Preview of the Week Ahead

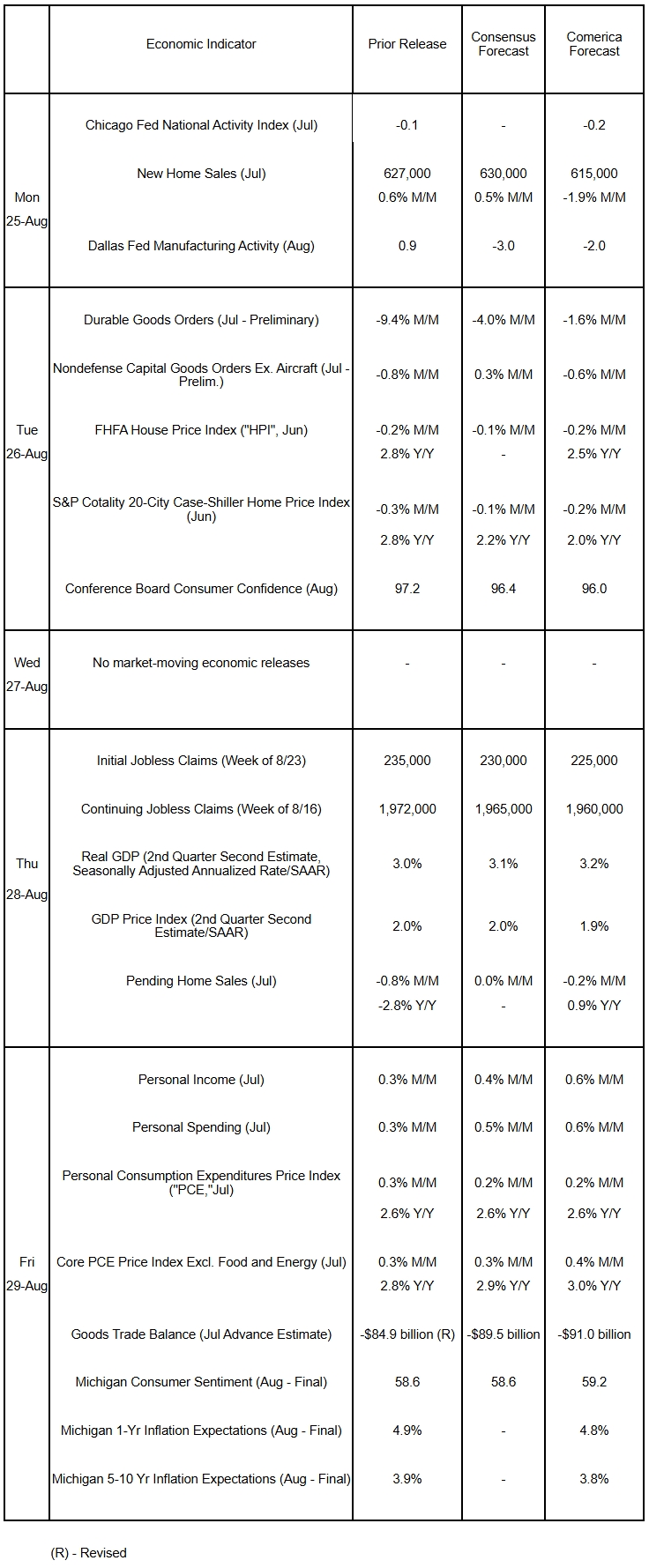

GDP in the second quarter of 2025 will probably be revised higher in the second estimate due to upward revisions to consumer spending. Personal incomes and spending are forecast to have risen at a solid pace in July. The Personal Consumption Expenditures (PCE) Price Index—the Fed’s preferred inflation gauge—likely rose modestly on soft food and gasoline prices, while the core PCE index, which excludes those items, likely accelerated. New home sales likely declined in July and home price indices probably fell in June and rose slower in year-over-year terms. Consumer confidence probably eased in August, although households’ short- and long-term inflation expectations remained elevated.

The Week in Review

Chair Powell opened the door for a rate cut at the Fed’s next meeting on September 17, in his much-awaited speech at the Jackson Hole monetary policy conference. While “Risks to inflation are tilted to the upside and risks to employment to the downside,” Powell sees the job market risks as more urgent, saying “The shifting balance of risks may warrant adjusting our policy stance.” Powell leaned against market speculation that the Fed would cut by more than a quarter percent, though, saying that “The stability of the unemployment rate and other labor market measures allows us to proceed carefully.” Comerica’s next rate forecast will see the Fed cutting the funds target a quarter percent at both the September and December meetings. The minutes of the FOMC’s July meeting show a divided committee, worried about the same inflation and employment risks mentioned in Powell’s Jackson Hole speech. “While a majority of participants judged upside risk to inflation as the greater of the two risks,” a “couple” deemed “downside risks to employment the more salient risk,” the minutes note. “Several” FOMC members “viewed the two risks as roughly balanced.” The weak July jobs report, released after the decision, have likely nudged the Committee’s balance of opinion closer to Powell’s position in his Jackson Hole speech.

Recent housing data were mixed. The National Association of Home Builders (NAHB) / Wells Fargo Housing Market Index eased by a point to 32 in August and remained well below the 2025 high of 47 recorded in January. The NAHB noted headwinds from “elevated mortgage rates, weak buyer traffic, and ongoing supply-side challenges.” Permits to build homes fell again in July, down 2.8% from the prior month to an annualized rate of 1.354 million units and 5.7% lower from a year earlier; they were the lowest since mid-2020. On the other hand, housing starts were stronger than expected, up 5.2% on a surge in multifamily units. Existing home sales rose 2.0% in July to 4.01 million annualized units, up 0.8% from a year earlier. Home listings edged up to 1.550 million, more than 200,000 units higher than in July of last year, and were equivalent to 4.6 months of supply at last month’s pace of sales. The median price of a home sold was $422,400, edging up 0.2% from last July.

Business activity rose at the fastest pace yet this year in August, according to the flash release of S&P Global’s US PMI indexes. The better-than-expected readings were driven by a big pickup in manufacturing activity. The surveys report service-providing activity continued to expand solidly. Hiring was reported to have increased at the fastest pace in over three years. Business costs rose at the second fastest pace in nearly three years, which survey respondents primarily attributed to tariffs.

For a PDF version of this publication, click here: Comerica Economic Weekly, August 25, 2025(PDF, 205 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.