Daring to Be Great

“Good Seasons Start with Good Beginnings.”

-Sparky Anderson

Introduction

Well, what a year so far! As, we round into the Fall Classic, I am reminded of the job of a skipper to help steer players and fans through the changing times that lie ahead. Extending the analogy to investing, our game plan or philosophy is built on avoiding strikeouts and trying our best to hit the proverbial “single and double” every time we step up, knowing that having a high batting average usually suggests not trying to “swing for the fences” each trip to the plate. We have a sound and prudent approach waiting for the “sweet spot”, yet bold and risk-aware avoiding swinging at every pitch, a virtue that we believe will serve clients well over the long term.

Nowadays, let me suggest markets are filled with “home run hitters” and “junk pitches” promising an elixir of low risk and high returns, a recurring theme in the annals of investment lore. As Mark Twain once said, “history doesn’t repeat itself, but it often rhymes.” Market averages now sit at record highs and valuations are approaching lofty levels. While the investment themes look eerily familiar, it is imperative to stay patient, well-grounded, and diversified, avoiding the temptation to chase returns as success often hinges on unconventionality at the inflection points.

Today, we are committed to building a bank with enhanced services and capabilities with deep roots in the communities we serve. As well as an investment approach that combines discipline and hard work with thoughtful risk bearing, flair and insight.

So, play ball...

Executive Summary

As we enter the fourth quarter of 2025, investors face a landscape shaped by evolving macroeconomic dynamics, shifting sector performance and persistent global uncertainties. This memo highlights the investment environment for Q4 2025, examining key market trends, economic indicators, sector outlooks and the risks and opportunities. With global growth stabilizing, inflation moderating and central banks loosening monetary policy, asset allocation decisions will require careful attention to both regional and sector-specific developments. Investment flexibility and risk management will be crucial as investors seek to navigate an environment marked by an anticipated pickup in volatility and burgeoning market opportunities.

Domestically, the benefits emerging from the OBBBA should help offset the tariff drag for most corporations and consumers next year, except those in the bottom 40% of the income distribution. That demographic should eventually be helped by the curtailment of immigration, but those effects have yet to materialize. The substantial positive wealth effects are benefiting consumer spending and sustaining domestic economic growth thus far.

Key Highlights

- Economic Resilience: Despite policy uncertainties, the U.S. and other developed economies remain on solid footing but need to further stimulate growth to avoid stagflation concerns.

- Inflation Stabilizing but Employment Showing Signs of Stress: Closely monitoring a potential “second wave” as tariffs work through the system and further weakness in the labor market as the immigration policies take root.

- Equity Market Rotation: Mindful of high valuations, momentum, and sector concentration; finding relative value opportunities in areas outside of technology and the Magnificent Seven.

- Opportunities in Small Caps & International Markets Persist: In the early phase of a cyclical shift to smaller companies, including forgotten international small-cap stocks that should weather tariffs and benefit from lower interest rates.

- Real Assets & Alternatives Stay in Focus: Commodities, REITs, and private markets still offer inflation protection and solid portfolio diversification.

- Strategic Allocation Guidance: Geographic and style diversification is more important than ever to help navigate volatility and reduce idiosyncratic risk.

Global Economic Overview: In the middle innings.

