Preview of the Week Ahead

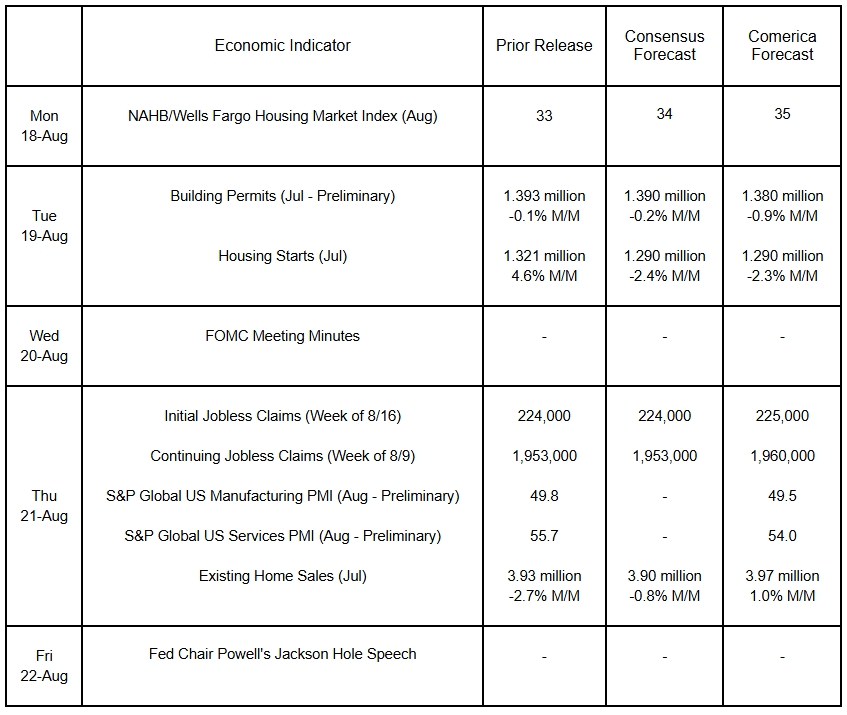

The Fed is back in focus this week. After July’s split FOMC decision, markets are anxious to see how the meeting’s minutes describe FOMC members’ views about the September meeting. On Friday, Chair Powell could explain how he plans to shape the meeting’s decision-making in his speech in Jackson Hole. Housing starts and building permit issuance probably declined in July, while existing home sales likely rose after a big slump in the prior month. S&P Global’s PMIs are anticipated to show a further contraction in manufacturing and a slowdown in services in the August flash estimates.

The Week in Review

July inflation data showed sharp increases in prices paid by producers, but limited pass-through to consumer prices. Matching Comerica Economics’ forecasts, the Consumer Price Index (CPI) rose 0.2% on the month and was up 2.8% from a year earlier. Core CPI, which excludes volatile food and energy prices, rose 0.3% in line with expectations, but was a bit over expectations in year-over-year terms, accelerating to 3.1% from 2.9% in June. Goods prices were mixed: Prices of durable goods, such as used cars and trucks, accelerated. Nondurable goods prices declined modestly on lower prices of gasoline and food at home. Shelter costs rose by 0.2% for the second successive month. Amid uneven tourism spending, prices of lodging away from home (Mostly motels and hotels) declined for the fifth month running. There was a marked acceleration in inflation of many core service prices, such as medical care services, motor vehicle maintenance and repair, and garbage and trash collection. The Producer Price Index (PPI) for final demand surged by 0.9%, lifting annual inflation to 3.3% from 2.4% in June. Every major category of goods and services in the PPI posted outsized increases. Most notable were the 2.0% monthly increase in trade margins, the 1.4% increase in foods, and the 0.9% increase in energy prices—diesel surged by nearly 12%, while home heating oil rose a whopping 15%.

Consumer spending is off to a good start in the third quarter. Sales at retail, food services and drinking establishments rose a solid 0.5% in July and matched Comerica Economics’ forecast. Retail sales were strong across the board, with revenues higher in nine out of thirteen retail subcategories. Spending was particularly strong at motor vehicle and parts dealerships, furniture stores, department stores, and nonstore retailers. Promotions by dealerships, big-box stores, and online retailers likely contributed to the strong showing. Consumers front-loaded purchases of EVs ahead of the phaseout of subsidies on October 1, another boost. Core retail spending, used in computing nominal GDP, rose a solid 0.5%. Sales in May and June were revised up, which will likely fuel upward revisions to consumer spending in the next estimate of GDP for the second quarter. Consumer sentiment dipped in the University of Michigan’s preliminary August release, but what consumers do is more important than what they say.

The federal fiscal balance swung from a $27 billion surplus in June to a $291 billion deficit in July. The deficit through July of the October-to-July fiscal year-to-date (CFYTD) was $1,629 billion, up 7.4% from the same period in the prior fiscal year. However, the February-to-July cumulative fiscal deficit—since the change in administrations—is down 20% on the year. Over this period, customs receipts (tariff revenues) rose $70 billion and account for slightly more than a third of the deficit’s decline.

For a PDF version of this publication, click here: Comerica Economic Weekly, August 18, 2025(PDF, 135 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.