Preview of the Week Ahead

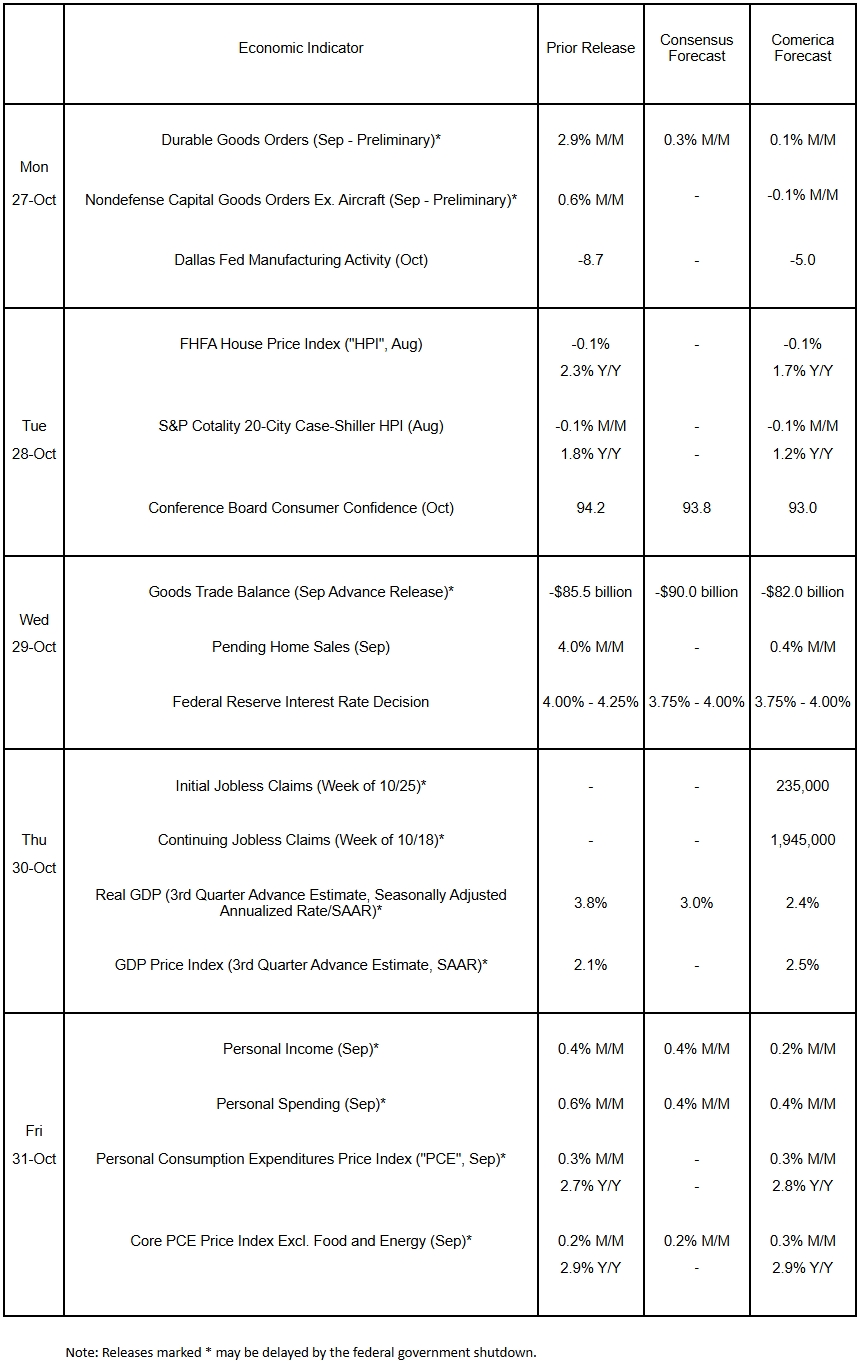

The Fed will ease the federal funds target rate by a quarter percent to a range of 3.75% to 4.00% at their meeting Wednesday, after last Friday’s release of the September Consumer Price Index report (CPI) contained little to dissuade them from a cut. Pending home sales likely rose slower in September following August’s large increase. Consumer confidence probably changed little in October, while households’ inflation expectations are anticipated to have remained elevated.

The Week in Review

The CPI rose by 0.3% in September, while core CPI, which excludes volatile food and energy prices, increased by 0.2%. As a result, headline and core CPI were both 3.0% higher from a year earlier. Gasoline prices, up 4.1% last month, were the single biggest driver of inflation. American households were reported to have seen large monthly declines in electricity and utility (piped) gas costs. Food prices moderated after a large increase in the prior month. Beef prices rose sharply again and are up nearly 15% from a year earlier. Prices of goods that are largely imported were mixed: Apparel prices jumped, while medical care commodity prices eased. On the services side, shelter inflation moderated after a significant increase in August. Prices of “Supercore” services excluding shelter and energy services, however, posted a big monthly increase and were up 3.2% from a year earlier. Services such as motor vehicle maintenance and servicing, airline transportation, and personal care (haircuts etc.) contributed to September’s increase.

Matching the consensus estimate, existing home sales rebounded by 1.5% in September to an annualized rate of 4.060 million units and were 4.1% higher from a year earlier. On an unadjusted basis, they declined for the third consecutive month. About a third of homes sold in September were all-cash transactions and the majority were at the highest price ranges. The number of homes listed for sale, at 1.550 million units, was 14.0% higher from a year ago, equivalent to 4.6 months of supply at last month’s pace of sales. The median price of a home sold rose by 2.1% from a year earlier to $415,200.

U.S. business activity accelerated in October to the second-fastest pace in the year to date, according to S&P Global’s flash release of the month’s PMI surveys. Overall activity was boosted by the largest increase in new orders so far this year, with new work up markedly for service providers. Businesses modestly increased headcount. Input costs for manufacturers remained “especially high,” while service providers reported “registering one of the steepest increases seen over the past two years.” Despite facing heavy cost pressures, businesses passed on costs to consumers at the slowest rate in six months, attributing their pricing decisions to subdued demand and fierce competition.

Consumer sentiment was little changed in October. Nearly a month into the federal government shutdown, only a handful of survey respondents mentioned the shutdown as an economic concern. Instead, they once again reported high inflation as their top issue. This was reflected in elevated year-ahead and long-term inflation expectations, with the former at 4.6% and the latter at 3.9%.

For a PDF version of this publication, click here: Comerica Economic Weekly, October 27, 2025(PDF, 169 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.