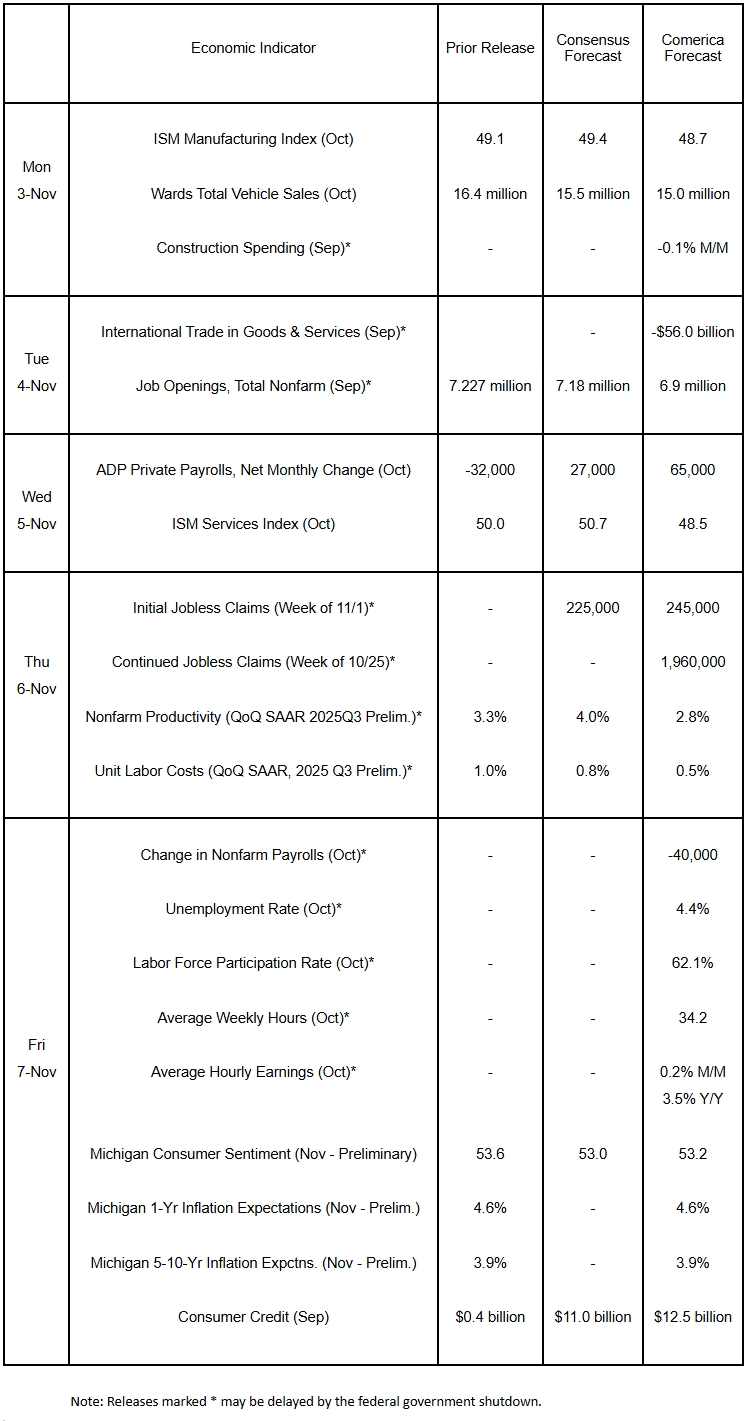

Preview of the Week Ahead

Payroll processing company ADP is likely to report private employment rebounded modestly in October after a decline in the prior month. The government’s jobs report would probably have shown a decline due to lower federal government employment, but is delayed by the shutdown. The ISM Manufacturing and Services PMIs probably fell in October amid headwinds from ongoing trade disputes and the government shutdown. Vehicle sales likely fell, too, after EV tax credits expired on Sep 30th. Consumer credit is expected to have risen in September after holding steady in the prior month. Consumer sentiment and households’ year-ahead and long-term inflation expectations are forecast to hold steady in their early November releases.

The Week in Review

As expected, the Federal Open Market Committee (FOMC) reduced the federal funds target rate a quarter of a percent to a range of 3.75% to 4.00% at its October 29 interest decision. Unusually, two members dissented: Recent Trump appointee Governor Miran preferred a larger, half-percent cut, while Kansas City Fed President Jeffrey Schmid favored holding the policy rate unchanged. Chair Powell, in prepared remarks, attempted to cast doubts on financial markets’ confidence that the Fed would cut again in December, remarking, “A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it. Policy is not on a preset course.” He also observed that policymakers had “strongly differing views on how to proceed in December.” Following declines in bank reserves and signs of reduced liquidity in short-term funding markets, the FOMC also decided to end its balance sheet reduction program (AKA “Quantitative Tightening” or QT) on December 1st, and will hold the size of their balance sheet steady thereafter by reinvesting maturing bonds into Treasuries.

In their policy statement, monetary policymakers saw the job market as “less dynamic” and “somewhat softer” due to issues affecting both labor supply (lower immigration and reduced labor force participation) and labor demand (slow hiring). They see downside risks to employment ahead. On inflation, the FOMC sees crosscurrents. While tariffs are driving goods inflation higher, they see services prices rising at a slower pace due to cool increases of house prices and rents. Overall, policymakers see risks to inflation tilted to the upside. In balancing the conflict between their employment and price stability goals, policymakers opted for the former, since the job market concerns them more than inflation.

The Pending Home Sales Index, derived from signed contracts to purchase homes and so a solid leading indicator of future existing home sales, was flat on the month in September on a seasonally adjusted basis. On an unadjusted basis, it rose 1.5% from a year earlier, although it has made its usual seasonal decline from the summer peak. Mortgage rates are down about half a percent from their recent peak in May and June, but this is providing limited support for home sales. Other factors, such as buyers’ skittishness over job security, appear to be keeping homebuyers on the sidelines.

Consumer confidence was essentially unchanged in October. Consumers’ assessments of current and future conditions were also little changed. Worries about job availability persisted, while inflation remains the foremost issue affecting households’ views of the economy.

For a PDF version of this publication, click here: Comerica Economic Weekly, November 3, 2025(PDF, 215 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.