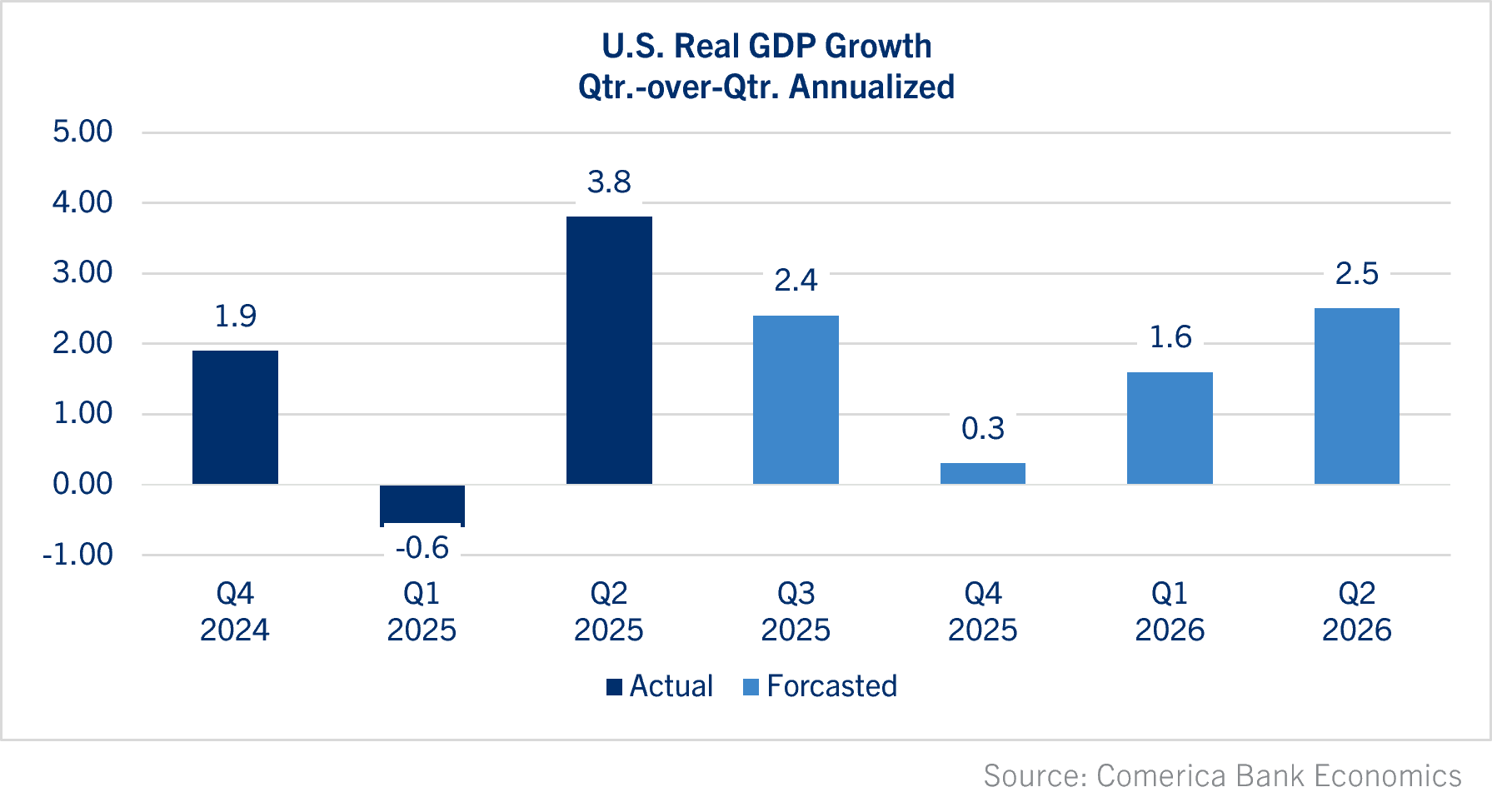

- United States: Global GDP growth is expected to stabilize in Q4 2025 after a year of uneven expansion. In developed markets, growth rates are projected to moderate as the effects of post-pandemic recovery wane and fiscal stimulus measures are gradually withdrawn. The United States is forecast to grow at an annualized rate near 2%, supported by resilient consumer spending. However, GDP is forecast to face headwinds in the fourth quarter from the federal government shutdown that began in October.

- Europe: Facing challenges from sluggish growth and persistent political uncertainty. The ECB’s cautious stance supports financial stability, but structural issues in Southern Europe and post-Brexit trade frictions weigh on prospects. Equity markets offer selective opportunities, especially in healthcare and renewable energy. Fixed income strategies should emphasize high-quality sovereign and corporate debt.

- Asia: Continues to drive global growth, with China rebounding from policy-driven slowdowns and India posting robust expansion. Technology, manufacturing, and consumer sectors are key drivers. Japanese equities benefit from accommodative monetary policy and corporate reforms. Fixed income investors can find value in Asian sovereign and corporate bonds, while alternative assets offer growing appeal.

