Summary

- The U.S. Dollar index has stabilized to 97.00 after hitting 3-year lows at the beginning of July.

- President Trump continues his demands to lower interest rates, citing a weaker currency is more conducive to a productive economy.

- There is an 85% chance of an interest rate cut in September though the labor market remains strong.

- Japan and the U.S. have agreed to a 15% blanket tariff on Japanese exports including automobiles as well as Japan investing $550 billion into the U.S. economy.

- Japan’s Liberal Democrats Party has lost its majority in both houses as the country struggles with inflation and GDP growth.

- The euro is making a return as a safe-haven asset as it ends its cutting cycle and retains more consistent economic policies.

- The EU is prepared for aggressive counter measures if a trade deal between the U.S. and the EU does not materialize by August 1st.

- The U.K. and India agreed to a trade deal opening the Indian subcontinent for British exports

- President Trump is traveling to Scotland to continue trade negotiations with the U.K.

Dollar Holds Steady as Pressure Builds

After a brief dip of the U.S. Dollar index into the 96’s, a 3-year low at the start of July, the U.S. dollar has stabilized at 97.00, currently trading at 97.76 in what has proven to be a tumultuous seven months for the greenback.

On Thursday, during a live tour of the Federal Reserve (Fed) renovations with Jerome Powell, President Trump continued his demands for rate cuts and reminded everyone that each point cut would amount to “$375 billion in debt savings.” As Trump continues attempts to disrupt the independence of the Federal Reserve, the bond market remains vigilant with rates poised to rise on the long end of the curve if confidence in the Fed is undermined.

President Trump, in an interview after the tour, restated that firing Powell wasn’t necessary and could’ve been an influence behind the recent U.S. dollar retracement.

President Trump also stated that a weaker dollar is more conducive to a productive economy saying, “when you have a strong dollar you can’t sell anything”. Trump cited the Chinese government and their export-driven model as an example of a country that has profited from continuous devaluing of their currency to make exports cheaper, a goal that Trump himself would like to have for the U.S. economy.

Traders remain skeptical of any cuts this meeting but expect one in September with 85% probability. With two cuts currently baked into the year, the Federal Reserve is not so split on cutting interest rates anymore, but more so split on the timing of the cuts.

With 4.4% unemployment, and an initial jobless claims beat of 217,000 vs. 226,000 and the week before at 221,000, the labor market continues to show signs of resilience. However, inflation remains a concern for the Federal Reserve. CPI is still at 2.7% and the lagging effects of tariffs remain top of mind for the board of governors. However, governors Michelle Bowmen and Christoper Waller have publicly called for lower rates as the Fed continues its blackout period before their next meeting on the 31st.

Japanese Trade Agreement

The U.S. and Japan agreed to 15% tariffs on all Japanese exports, including for cars which were initially poised to be 27.5%. Japan also agreed to open its doors for American cars and rice, among other exports though they managed to protect most of their agricultural industry from U.S. crops. The Japanese government, in tandem with Softbank and a few other Japanese corporations will invest $550 billion into the United States across a variety of industries, namely semiconductors, pharmaceuticals, precious metals, AI and other sectors.

Prime Minister Shigeru Ishiba’s and the Liberal Democrats lost their majority in both the upper and lower houses in the Japan Parliament. Despite being in a significantly weaker position to achieve the LDP’s goals, PM Shigeru Ishiba has vowed to press on in what can only be described as a challenging year for the Japanese economy which is facing continued inflation, growth, and population problems.

