Preview of the Week Ahead

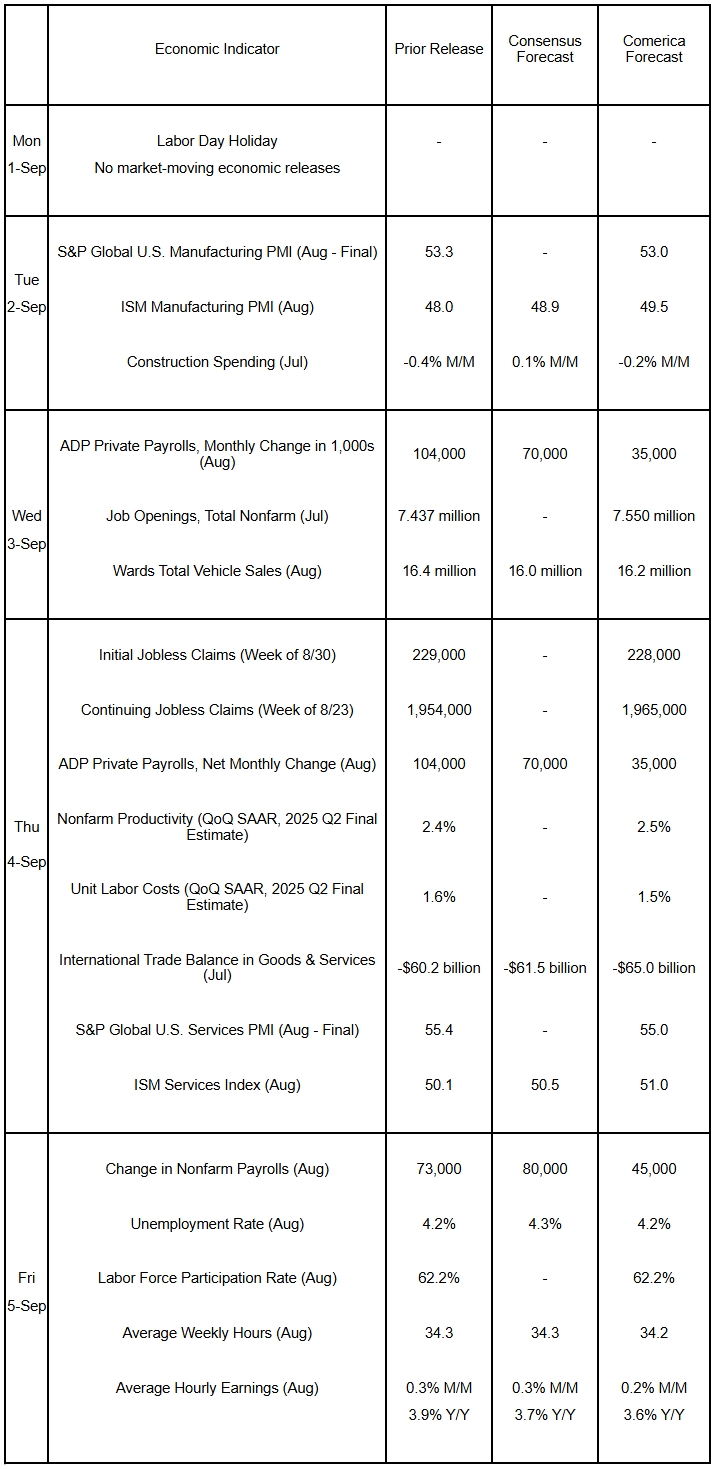

In a holiday-shortened week packed with data releases, the most attention will go to the August jobs report. It is expected to show modest growth of payroll employment, a little above the last few months’ average pace. Comerica forecasts a stable unemployment rate, slightly better than the consensus’ expectation for a slight uptick. Earnings growth is forecast to slow.

In the week’s other releases, construction spending is forecast to contract again in July after falling in five of the first six months of 2025. The ISM manufacturing and services PMIs are forecast to rise in August after July’s reports showed the private sector growing at a modest pace. August probably saw another solid month of vehicle sales as EV buyers rushed to cash in on tax credits before those programs sunset at the end of September.

The Week in Review

The campaign to pressure the Fed to cut rates intensified last week as President Trump attempted to fire Governor Lisa Cook; Governor Cook is filing suit to contest her firing, which the President asserts is for cause. The administration criticized Chair Powell for the cost of the Fed’s renovations in July; former Governor Adriana Kugler took personal days during the Fed’s July meeting and did not take a side in the split vote between advocates of a cut and FOMC members who thought rates should hold steady, then resigned a few months before her term was scheduled to end. Financial markets are largely shrugging off the attacks on the Fed’s independence, apparently betting the episode is Greenland redux.

Second quarter real GDP growth was revised up to a 3.3% annualized increase in the second estimate from 3.0% in the first estimate, with upward revisions to consumer spending and business fixed investment. Real final sales to private domestic purchasers, which include the components of GDP that track closest to the economy’s underlying trend, was revised up to 1.9% and matched the first quarter’s increase—a nice moderate pace of growth. The personal consumption expenditures price index was revised down a hair to 2.0% annualized from 2.1% previously, while core PCE inflation was unchanged at 2.5% annualized. Real gross domestic income rose a robust 4.8% annualized, and corporate profits rose 1.7% (not annualized).

Consumer confidence edged lower in August, although its level was better than forecast due to upward revisions to confidence in July. Both the Current Conditions Index and Expectations Index were weaker on the month. Consumers' assessment of the job market was the least optimistic since early 2021.

The FHFA House Price Index (HPI) fell 0.2% in June, and the S&P Cotality Case-Shiller 20-City HPI fell 0.3%. It was the third consecutive monthly decline for the FHFA HPI and the fourth for the Case-Shiller. From a year earlier, the FHFA HPI slowed to a 2.6% increase from 2.9% in May, and the Case-Shiller to a 2.1% increase from 2.8% in May. Housing sales were better than prices in last week’s data, with new home sales registering 652,000 annualized units in July, beating the 630,000 consensus due to upward revisions to June. The median price of a new home sold fell 5.9% from a year earlier.

For a PDF version of this publication, click here: Comerica Economic Weekly, September 2, 2025(PDF, 245 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.