Preview of the Week Ahead

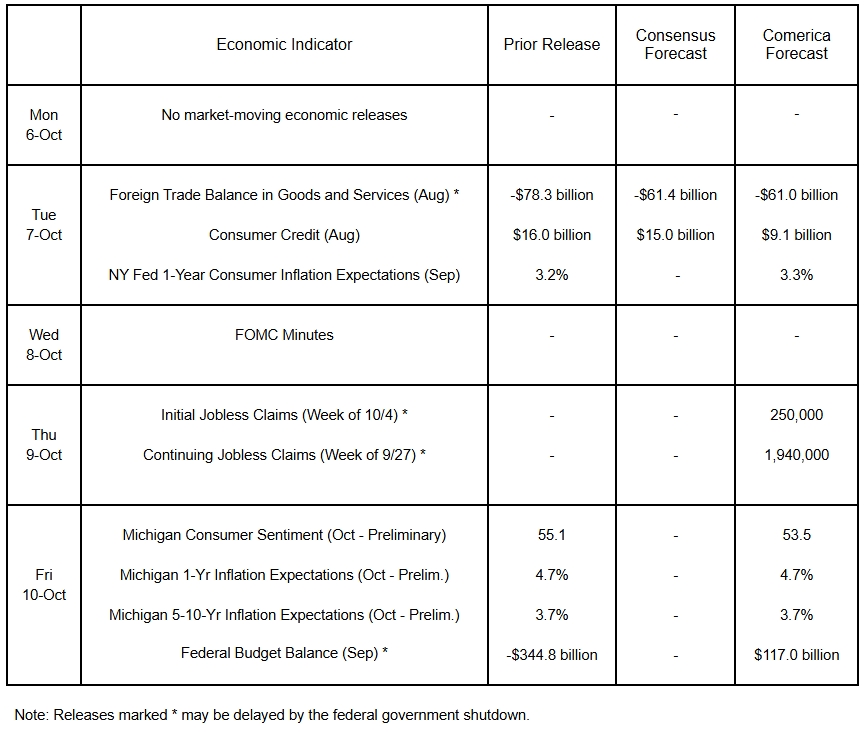

Financial markets will dissect the minutes of the FOMC’s September meeting to search for new clues about policymakers’ views of the economy and future monetary policy and try to clarify the wide split of views among Committee members. Consumer sentiment is expected to have eased in early October, while short- and long-term inflation expectations are anticipated to have held steady at elevated levels. Consumer credit growth likely moderated in August following robust expansion in the prior month. If the government shutdown doesn’t prevent their release, foreign trade data will likely show the deficit narrowed in August, and the federal fiscal balance swung to a seasonal surplus in September.

The Week in Review

Markets paid closer-than-usual attention to private labor market data since the federal government’s shutdown delayed publication of the Bureau of Labor Statistics’ September jobs report. The payroll processor ADP reported 32,000 private job losses in September and revised down August from a 54,000 gain to a 3,000 decline. ADP reported employees who stayed at their jobs saw their pay increase 4.5% compared to a year earlier. On the other hand, HR data provider Revelio Labs estimates 60,000 jobs were added in September. The outplacement firm Challenger, Gray, and Christmas reports 54,000 layoff announcements in September, down over 20% from a year earlier, but also that employers’ hiring announcements collapsed to their lowest in over 15 years, a downbeat signal about seasonal holiday hiring this year.

In the last pre-shutdown federal data release, job openings edged up to 7.227 million in August from an upwardly revised 7.208 million in July. The number of unemployed persons exceeded vacancies for the third consecutive month. The economywide average, however, masks that openings still exceed jobseekers in a number of major industries, such as leisure, hospitality, education, and healthcare. The number of employees quitting their jobs and the quits rate—widely watched proxies for labor market mobility—fell again and matched post-pandemic lows. The quits data tell a similar story to recent consumer surveys, which report increased pessimism about job availability.

The ISM Manufacturing PMI held in contractionary territory for the seventh successive month in September. Production expanded. Indicators of future production (new orders, backlog of orders, new export orders) all declined, pointing to further softness in the coming months. Employment fell again, while inflation of prices paid for inputs remained elevated. Service-providing activity stalled in September, according to the ISM Services PMI. The finer details of the report were mostly discouraging: Business activity edged lower; new orders slowed materially; employment declined for the fourth month in a row; and input costs rose at the fastest pace in nearly three years.

The Consumer Confidence Index fell by 3.6 points to 94.2 in September. The decline was driven by a sharp deterioration in consumer perceptions of current job availability, which fell for the ninth successive month to a multiyear low. Consumers’ views of the job market worsened. The Kirk assassination, increased political turbulence, and the approaching government shutdown likely weighed on consumer attitudes in the survey.

For a PDF version of this publication, click here: Comerica Economic Weekly, October 6, 2025(PDF, 182 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.