Preview of the Week Ahead

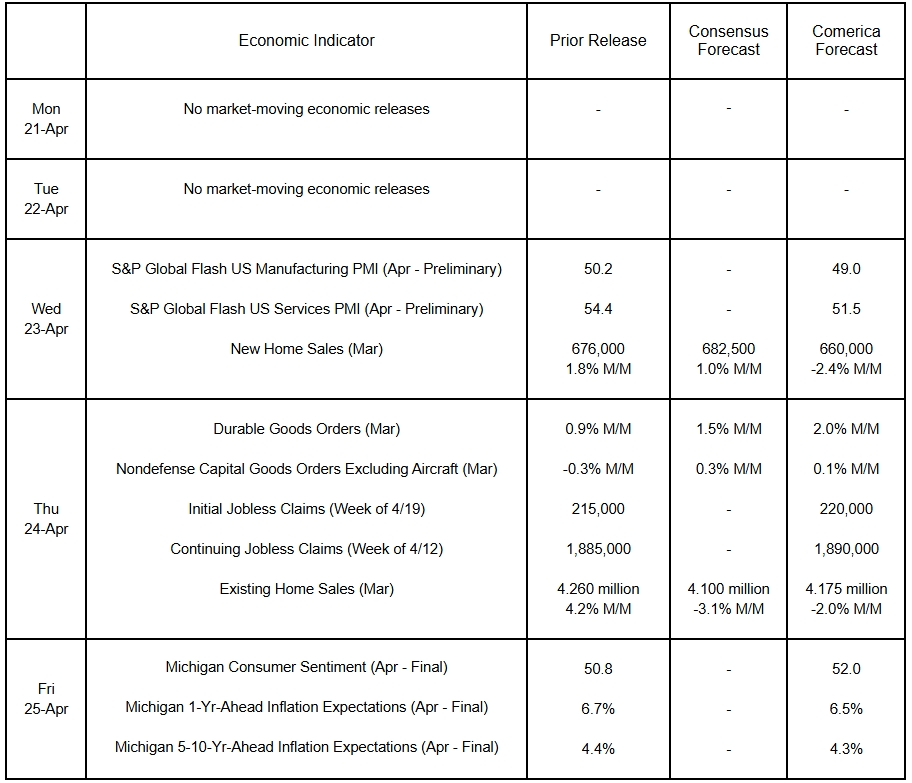

The flash releases of S&P Global’s PMIs will offer the first broad-reaching view of business conditions in April. They are expected to show manufacturing in contraction and growth of service-providing businesses slowing. Economic uncertainty and high prices likely weighed on new and existing home sales in March. Household sentiment was likely a little less dour in the April final release of the University of Michigan’s Survey of Consumers with the stock market stabilizing at month end. Households’ short and long-term inflation expectations, which soared after the initial reciprocal tariff announcement, were likely slightly lower. Durable goods orders probably posted another strong increase last month as car dealers rebuilt inventories that ran low during March’s surge in demand. Orders for nondefense capital goods excluding aircraft—a widely-watched proxy for business spending on equipment—likely rose at a modest pace, as businesses take a “wait and see” approach to investment amidst heightened economic uncertainty.

The Week in Review

Sales at retail and food and drinking establishments rose by 1.4% in March and matched Comerica Economics’ forecast. The prior two months’ sales were revised up 0.2% higher, indicating consumer spending was not as weak as initially estimated. Motor vehicle and parts dealer sales surged 5.3% as consumers front-ran tariffs. Sales rose across 10 out of the other 12 retail subsectors, too. With gasoline prices down, sales at gas stations tumbled. Core retail sales, used in computing nominal spending on most goods in the GDP report, rose by 3.5% annualized last quarter, indicating consumer spending likely made a positive contribution to real GDP growth.

Industrial production fell by 0.3% in March on the back of a steep fall in utilities production amid milder weather. Manufacturing and mining output expanded. Capacity utilization eased by four-tenths of a percentage point to 77.8% and was nearly 2% below its long-term average of 79.6%. The overall capacity utilization rate masks stark divergences across industries. Primary metals manufacturing capacity utilization, for example, of around 70% indicates American metals producers have notable capacity to take market share as tariffs reduce imports of foreign-made metals. The energy industry, on the other hand, has limited spare capacity with oil and gas extraction and petroleum and coal manufacturing sectors functioning at over 90% of capacity.

Housing activity is subdued. The NAHB / Wells Fargo Housing Market Index (HMI) edged up to 40 in April, but the report’s details were soft. Homebuilders report policy uncertainty is weighing on their ability to “accurately price homes and make critical business decisions.” Six out of ten homebuilders note their suppliers have increased prices due to imposed, announced, or expected tariffs, with an average increase of 6.3%, equivalent to a $10,900 cost increase per home. Housing starts tumbled by 11.3% in March from a downwardly-revised 9.7% increase in the prior month and were essentially unchanged in the first quarter from the fourth quarter of 2024. Building permits rose 1.6% in March, rebounding from a sharp decline in the first two months of 2025. Permits averaged 1.471 million annualized in the first quarter, a 1.8% annualized increase from the fourth quarter of last year.

For a PDF version of this publication, click here: Comerica Economic Weekly, April 21, 2025(PDF, 136 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.