Preview of the week ahead

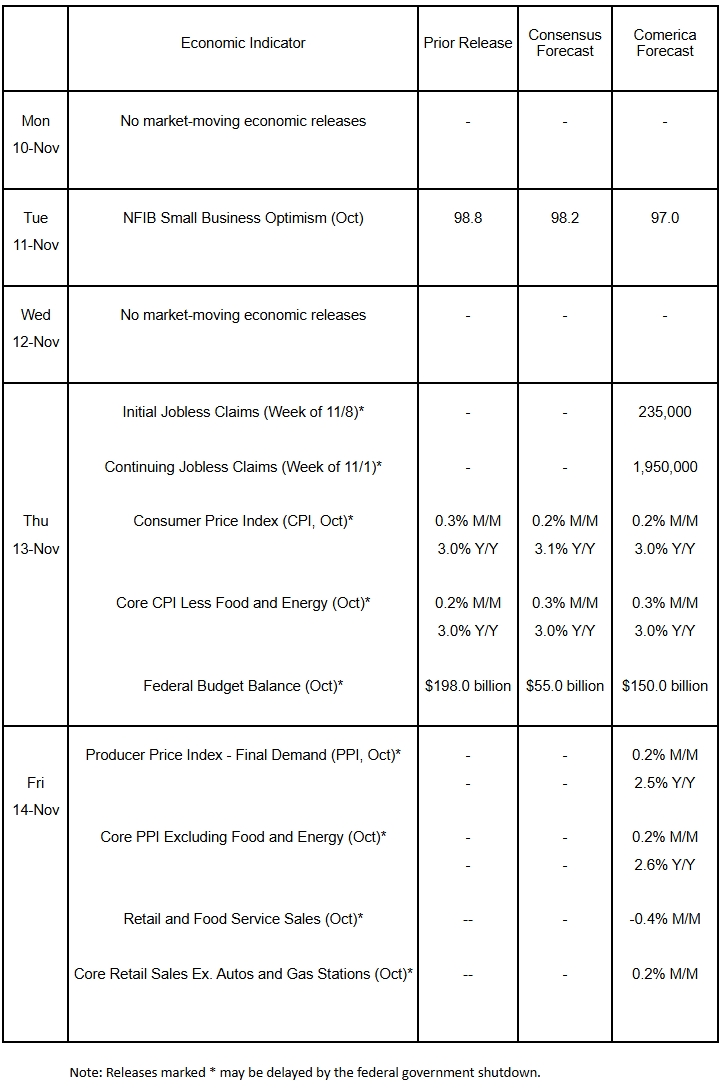

The October Consumer Price Index (CPI) will not be published, a first in the price index’s history, according to a White House social media post. Other critical economic releases scheduled for this week, including the Producer Price Index and Retail Trade reports, also are unlikely to be published as most employees of the statistical agencies were furloughed in October. The federal government likely posted a surplus last month as the shutdown froze many payments to public employees and contractors. Small business optimism probably took a further leg down in October amidst heightened economic uncertainty and slower economic activity.

The week in review

In the absence of key labor data releases, such as the jobs and JOLTS reports, financial markets once again relied on private data to gauge the health of the labor market. Overall, they pointed to a further weakening of the labor market. Payroll processer ADP reported private sector employers added 42,000 jobs in October. While October’s gain exceeded the 25,000 consensus, it was the first increase since July and just a fraction of the 221,000 increase reported for the same month last year. ADP’s figures do not include changes in government employment and so omit the resignation of perhaps 100,000 federal employees on September 30th. The administration offered a buyout (Deferred Resignation Program, “DRP”) to federal employees in early 2025, and employees ceased receiving buyout pay in October. Considering falling federal employment, total employment likely contracted in October. ADP reported annual pay growth of job stayers held steady at 4.5%. Highlighting the weakness in the labor market, the outplacement firm Challenger, Gray, and Christmas reported 153,074 layoffs were announced in October, an increase of about 175% from both September and from a year earlier. 1.1 million layoffs have been announced so far this year, the most since 2020. Employers cited a slew of reasons for their retrenchment decisions, including government spending cuts, their own cost cutting, and AI adoption.

Matching Comerica Economics’ forecast, the ISM Manufacturing PMI declined for the eighth consecutive month in October. Production slipped back into contraction, while new orders fell at a slower pace. Manufacturing payrolls declined for the ninth month running. On a positive note, manufacturers reported prices paid for inputs rose at a slower pace. The services side of the economy fared much better, with the ISM Services PMI moving back into expansion. The index’s gain was driven by sharp increases in new orders and production. Higher production, however, did not translate into increases in hiring, which contracted again. Service providers also reported input costs rose at the fastest pace in three years.

Consumer credit rose by $13.1 billion in September. Revolving credit – mostly credit card loans – rebounded by a modest $1.6 billion following a $6.0 billion slump in August. Nonrevolving credit – mostly auto and student loans – increased by $11.4 billion. Loans to automobile buyers likely made a sizeable contribution to the increase in nonrevolving credit, as auto purchases rose ahead of the expiry of EV tax credits on September 30th.

For a PDF version of this publication, click here: Comerica Economic Weekly, November 10, 2025(PDF, 201 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.