumer Price Index (CPI) rose by 0.3% in April, a tenth of a percentage point below the consensus estimate. CPI was up 3.4% from a year earlier, easing a notch from March. Matching the consensus, core CPI, which excludes the volatile food and energy components, rose 0.3% in April and was 3.6% higher from a year earlier. While this was the slowest since mid-2021, annual core inflation still has been stubbornly sticky, falling just 0.5 percentage points in the past eight months. Food prices held steady in April. Gasoline prices rose sharply for the third consecutive month, but a steep decline in utility (piped) gas prices tempered overall energy inflation. Shelter costs rose by 0.4% for the third consecutive month and were up 5.5% from a year earlier. Prices of services less shelter and energy services, commonly known as Supercore CPI, rose by 0.4%—the slowest pace since December—but nonetheless were up the most in annual terms since last April.

The Producer Price Index for Final Demand (PPI) rose by 0.5% last month and accelerated to 2.2% in year-ago terms from 1.8% in March. Core PPI, which excludes the volatile food, energy, and trade components, was also up sharply by 0.4% and increased to 3.1% on an annual basis. Overall, prices at the producer level were notably higher than expected. The New York Fed’s Survey of Consumer Expectations showed households’ short-term and long-term inflation expectations rose in April. Consumers expect to pay higher prices for homes as well as for necessities like food, gas, and rent.

Retail and food service sales, industrial production, housing starts, and building permits were all weaker than expected in April. Retail saw sizeable declines in auto and part dealerships and modest growth in food service sales. The poor retail sales performance is likely related to the jump in personal income tax payments in April. Media report 3.3% fewer taxpayers got refunds this year than last. Industrial production was weighed down by drops in manufacturing and mining output as the motor vehicle assembly rate dipped on the month. A downwardly-revised drop in multifamily starts in March that largely persisted in April was the key headwind to the month’s construction data.

For a PDF version of this publication, click here: Comerica Economic Weekly, May 20, 2024(PDF, 127 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.