Preview of the Week Ahead

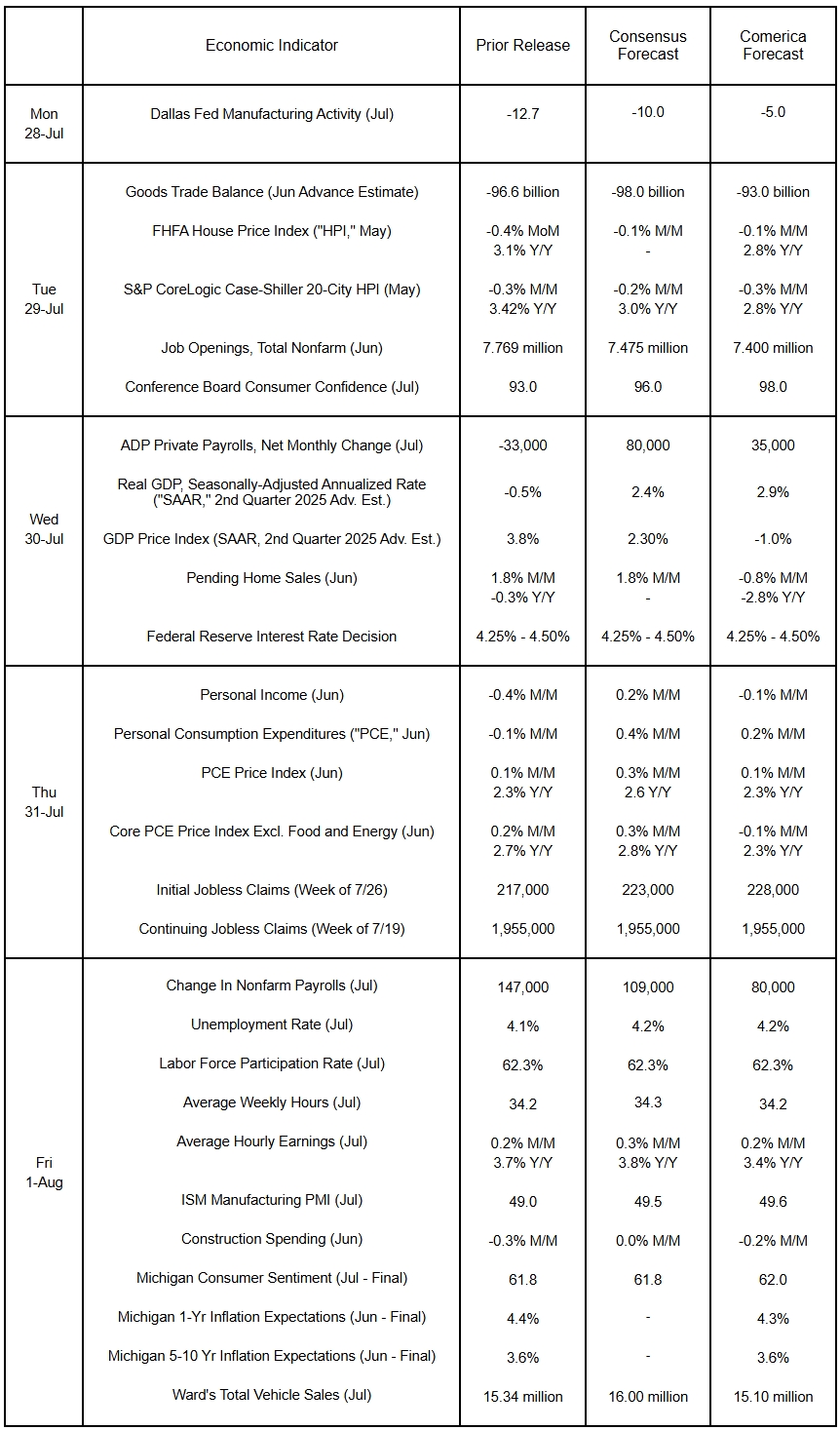

The FOMC will almost certainly hold the fed funds rate steady at a range of 4.25% to 4.50% at its decision Wednesday. Chair Powell will probably reiterate that the Fed sets monetary policy independent of political considerations at press conference after the decision. The advance estimate of second quarter GDP will probably show a rebound after the first quarter’s contraction, driven by large swings in trade and inventories. Inflation-adjusted final sales to private purchasers (households and businesses) are expected to be soft. The labor market likely cooled in July, with a modest addition to payrolls. The unemployment rate, the labor force participation rate, and the average workweek were likely little changed last month. The last major monthly indicators for June likely showed job openings, construction spending, pending home sales, and personal incomes dipped, while consumer spending rose moderately. The ISM Manufacturing PMI probably will signal the manufacturing sector contracted for the fifth month running in July. House price indexes probably fell again in May.

The Week in Review

The U.S. reached a new trade deal with Japan on July 22, the first with a major trading partner. The deal imposes a 15% incremental tariff on U.S. purchases of Japanese goods; Japanese tariffs do not increase. Imports of Japanese autos will also be tariffed at 15%. Tariffs on Japanese steel and aluminum remain at 50%. Japan also agrees to invest $550 billion in the U.S. The deal will tariff Japanese autos at a lower rate than cars and trucks assembled in Mexico and Canada, which typically have much higher U.S.-sourced content.

The housing market ended the usually busy second quarter on a soft note. Existing home sales fell by 2.7% in June to an annualized rate of 3.93 million units and were flat from a year earlier. The median existing home price rose by a moderate 2.0% from a year earlier to $435,300. 1,530,000 homes were listed for sale in June, up nearly 16% from a year earlier. Listings were equivalent to 4.7 months of supply at last month’s pace of sales, the highest months’ supply in a decade for the month of June. New home sales rose by 0.6% to an annualized rate of 627,000 units, but were down 6.6% from a year earlier. Homebuilders cut prices to move inventories of unsold homes, which rose to 10 months of supply at last month’s rate of sales; inventories were the highest since 2007. The median price of a new home fell by $20,900 from May to $401,800 last month. From a year earlier, new home prices were down nearly 3%.

Service-providing business activity rose solidly in July, according to S&P Global’s flash estimate of their US Services PMI. Service sector output rose at the fastest pace in seven months. Service providers reported an acceleration in new orders. The manufacturing PMI slipped into contractionary territory in the July flash estimate, with manufacturers reporting a slight drop in new work. Price pressures intensified for both manufacturers and service-providing businesses, which were widely blamed on tariff-induced price hikes. The July releases of business surveys from the New York, Philadelphia, Richmond, and Kansas City branches of the Federal Reserve mostly improved from June.

For a PDF version of this publication, click here: Comerica Economic Weekly, July 28, 2025(PDF, 166 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.