- Emerging Markets: Present a mixed picture in Q4 2025. Latin America is recovering from commodity price volatility, while Southeast Asia benefits from strong export demand. Political risks and currency fluctuations remain concerns but improving fundamentals in select markets support investment opportunities. Diversification and active management are essential to navigating regional volatility.

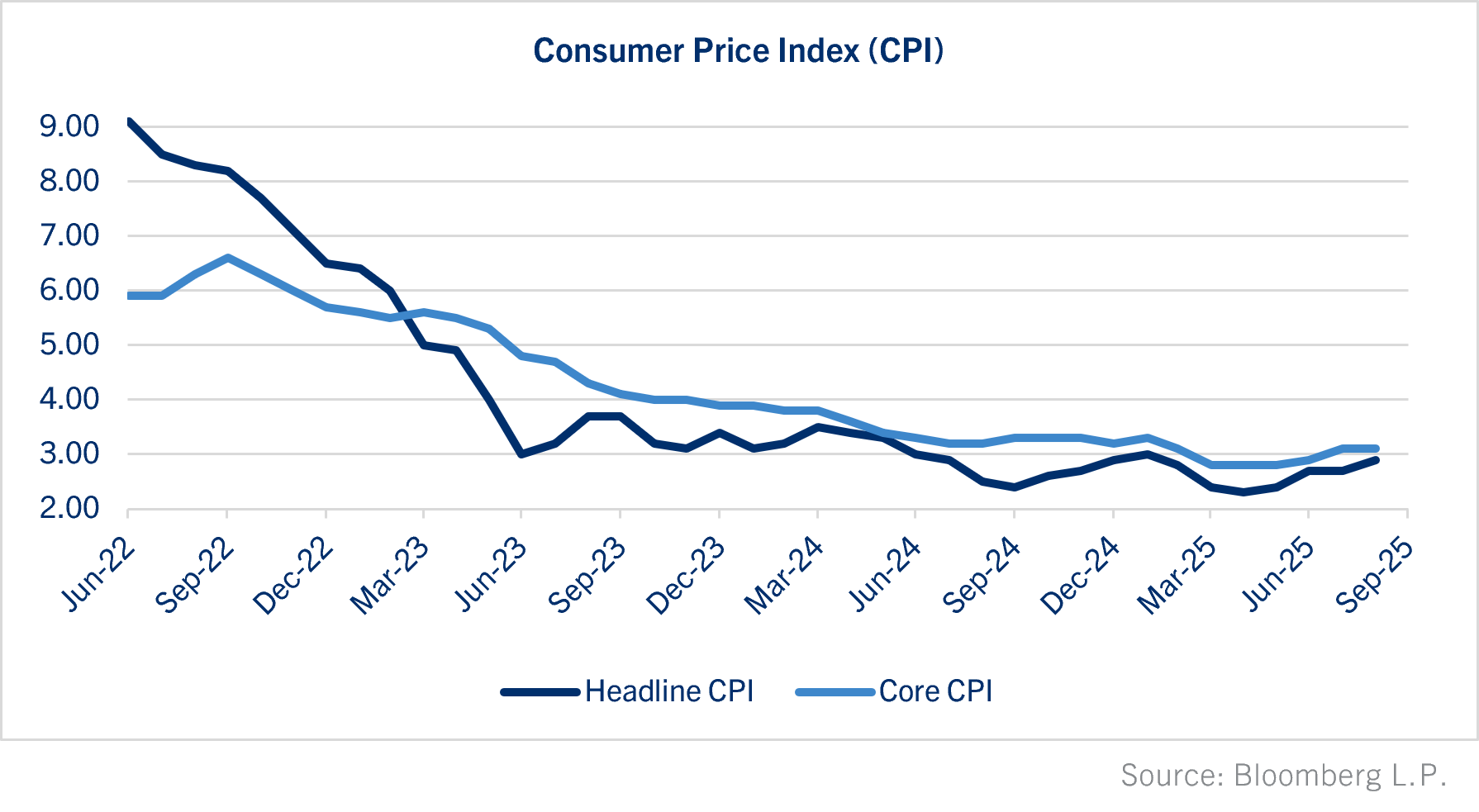

Inflation

Inflation pressures are anticipated to moderate in most major economies during Q4 2025. Supply chain disruptions have largely abated, and commodity prices have stabilized, contributing to easing input costs. The U.S. Consumer Price Index (CPI) is sticky and expected to run higher than the Federal Reserve’s 2% target, while the Eurozone’s Harmonized Index of Consumer Prices (HICP) should hover around 2%. In emerging markets, inflation remains a concern in select economies due to currency volatility and elevated food prices, but overall global inflation is expected to moderate.