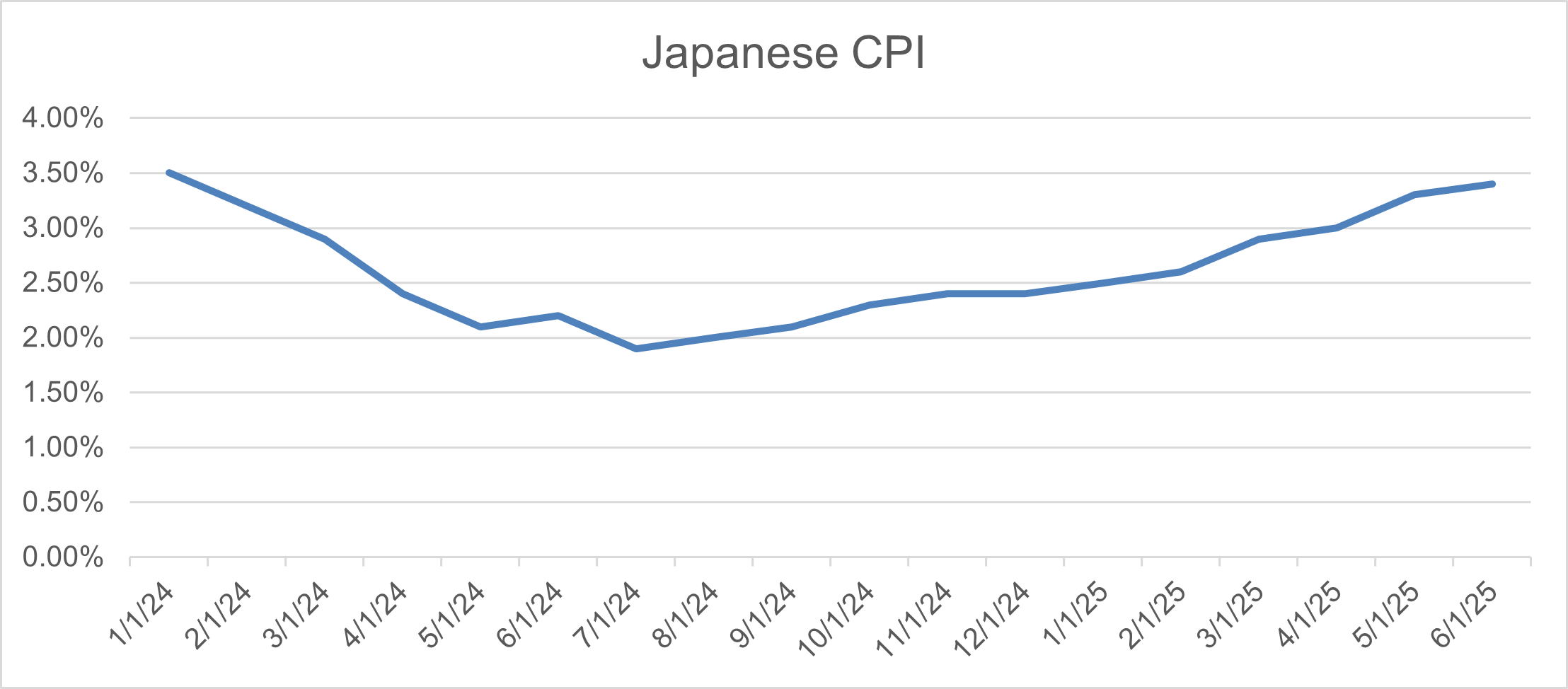

The June CPI was reported 1.1% above the target at 3.1%. Q1 GDP stalled out completely and was -0.2%. The Japanese yen has appreciated about 6% against the U.S. Dollar since the beginning of the year and is trading at 147, close but not nearly at historical levels in the upper 130’s. The possibility of a Japanese rate hike remains on the table though not likely at the next BOJ meeting on July 31st.

Euro’s Evolution

The euro is growing as a safe-haven asset amidst turbulent U.S. fiscal policy and growing financial mishandling. YTD, the euro has rallied almost 12% against the dollar and shows no signs of slowing down with the resistance level at 1.1800 for now. After 6 straight days of gains, the euro appears to be cooling down a bit and is trading at 1.1727 at the time of this publication.

On Thursday’s European Central Bank meeting, the council members elected to keep interest rates unchanged. After 8 straight cuts, council member Joachim Nagel said, “it now makes sense to hold” despite tariff uncertainty, the eurozone posted a 2% inflation read but there are still concerns on the lagging effects of tariffs, or what the tariffs could be for that matter. In addition, geopolitical concerns remain paramount with two major conflicts adjacent to the EU.

In trade news, the EU and U.S. were very close to a deal at 10% tariffs before the Trump administration pulled back and announced 30% blanket tariffs. For now, it appears that 15% blanket tariffs will be the new proposal, though there will still be the 50% tariff on steel and aluminum as well as 25% on cars. While both sides remain confident a deal will get done, President Trump said that a deal with the EU is 50-50 on Friday morning. The EU is currently preparing a counter-tariff package of 30% on nearly $110 billion dollars of U.S. goods if the two sides don’t make an agreement by President Trump’s August 1st deadline. The EU tariff package would include items such as aircrafts, carts, poultry, and more and would go into effect August 7th. In addition, the anti-coercion instrument that France pushed for is now being backed by Germany as well which could restrict U.S. businesses from accessing European financial markets, place limits on intellectual property rights, and add additional tariffs.

Deals Across the Pond

Indian Prime Minister Narendra Modi and United Kingdom Prime Minister Kier Starmer secured a major trade deal for free trade eliminating tariffs on items such as cars, alcohol, food and more for the English and increasing access to Indian textiles and jewelry. India would gain cheaper access to British cosmetics, medical devices, food, and other products. Some 90% of tariffs will be reduced for exports from England to India and 85% of the tariffs will be eliminated within a decade. As Modi prepares to return to India from the U.K., President Trump will be heading to Scotland to open a new golf course and meet with Prime Minister Starmer and Scottish First Minister John Swinney.

Contact Comerica Foreign Exchange

This publication has been prepared for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice. The information contained herein has been obtained from sources believed to be reliable, but Comerica does not represent, or guarantee, its completeness or accuracy. The views expressed herein are solely those of the author(s) at the time of publication. Comerica will not be responsible for updating any information contained within this publication, and such information is subject to change without notice. Comerica does not assume any liability for any direct, indirect or consequential losses that may result from reliance upon this publication.