Preview of the Week Ahead

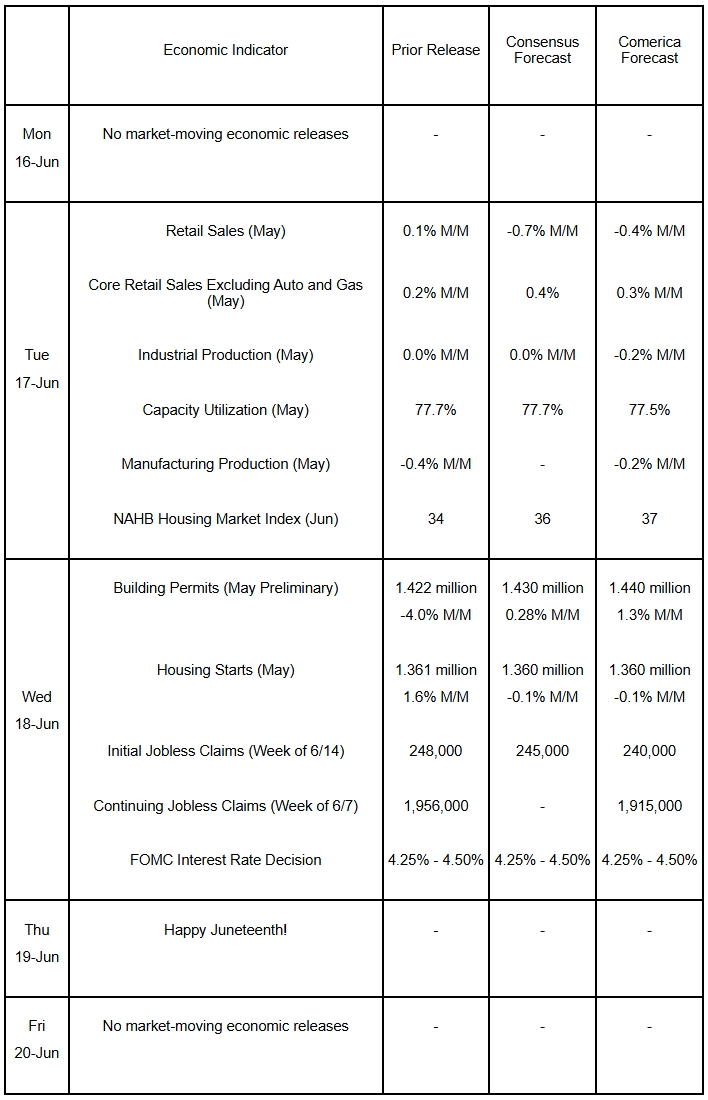

The FOMC is forecast to hold the federal funds target unchanged at their decision on Wednesday. They will likely repeat that the federal funds target’s current setting at a range of 4.25% to 4.50% puts monetary policy “in a good place” to react to downside risks to the job market or upside risks to inflation should they materialize. The Fed is also likely to repeat that they think it is appropriate to exercise “patience” and “wait and see” how the mix of higher tariffs and tax cuts collectively impacts the economy. A repeat of the patience/wait and see language would signal that policymakers expect to hold the federal funds target steady again at the July decision.

May’s economic activity indicators due out this week are likely to come in weak. Retail sales are expected to fall on a drop in new car and truck sales and lower gas prices. Core retail sales excluding these categories likely rose, though. Industrial production was likely lower in May, too, with tariff uncertainty weighing on manufacturing and lower oil and gas production a headwind to mining. Housing indicators were likely mixed in May. Building permits likely rose after a large drop in April, while housing starts were likely lower on the month.

The Week in Review

Inflation ran cool in May, helped by lower energy and egg prices. Both total and core CPI rose 0.1% on the month, as did total and core PPI inflation. From a year earlier, CPI rose 2.4%, a third consecutive month under 2.5%; core CPI held steady at 2.8%, the lowest since early 2021. In the same terms, PPI picked up to a 2.6% increase from an upwardly-revised 2.5% in April, while core PPI excluding foods and energy slowed to 3.0% from 3.2%. The Fed will welcome the cool inflation data, but won’t breathe too easy since the ISM PMIs reported business input prices rising at the fastest rate since late 2022 in May. Also, crude oil futures have bounced to the highest since early April after Israel attacked Iran, which will raise June’s CPI if sustained.

In addition to May’s cool price data, the latest jobs data came in soft, too. Initial jobless claims for the week ended June 7, as well as continued jobless claims which are released at a one-week lag, were both the highest in more than a year in the latest reports. The four-week moving average of initial claims is the highest since August 2023, while the four-week moving average of continued claims is the highest since late 2021. The wobbly jobless claims data are further evidence that the job market softened more in May than suggested by the headline of the last monthly jobs report.

The federal fiscal balance swung from a $258 billion surplus in April to a $316 billion deficit in May as the boost to revenues from income tax season passed. Receipts jumped 14.7% on the year as tariff revenues increased, while outlays were up just 2.5%. The University of Michigan’s Consumer Sentiment Indicator rebounded to the highest since February in the preliminary release for June as inflation expectations fell, but may weaken in the final release after the latest Mideast conflict.

For a PDF version of this publication, click here: Comerica Economic Weekly, June 16, 2025(PDF, 136 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.