Monetary Policy

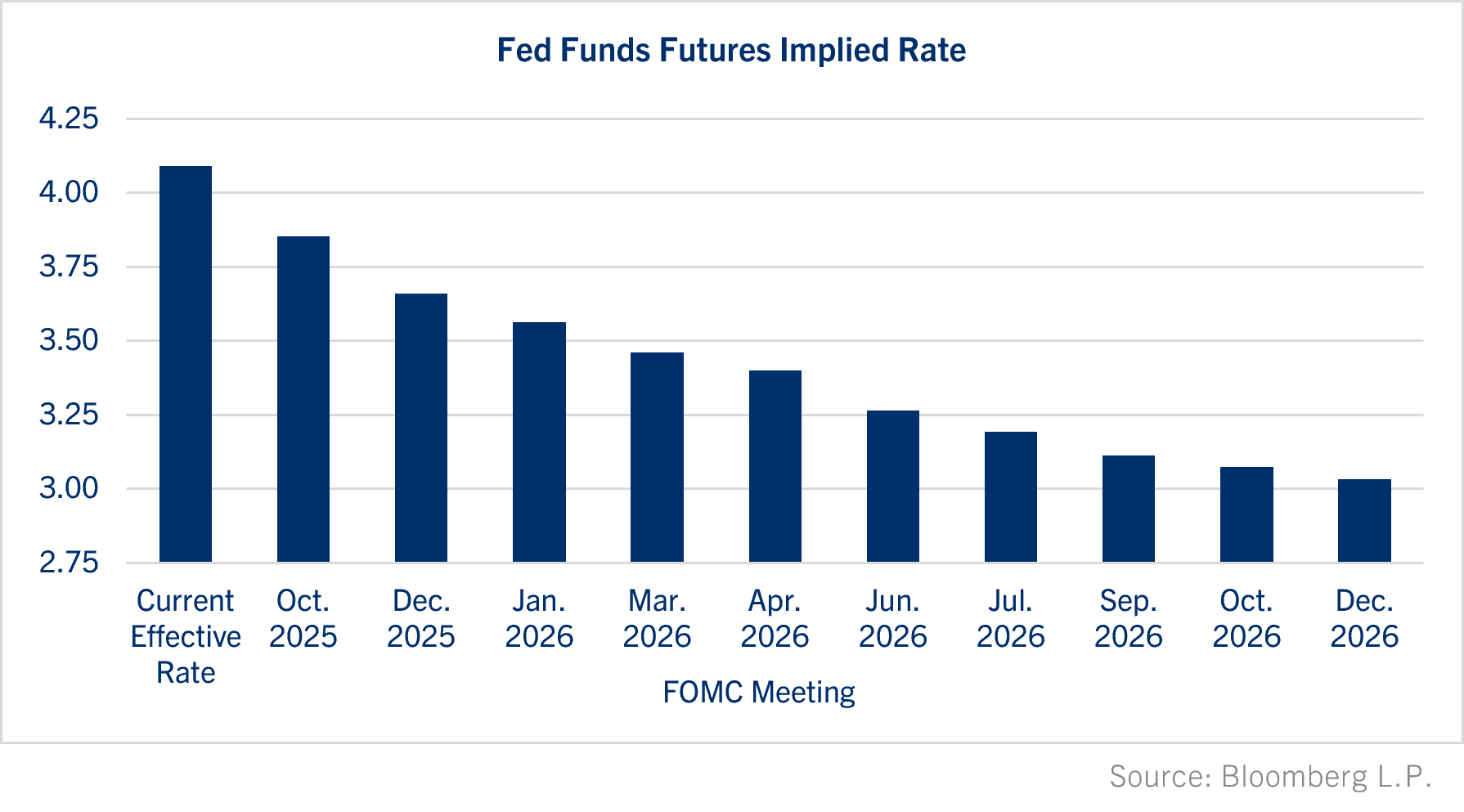

Central banks are poised to maintain a cautious approach in Q4 2025. The Federal Reserve has signaled further rate cuts, focusing on data-dependent adjustments to ensure price stability without stifling growth. The European Central Bank (ECB) is expected to maintain its current policy stance, balancing inflation control against economic fragility. The Bank of Japan continues its accommodative policies, while the People’s Bank of China is likely to pursue targeted easing to support domestic demand. Investors should monitor central bank communications closely with U.S. data temporarily lacking due to the government shutdown, as unexpected policy shifts could spur market volatility.

Equity Markets Keep your eye on the ball

Major Market Performance

Global equity markets have demonstrated resilience in 2025, with major indices posting moderate gains. The S&P 500® closed Q3 up over 8% and nearly 15% year-to-date, supported by strong corporate earnings and technology sector leadership. The broadening out started to unfold with the Russell 2000 and Russell Microcap index soaring over 12% and 17% during the third quarter. International markets have outperformed domestic markets this year helped by currency translations with the MSCI EAFE, Emerging Markets, and Frontier Markets gaining nearly 26%, 28%, and 38%, respectively. Renewed growth in China, India, and Asian markets have boosted emerging market returns while valuations remain attractive; earnings sustainability and inflation worries are likely to persist.

Sector Performance

The technology sector has been at the center of explaining the market, and it now accounts for a third of S&P 500® earnings, three times its share of 20 years ago. It sourced nearly three-quarters of 2024 earnings growth and over 60% of that this year. It has remained the top-performing sector, buoyed by capital spending in artificial intelligence, cloud computing, and semiconductor innovation. Healthcare has lagged with only biopharmaceuticals rallying due to breakthrough therapies and strong demand. Energy stocks have stabilized after a volatile first half, as oil prices level off and renewables see increased investment. Banks and financial stocks have benefited from widening net interest margins, benefiting from improved asset quality, and increased consolidation. Consumer discretionary stocks are mixed, with luxury brands outperforming mass-market retailers.

