Preview of the Week Ahead

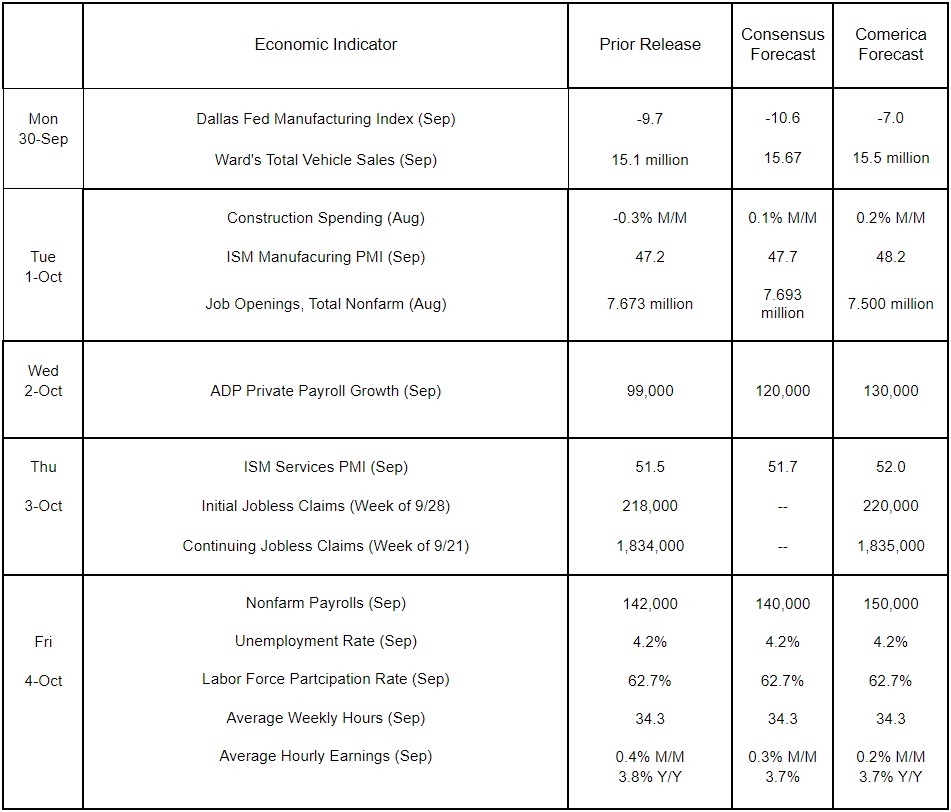

Key labor market data releases dominate the economic calendar this week. The economy probably added 150,000 jobs in September, and the unemployment rate likely held steady at 4.2%. Two sectors—education and healthcare and government—probably accounted for most of the jobs created. Average hourly earnings are expected to have slowed to a 0.2% increase in September from their 0.4% jump in the prior month, likely holding annual wage increases below 4% for the fourth consecutive month. In a further sign the labor market is cooling, job openings likely fell to 7.500 million in August.

The ISM Manufacturing PMI probably remained in contractionary territory in September, while its service equivalent likely expanded again. Markets are likely to scrutinize the input price sub-indices. Last week’s release of the flash estimate of the S&P Global PMIs reported prices charged by manufacturers and service-providers rose at the fastest pace in six months, as input costs, particularly wages paid in the services sector, rose to a 12-month high. Boosted by a surge in housing starts, overall construction spending likely rebounded in August after a 0.3% decline in July.

The Week in Review

The Bureau of Economic Analysis kept second quarter growth unrevised at 3.0% annualized as expected in its “third” and final estimate for the quarter. Consumer spending, which accounts for roughly two-thirds of the American economy, was revised down by a notch to a still very healthy 2.8%, while federal government spending, private inventory investment, and imports were corrected substantially higher. First quarter growth also was revised up, and the economy expanded by 2.4% in the first half of the year, above its longer run potential growth rate of about 1.8%. The economy-wide Gross Domestic Product Price Index and the Personal Consumption Expenditures (PCE) Price Index—the Fed’s preferred inflation gauge—were both unrevised at 2.5% annualized. Prior quarters’ personal incomes and savings figures were revised up notably in the annual GDP benchmark revisions. Consumer incomes and savings could, hence, continue to be supportive of growth going forward.

The Conference Board’s Consumer Confidence Index unexpectedly fell in September, as households’ assessments of their current situation and short-term outlook dimmed sharply. The Index is a composite indicator that places a large weight on participants’ assessments of labor market conditions, so the Bureau of Labor Statistics’ recent 818,000 downward revision to employment statistics may have clouded respondents’ views. Prices and inflation continue to be a key factor affecting households’ perceptions of the economy and, despite the recent decline in inflation, consumers’ year-ahead inflation expectations rose to 5.2%.

Hefty declines in interest and dividend incomes largely offset robust increases in wages and salaries last month. As a result, personal incomes rose by a modest 0.2%. PCE matched our expectation for a modest 0.2% increase, as households pulled back on spending on goods and focused their expenditures largely on essential services, such as housing and insurance. Monthly headline and core PCE inflation matched our 0.1% forecast and were 2.2% and 2.7% higher, respectively, from a year earlier.

For a PDF version of this publication, click here: Comerica Economic Weekly, September 30, 2024(PDF, 102 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.