Preview of the Week Ahead

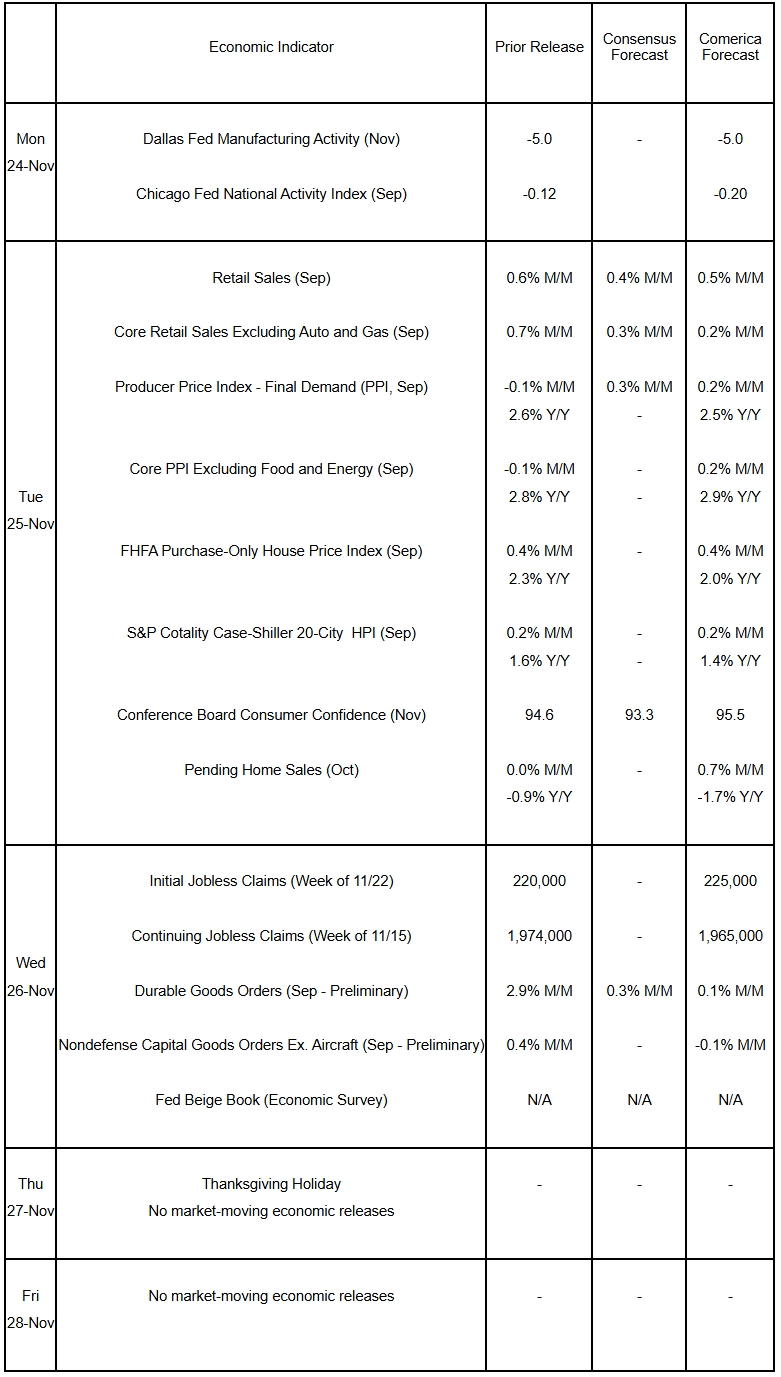

Retail sales are forecast to have posted a large increase in September, as consumers rushed to purchase EVs before the expiry of tax credits at the end of that month, but core retail sales likely increased at a more moderate pace. Weak commodity prices likely tempered producer price increases in September. Continuing a multi-month trend, annual house price inflation likely eased again in September. Consumer confidence probably rose as the government shutdown ended, echoing the uptick in consumer sentiment reported by the University of Michigan last week. The report on GDP for the third quarter originally scheduled for this week is delayed due to the government shutdown.

The Week in Review

Members of the Federal Open Market Committee (FOMC)—the Federal Reserve’s rate-setting body—saw the economy expanding at a moderate pace, according to the minutes of their October meeting, but also observed that “downside risks to employment had risen in recent months.” They noted inflation had risen since early in 2025 and expected it to “remain somewhat elevated in the near term before moving gradually to 2 percent.” “Many participants” favored cutting rates in October due to risks to the labor market, but the December decision looks like a closer call: Members expressed “strongly differing views about what policy decision would most likely be appropriate” at the meeting. They judged bank reserves to be approaching levels they considered “ample,” supporting their decision to end reductions in the size of the Fed’s balance sheet (a.k.a. “Quantitative Tightening”) on December 1st. After the meeting, New York Fed President John Williams said the Fed may “soon” need to restart growth of the balance sheet to alleviate short-term funding stresses.

Employers added 119,000 jobs to payrolls in September, well above the 52,000 consensus estimate. Beyond the beat, there was plenty of weakness in the report. Employment in July and August were revised down by a combined 33,000. With the revisions, only half as many jobs have been added in the year through September as in the first nine months of 2024 (This comparison does not account for the 911,000 preliminary benchmark revision to employment in March 2025, which would reduce job growth in both 2024 and early 2025). Additionally, about 85% of the jobs added so far this year are in private education and health services. Also, roughly 100,000 federal employees who took deferred resignations earlier in 2025 left payrolls on September 30th, according to press reports of data from the federal Office of Personnel Management. Those resignations happened after the reference period for measuring September payrolls, and likely would have pushed employment negative if they were included. The unemployment rate edged up to 4.4%, the highest in nearly four years. The labor force participation rate also edged higher but was down from a year earlier. The average workweek held steady at a relatively low 34.2 hours. Average hourly earnings rose a modest 0.2% and were up 3.8% from a year ago. The increase in the unemployment rate will pressure the Fed to cut again in December, but a split vote seems likely.

The trade deficit declined by a steep 23.8% to $59.6 billion in August due to a sharp fall in goods imports and a larger services surplus. The goods deficit with Mexico and the European Union has increased materially in 2025, but is down notably with China and Canada.

For a PDF version of this publication, click here: Comerica Economic Weekly, November 24, 2025(PDF, 200 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.