Valuation Trends

Equity valuations are solidly above historical averages, especially among high-growth technology stocks. Technology earnings have exceeded expectations, and their returns have tracked their growth rate. The market is increasingly top heavy with signs of speculation emerging in some areas. Forward price-to-earnings ratios for the S&P 500® hover near 23x, while European indices trade at a discount, reflecting slower growth prospects. Asian markets offer attractive valuations, particularly in India and select Southeast Asian economies. Investors should be vigilant about valuation risks, especially in sectors where future earnings growth may not justify current multiples.

Interest Rates and Spreads Locked up

Interest Rates

Interest rate dynamics remain central to fixed income strategies in Q4 2025. The Federal Reserve’s resumption of rate cuts has lowered short-term yields, yet longer-term rates have drifted higher in response to sticky inflation expectations and ballooning deficit and mounting debt concerns. We are reminded of “Ferguson’s Law” which states that any great economic and global power ceased to be a great power when it spends more on debt servicing than on national defense—the United States violated Ferguson’s Law for the first time in 2024. Low interest rates embedded in the stock of debt and structural fiscal concerns have kept upward pressure on the long end of the curve. Tariffs still pose a risk to the economy and the effective rate on goods imports is set to climb from 11% in July to about 16%, with two-thirds or more of that likely to fall on customers.

Credit Markets

Credit spreads have tightened as investor risk appetite returns, but select pockets of stress remain, especially in sectors exposed to cyclical downturns or high leverage. Investment-grade corporate bonds offer moderate returns, with default rates contained. High-yield bonds have seen renewed interest, but investors should be mindful of credit quality and narrow spreads. Emerging market debt presents opportunities, particularly in Asia and Latin America, where improving fundamentals support creditworthiness.

