Preview of the Week Ahead

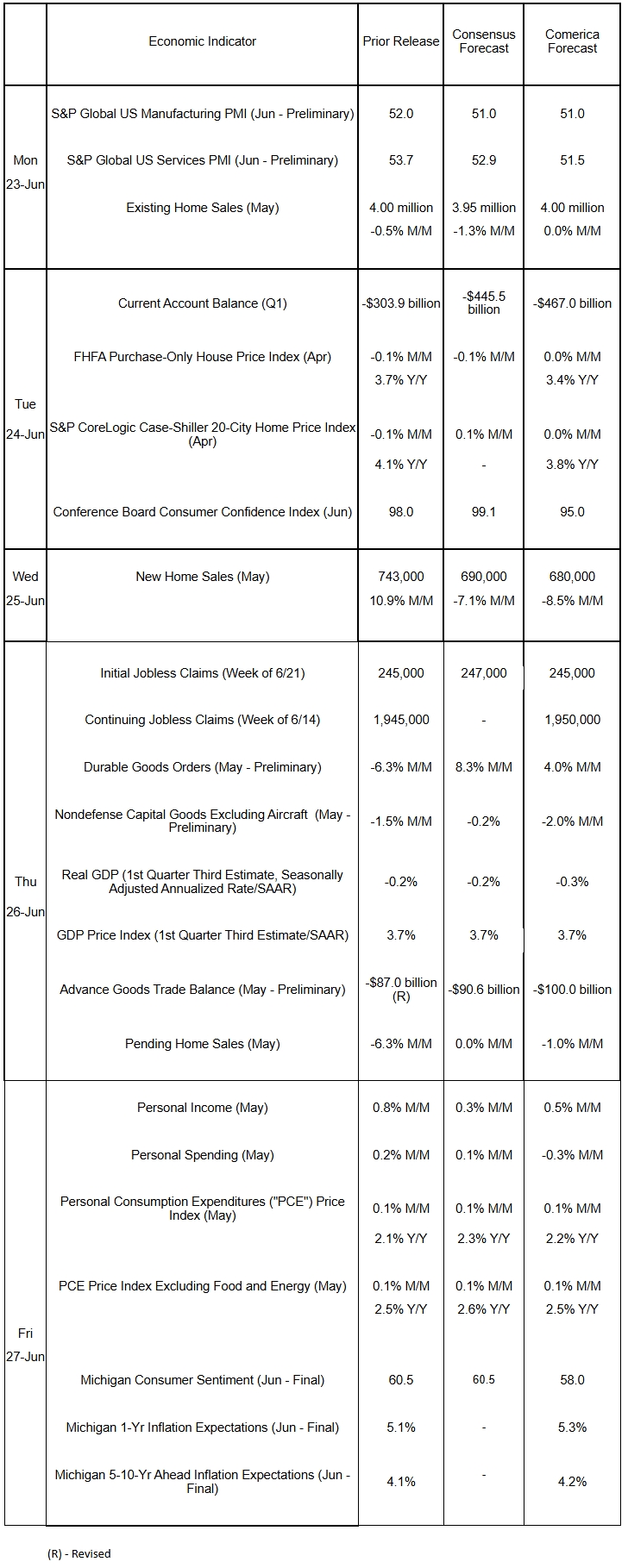

GDP growth in the first quarter will probably be revised down in the third estimate, incorporating revisions in last week’s retail sales report and a soft release of the Quarterly Services Survey. Household incomes likely rose solidly in May, while personal consumption expenditures probably pulled back. Total and core PCE inflation are expected to have edged up in May, leaving annual inflation little changed at a bit above the Fed’s target. The mid-month flash releases of S&P Global’s PMI surveys will probably show both manufacturing and service-providing sectors lost momentum in June due to cautious consumer demand and heightened economic uncertainty. Home sales were likely sluggish in May, and house price increases likely slowed further in year-over-year terms in this week’s releases of April data.

The Week in Review

As expected, the FOMC held the federal funds target rate steady at a range of 4.25% to 4.50% in a unanimous decision on June 18. Changes to the policy statement were minimal. Policymakers adjusted their forecasts in the Survey of Economic Projections (“Dot Plot”) to anticipate more inflation and slower growth. The median FOMC member now expects annual economic growth to slow to 1.4% in the fourth quarter of 2025, down from 1.7% when the Fed last published a Dot Plot in March. Growth projections for 2026 also were revised down. The FOMC expects the unemployment rate to rise and average 4.5% in the fourth quarter of the year, a little higher than projected in the March Dot Plot. The median policymaker also forecasts annual headline and core PCE inflation to average 3.0% and 3.1%, respectively, in the fourth quarter of 2025, up 0.3 percentage points from the March Dot Plot. They project for inflation to slow in 2026 but still be a bit above the Fed’s 2.0% inflation target in 2027. The Dot Plot shows that the median FOMC member expects it will be appropriate to cut rates half a percent by year-end, but the policy statement shows they are unlikely to cut in the very near term: “For the time being, we are well positioned to wait to learn about the likely course of the economy before considering any adjustments to our policy stance.” Also, seven FOMC members thought it would be better to hold the rate unchanged through year-end, up from just four who thought so in March.

Consumers pulled back on retail spending in May after being rattled by trade war headlines and stock market volatility in March and April. Retail sales dropped 0.9% after a downwardly-revised 0.1% decline in April, with spending lower at auto dealerships, building materials retailers, gas stations, restaurants, coffeeshops and bars, and grocery stores. March’s sales also were revised lower.

Homebuilder sentiment fell to the third-lowest reading since 2012 in June, according to the survey by the National Association of Home Builders and Wells Fargo. The NAHB attributed the fall to “elevated mortgage rates and tariff and economic uncertainty.” The May residential construction data were weak as well, with housing starts falling nearly 10% and building permits down by 2.0%. Industrial production fell by 0.2% in May on a sharp pullback in utilities output. Manufacturing production rose modestly following a large drop in April, with auto manufacturing a notable bright spot as carmakers ramped up to replenish low inventories on dealer lots. Industrial capacity utilization edged down on the month and was notably below its long-term average.

For a PDF version of this publication, click here: Comerica Economic Weekly, June 23, 2025(PDF, 183 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.