Preview of the Week Ahead

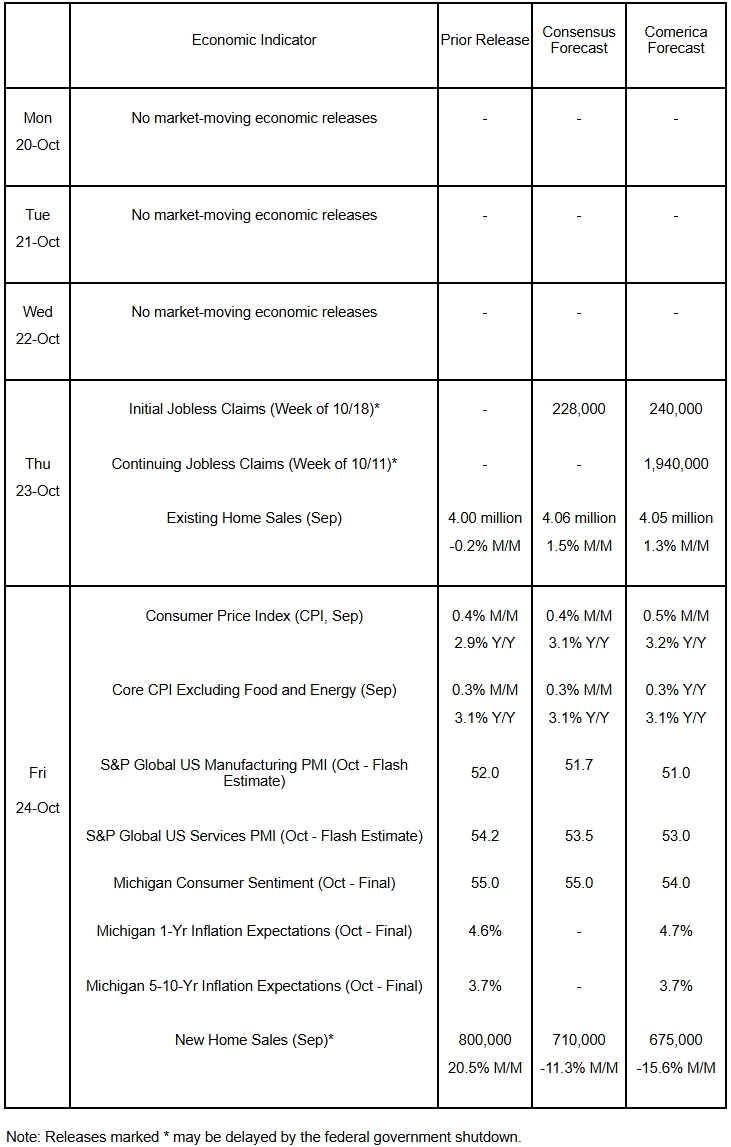

The September inflation report will probably show a sharp monthly increase in headline consumer prices and a moderate rise in core prices, resulting in annual changes for both measures holding above 3%. Big jumps in beef and electricity prices are expected to have contributed to the higher inflation print. S&P Global’s Flash PMIs will likely show a further moderation in economic activity in both manufacturing and services sectors. Boosted by lower mortgage rates, existing home sales probably rose last month. Weighed down by the government shutdown, consumer sentiment likely eased in October, while households’ year-ahead and long-term inflation expectations are anticipated to have held steady.

The Week in Review

The federal government ran a deficit of $1,775 billion for the entire 2024/25 fiscal year. That’s a modest $41 billion improvement in nominal dollar terms. But after accounting for the economy’s growth, the Treasury Department estimates the deficit shrank from 6.3% of GDP in the ‘23/’24 fiscal year to 5.9% of GDP in the current one. Helped by a 153% increase in customs duties, which includes tariff receipts, revenues topped $5 trillion. Among major revenue sources, corporate income taxes declined by nearly 15%. Spending rose above $7 trillion for the first time ever, with many major expenditure items—Social Security, Medicare, Medicaid, defense, and interest payments—up notably.

The October Beige Book—the Federal Reserve’s compilation of anecdotal information on current economic conditions across the nation—notes little change in economic activity since early September. Consumer spending, particularly on retail goods, was reported to have decreased slightly. Employment held steady in recent weeks, but demand for labor was “muted.” The report noted strains in labor supply in hospitality, agriculture, construction, and manufacturing due to changes in immigration policies. Inflation persisted and picked up in some regions, which the report attributed to tariffs and higher prices of insurance, healthcare, and technology services. Some firms passed on higher costs to customers, while others absorbed them to maintain market share.

The NFIB Small Business Optimism Index fell by two points to 98.9 in September, but remained above its 52-year average of 98. Uncertainty among small business owners jumped to the fourth-highest level in over 50 years. Supply chain disruptions and inflation remained the foremost problems faced by small business owners, while views of the economic outlook fell considerably. Businesses continue to struggle with labor quality issues. On a positive note, most small business owners surveyed by the NFIB reported that their businesses were healthy, and earning trends were the best since late 2021.

Led by a jump in future sales expectations, the NAHB / Wells Fargo Housing Market Index (HMI) rose by five points to 37 in October. Subindices tracking current conditions and current buyer traffic also increased. The trade association notes homebuilders expect further declines in interest rates, which they anticipate will lead to a “slightly improving sales environment, albeit one in which persistent supply-side cost factors remain a challenge.” About four in ten homebuilders cut prices to boost sales, while around two in three used incentives to sell homes.

For a PDF version of this publication, click here: Comerica Economic Weekly, October 20, 2025(PDF, 143 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.