Bond Yields

Bond yields are expected to remain range-bound in Q4 2025, with upside limited by central bank caution and moderating inflation. Investors seeking income should consider a diversified approach, balancing government securities with high-quality corporate debt and select emerging market bonds. Duration management will be critical, as yield curve steepening impacts returns. This bullish steepening is an indicator that the Fed will bring down short-term rates to stimulate the economy and are less worried about inflation. This contrasts with a bearish steepening when long rates rise in response to higher inflation. Since lower-end consumption and credit card debt are more interest rate sensitive, as well as small business lending that carry more short-term debt; bullish steepening tends to benefit retail, consumer, and small business activity. Additionally, it tends to benefit more value-oriented areas of the market like smaller banks and early cyclical stocks.

Commodities and alternatives Utility players

Oil

Although oil prices have been soft in 2025, supply discipline from OPEC+ and improving global demand have supported prices, while geopolitical risks in the Middle East and Eastern Europe continue to pose upside threats. Energy transition policies are accelerating investment in renewables, but oil remains the key component of the energy mix and important to subduing headline inflation.

Gold/Silver

Gold has maintained its role as a defensive asset and hedge against inflation as well as structural debt concerns. Investor demand for safe havens has accelerated as cracks in the Dollar’s reserve status has emerged. Gold remains a strategic hedge against geopolitical and market uncertainty, and Central bank purchases have provided additional support, particularly in emerging markets. Silver has increased industrial use demand to further drive price appreciation.

Real Estate

Global real estate markets are mixed in Q4 2025. Commercial property in major cities has recovered from pandemic lows, driven by strong demand for logistics and data centers. Residential markets remain resilient, though affordability concerns persist in the U.S. and parts of Europe. Real estate investment trusts (REITs) offer attractive yields, but investors should be selective, focusing on sectors with sustainable demand drivers.

Alternative Assets

Alternative assets, including private equity, infrastructure, and hedge funds, continue to attract capital as investors seek diversification and non-correlated returns. Private equity deal flow remains robust, particularly in technology and healthcare, while infrastructure investments benefit from government stimulus and green transition initiatives. Hedge fund performance is varied, with macro strategies outperforming in volatile environments.

Risks and Uncertainties Warning tracks

Geopolitical Risks

Geopolitical tensions remain a key risk for investors in Q4 2025. Conflicts in Eastern Europe and the Middle East have the potential to disrupt energy markets and global supply chains. Trade disputes between major economies, particularly the U.S. and China, could flare up, impacting market sentiment. Investors should maintain awareness of geopolitical developments and incorporate risk mitigation strategies into portfolios.

Regulatory Changes

Regulatory uncertainty, especially in technology and financial services, poses challenges for investors. Data privacy, antitrust actions, and cross-border taxation are areas to watch. Changes in environmental policy, particularly in the U.S. and Europe, could affect energy, automotive, and manufacturing sectors.

Market Volatility

Market volatility is expected to significantly increase in Q4 2025, driven by macroeconomic uncertainties, policy shifts, and episodic risk events. While volatility creates challenges, it also presents dynamic opportunities for investors. Employing well-diversified global asset allocation strategies and active management can help mitigate downside risk and capture relative upside potential.

Global Asset Allocation Cover your bases

Effective asset allocation will be paramount in Q4 2025. A balanced approach, incorporating equities, fixed income, commodities, and alternatives can help investors achieve better risk-adjusted returns, with commodities and alternatives provide optimal diversification benefits.

- Equities: Overweight positions in financials, healthcare, small-cap and micro-cap allocations, and select international and emerging markets are warranted while underweighting momentum and high-valuation sectors.

- Fixed Income: Prioritize investment-grade credit, manage duration risk, and consider emerging market debt for yield enhancement.

- Commodities: Maintain exposure to oil and gold/silver as hedges against inflation and geopolitical risk.

- Alternatives: Private equity, venture, and infrastructure for non-correlated returns and long-term growth while mindful of capacity constraints, fees, and less liquidity.

Conclusion “Take me out to the ball game”

Today, despite the positive wealth effect in America, we are not in the roaring 1920s nor the booming 1990s. The stock market is trading at lofty levels but there are still opportunities for well-grounded investors to preserve and even grow wealth.

The fourth quarter of 2025 offers a complex but navigable environment for investors. Global growth is stabilizing, inflation is moderating, and central banks are recalibrating policy to support continued expansion. Sector and style rotation and geographic diversification present opportunities, and geopolitical and regulatory uncertainties underscore the need for robust risk management. By adopting a disciplined, diversified approach and remaining vigilant to evolving market conditions, investors can position themselves for success in the final months of 2025 and beyond.

