Preview of the Week Ahead

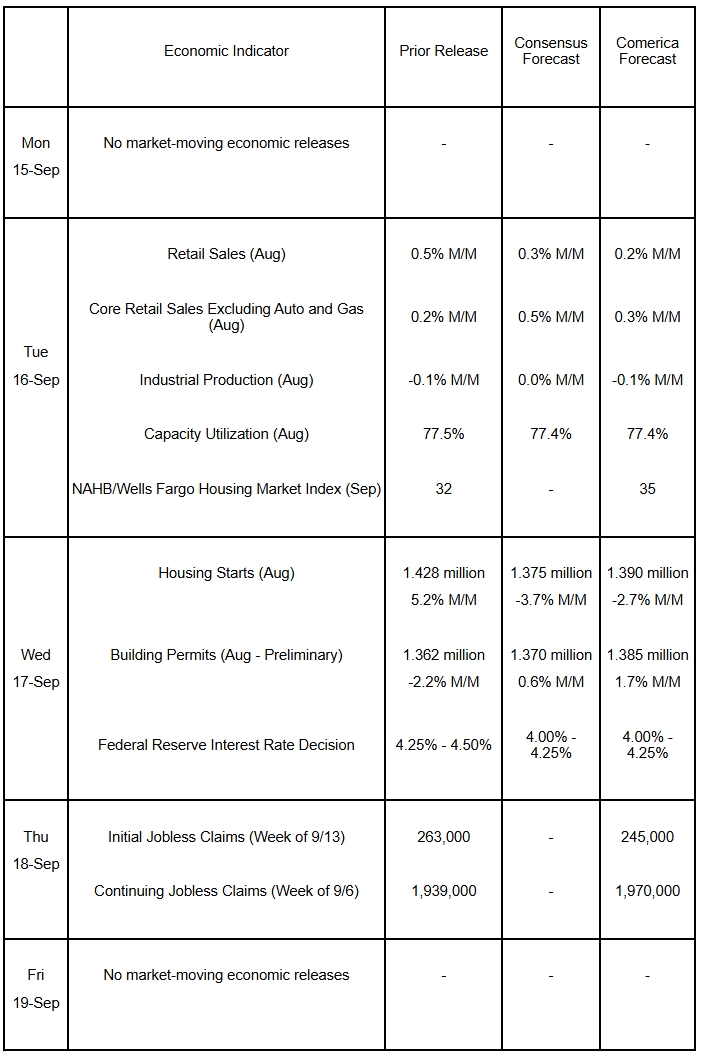

Comerica forecasts for the FOMC to cut the fed funds target rate by a quarter percent to a range of 4.00% to 4.25% at its next decision Wednesday. The Fed will publish an updated Dot Plot, with their forecasts of growth, inflation, the unemployment rate, and the most appropriate course for rates. If Chair Powell repeats the cautious guidance from his speech at Jackson Hole in August, markets could abruptly reprice their aggressive pre-meeting rate cut expectations. Retail sales probably grew slower in August on lower vehicle sales after a robust increase in July. Core retail sales, which exclude sales at dealerships and gasoline stations, are expected to rise solidly. Housing starts probably eased in August following sharp increases in July, while issuance of building permits likely picked up after a big decline in July. Industrial production likely held steady in August, as mining (especially oil and gas extraction) and utilities output weighed on the index.

The Week in Review

August’s inflation data were mixed. The Consumer Price Index (CPI) rose 0.4%, a notch higher than the 0.3% consensus forecast, and accelerated to 2.9% in annual terms from 2.7% in July. Core CPI, which excludes the volatile food and energy components, rose 0.3% on the month and 3.1% on the year, both matching expectations. Food prices rose sharply, particularly those of food consumed at home, while energy prices also rose on the back of a rebound of gasoline prices, which fell in July. Shelter costs rose at the fastest pace in nearly a year, as this index of owners’ equivalent rent of residences, rents of primary residences, and motel and hotel accommodation prices rose at the fastest pace in several months. Tariffs raised the prices of a number of goods and some services. There were outsize increases in prices of apparel, televisions, recreational vehicles, and alcoholic beverages, as well as motor vehicle maintenance and repair, which includes the cost of foreign-sourced parts.

Prices paid by producers were tamer than expected, with the Producer Price Index for Final Demand (PPI) down a tenth of a percentage point, well below the median economic forecaster’s prediction for a 0.3% increase. From a year earlier, the PPI rose 2.6% in August, half a percent below the 3.1% increase in the prior month and also well below the 3.3% consensus forecast. Core PPI, which excludes volatile prices of energy, foods, and wholesaler and retailer margins, increased by 0.3% in August following a 0.6% jump in the prior month and rose a notch to 2.8% in year-over-year terms.

The Bureau of Labor Statistics revised down the number of jobs added to U.S. payrolls in the 12 months ending in March 2025 by a record 911,000 in the September 2025 Preliminary Benchmark Revision. The big downward revision, coupled with the highest initial unemployment insurance claims in the week of the Labor Day holiday since late 2021, reinforce the weak August jobs report’s signal that the job market is wobbly.

In the penultimate month of the 2024/25 fiscal year, the federal deficit widened to $345 billion from a $291 billion deficit in July. The deficit marks an improvement from a year earlier, with revenues up 12.3% on tariff collections, while expenditures are up a much more modest 0.4%.

For a PDF version of this publication, click here: Comerica Economic Weekly, September 15, 2025(PDF, 182 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.