Florida Economy’s Growth to Moderate in 2026

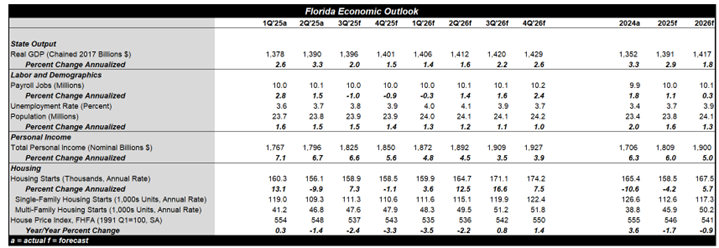

Florida’s nation-leading economy grew robustly again in the first half of 2025, but is forecast to slow and grow roughly in line with the rest of the U.S. next year. A moderation of consumer spending, softening labor market, strains on housing market fundamentals, and fewer tourists are weighing on the state’s growth outlook. Florida will benefit from the national boom in AI-related businesses, but this industry is a more modest share of the state’s economy than in tech centers. Growth should pick up in the second half of 2026 on monetary and fiscal stimulus and the easing of strained relations with major tourist source countries. New and expanded tax deductions for seniors, workers earning tips and overtime pay, and homeowners paying high property taxes will boost incomes and consumer spending power.

The Sunshine State registered the fastest employment growth of any large state in recent years, but this is set to moderate in 2026 as hiring slows in the healthcare, tourism, and agriculture industries. The unemployment rate is forecast to increase and peak in mid-2026, but still stay low relative to its long-run history (and also be lower than the U.S. average). Slower hiring will also make it harder for Americans to relocate to Florida from the rest of the country, slowing population growth; in-migration faces additional headwinds from expensive housing, surging property insurance premiums, and fewer international arrivals amid more stringent immigration rules.

Florida’s housing construction is forecast to recover in 2026 after the long correction from the post-pandemic boom. Homebuilder sentiment has brightened considerably in recent months as mortgage rates declined. Trade disputes with Canada, China, and Mexico seem headed toward resolution, which could temper the effects of tariffs on building material prices. Around 120,000 new single-family units are forecast to be added to Florida’s housing supply next year. After a solid increase in the first half of 2025, multifamily construction is expected to strengthen further and add around 50,000 units in 2026.Laws imposing stringent inspections on older buildings and higher reserve funding are making older apartments less attractive, boosting demand for newer construction. Increased listings of existing homes, high insurance premiums, and fewer insurers in the state contributed to a correction in house prices in 2025, but modest home price gains will likely resume in late 2026.

For a PDF version of this publication, click here: 2026 Florida Annual State Economic Outlook(PDF, 139 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.