Preview of the Week Ahead

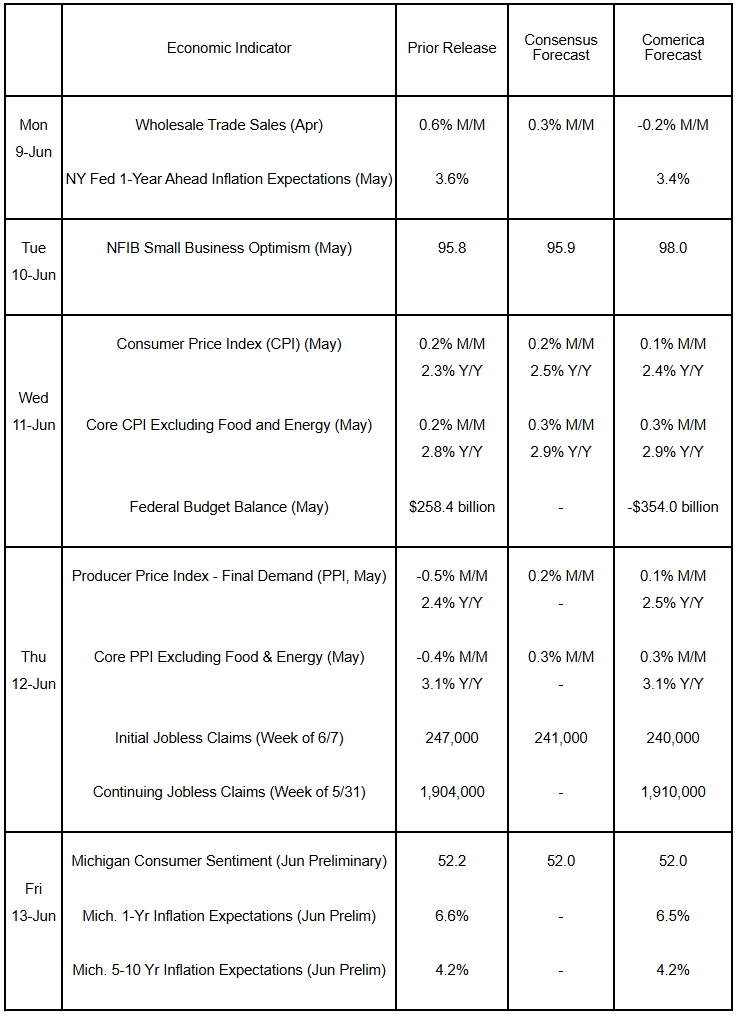

Inflation data will drive the economic narrative this week. The CPI and PPI probably rose modestly in May due to lower energy prices, while core CPI and PPI likely accelerated as businesses began passing tariffs on to their customers. The University of Michigan and NY Fed’s surveys of consumers are expected to show consumer inflation expectations edged lower but are still elevated, after the U.S. and China agreed to substantially reduce tariffs for 90 days. The partial tariff reprieve, along with the stock market’s outperformance in May, likely lifted consumer and business sentiment. The federal government likely posted a hefty deficit in May, as some of June’s outlays, such as social security payments and salaries, were made in May, since the first of June fell on a weekend.

The Week in Review

The May jobs report was mediocre, with good headlines but weak details. Employers added 139,000 nonfarm payroll jobs in May, but job growth in March and April was revised down a net 95,000. The unemployment rate held steady at 4.2%. But in the survey of households used to measure the unemployment rate, employment fell 696,000, unemployment rose 71,000, and working-age people outside the workforce rose 813,000. Average hourly earnings rose 0.4% and were up 3.9% from a year earlier, outpacing inflation. In separate data released at a lag to the jobs report, job openings were stronger than expected in April, up 191,000 to 7.391 million and well above the 7.1 million consensus forecast. While most sectors saw increases, there were pockets of weakness in manufacturing, leisure and hospitality, and government, all of which pulled back to the least openings since 2021.

Both manufacturing and service-providing sectors contracted in May, according to the ISM PMIs. Both reports pointed to sluggish economic activity and rising prices ahead. Business activity in the services sector was unchanged, while manufacturing production declined at a slower pace. New orders, a leading indicator of future production, contracted for both service providers and manufacturers. Employers reported employment in service-providing industries expanded after declining in the prior two months, while manufacturers reported lower headcount. Input costs rose for both industries, with service providers reporting the steepest price increases since November 2022.

Construction spending declined by 0.4% in April, led by a steep 0.9% fall in residential construction. Construction in the private sector was notably weak, with private non-residential construction, particularly manufacturing, commercial, and power construction, declining markedly. Led by government spending on highways and streets, public sector non-residential construction—the bright spot in the report—expanded by 0.5%.

The goods and services trade deficit plunged by 55.5% to $61.6 billion in April from $138.3 billion in the prior month. The much narrower trade deficit was due primarily to a 20% fall in imports of goods after tariff hikes. A jump in the services surplus, up 6.4%, also helped. Exports of travel services rose sharply on the month and from a year earlier, allaying fears that tourism would be negatively affected by tougher immigration enforcement.

For a PDF version of this publication, click here: Comerica Economic Weekly, June 9, 2025(PDF, 137 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.