Preview of the Week Ahead

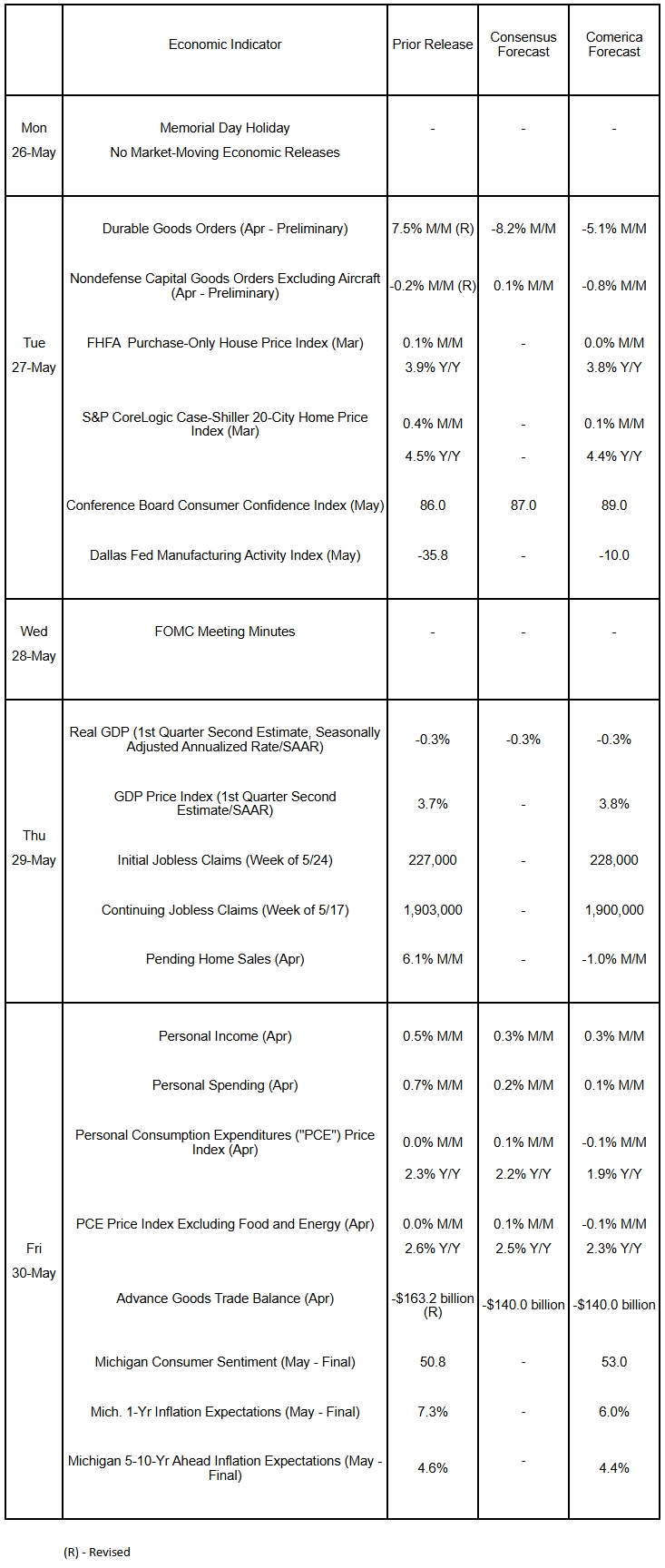

No material revisions are expected for either real GDP or the GDP Price Index when the second estimate for the first quarter of 2025 is published. Growth of both personal income and spending likely moderated in April after robust increases in the prior month. The headline and core Personal Consumption Expenditures (“PCE”) price indices probably eased in April, as businesses held back on passing higher costs to consumers. Cooler PCE inflation will be a welcome development, but seems unlikely to convince the Fed to cut interest rates near-term since last week’s survey releases showed that inflationary pressures are mounting rapidly. The goods trade deficit likely pulled back in April but was still larger than any month before 2025 as importers’ stockpiling of imports slowed.

On the housing front, pending home sales likely fell in April. A housing market moving closer to balance should translate to flat-to-modest monthly increases in house price indexes in March, further easing annual house price inflation. The University of Michigan’s final survey of consumers for May probably will improve, with a better outlook and lower inflation expectations after the partial rollback of tariffs on Chinese imports agreed on May 12 (The “90-day pause”). Durable goods orders likely fell in April after a sharp increase in the prior month. Orders for nondefense capital goods excluding aircraft—a widely-watched proxy for business spending on equipment—also likely fell as businesses waited for greater clarity on the economic outlook and took a wait-and-see approach to business investment.

The Week in Review

The economic calendar was very light last week. The flash estimates of S&P Global’s PMIs rose more than expected in May, beating the consensus. Manufacturing returned to expansion, while growth of the services sector expanded at a faster pace. New orders for service-providers and manufacturers rose, according to the survey, with the latter reporting the biggest increase of orders in fifteen months. The good news from production and new orders, however, did not translate into higher employment, as businesses reported net reductions in headcount. Worries over higher input costs continue to percolate among manufacturers, who reported stockpiling inventory at the fastest pace since mid-2022. As a result, inventories rose at the fastest pace in the PMI survey’s 18-year history. Manufacturers and service-providers’ input costs jumped at the fastest rate in a couple of years, as did prices they charged customers. Survey respondents overwhelmingly attributed the cost increases to a jump in prices of imports due to tariffs.

Providing further evidence of a weak start to the homebuying season, existing home sales edged down by 0.5% in April to an annualized rate of 4.0 million, weaker than the consensus forecast of economists. Last month’s sales were the weakest in 15 years for April and followed a nearly 6% slump in March. Homes available for sales jumped to 1.450 million units, the highest since September 2020, and were 20% higher than the same month of 2024. The supply of homes listed for sale rose to 4.4 months at April’s pace of sales, also a near-term high. Reflecting lower demand and higher supply, the annual increase in the median price of an existing house sold slowed again to 1.8% in April from 2.6% in March.

For a PDF version of this publication, click here: Comerica Economic Weekly, May 26, 2025(PDF, 164 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.