NOTE: IMPORTANT INFORMATION

All references to Comerica Bank or Comerica Bank & Trust, N.A., shall mean Fifth Third Bank, N.A., successor by merger to Comerica Bank and to Comerica Bank & Trust, N.A. All references to Comerica Incorporated shall mean Fifth Third Bancorp, successor by merger to Comerica Incorporated.

Comerica Wealth Management consists of various divisions and affiliates of Comerica Bank, including Comerica Bank & Trust, N.A. and Comerica Insurance Services, Inc. and its affiliated insurance agencies. Comerica Bank and its affiliates do not provide tax or legal advice. Please consult with your tax and legal advisors regarding your specific situation.

Non-deposit Investment products offered by Comerica and its affiliates are not insured by the FDIC, are not deposits or other obligations of or guaranteed by Comerica Bank or any of its affiliates, and are subject to investment risks, including possible loss of the principal invested.

©2026, Comerica Bank. All rights reserved

Unless otherwise noted, all statistics herein obtained from Bloomberg.

This is not a complete analysis of every material fact regarding any company, industry or security. The information and materials herein have been obtained from sources we consider to be reliable, but Comerica Wealth Management does not warrant, or guarantee, its completeness or accuracy. Materials prepared by Comerica Wealth Management personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of Comerica Wealth Management, including investment banking personnel.

The views expressed are those of the author at the time of writing and are subject to change without notice. We do not assume any liability for losses that may result from the reliance by any person upon any such information or opinions. This material has been distributed for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice.

Information supplied from another source.

While the information contained within has been provided/compiled from source(s) which are believed to be reliable and accurate to the best knowledge of Comerica Wealth Management. Comerica Wealth Management does not guarantee its accuracy. It should not be considered a comprehensive statement on any matter and should not be relied upon as such.

Past performance does not guarantee future results.

The S&P 500® Index, S&P MidCap 400 Index®, S&P SmallCap 600 Index® and Dow Jones Wilshire 500® (collectively, “S&P® Indices”) are products of S&P Dow Jones Indices, LLC or its affiliates (“SPDJI”) and Standard & Poor’s Financial Services, LLC and has been licensed for use by Comerica Bank, on behalf of itself and its Affiliates. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services, LLC (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings, LLC (“Dow Jones”). The S&P 500® Index Composite is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product nor do they have any liability for any errors, omissions, or interruptions of the S&P Indices.

NEITHER S&P DOW JONES INDICES NOR STANDARD & POOR’S FINANCIAL SERVICES, LLC GUARANTEES THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE WAM STRATEGIES OR ANY DATA RELATED THERETO OR ANY COMMUNICATION, INCLUDING BUT NOT LIMITED TO, ORAL OR WRITTEN COMMUNCATION (INCLUDING ELECTRONIC COMMUNICATIONS) WITH RESPECT THERETO. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES AND STANDARD & POOR’S FINANCIAL SERVICES, LLC MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES, OR MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY COMERICA AND ITS AFFILIATES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE S&P INDICES OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES OR STANDARD & POOR’S FINANCIAL SERVICES, LLC BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE. THERE ARE NO THIRD-PARTY BENEFICIARIES OF ANY AGREEMENTS OR ARRANGEMENTS BETWEEN S&P DOW JONES INDICES AND COMERICA AND ITS AFFILIATES, OTHER THAN THE LICENSORS OF S&P DOW JONES INDICES.

“Russell 2000® Index and Russell 3000® Index” are trademarks of Russell Investments, licensed for use by Comerica Bank. The source of all returns is Russell Investments. Further redistribution of information is strictly prohibited.

MSCI EAFE® is a trademark of Morgan Stanley Capital International, Inc. (“MSCI”). Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, endorsed, reviewed or produced by MSCI. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

FTSE International Limited (“FTSE”)© FTSE 2016. FTSE® is a trademark of London Stock Exchange Plc and The Financial Times Limited and is used by FTSE under license. All rights in the FTSE Indices vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE Indices or underlying data.