Preview of the Week Ahead

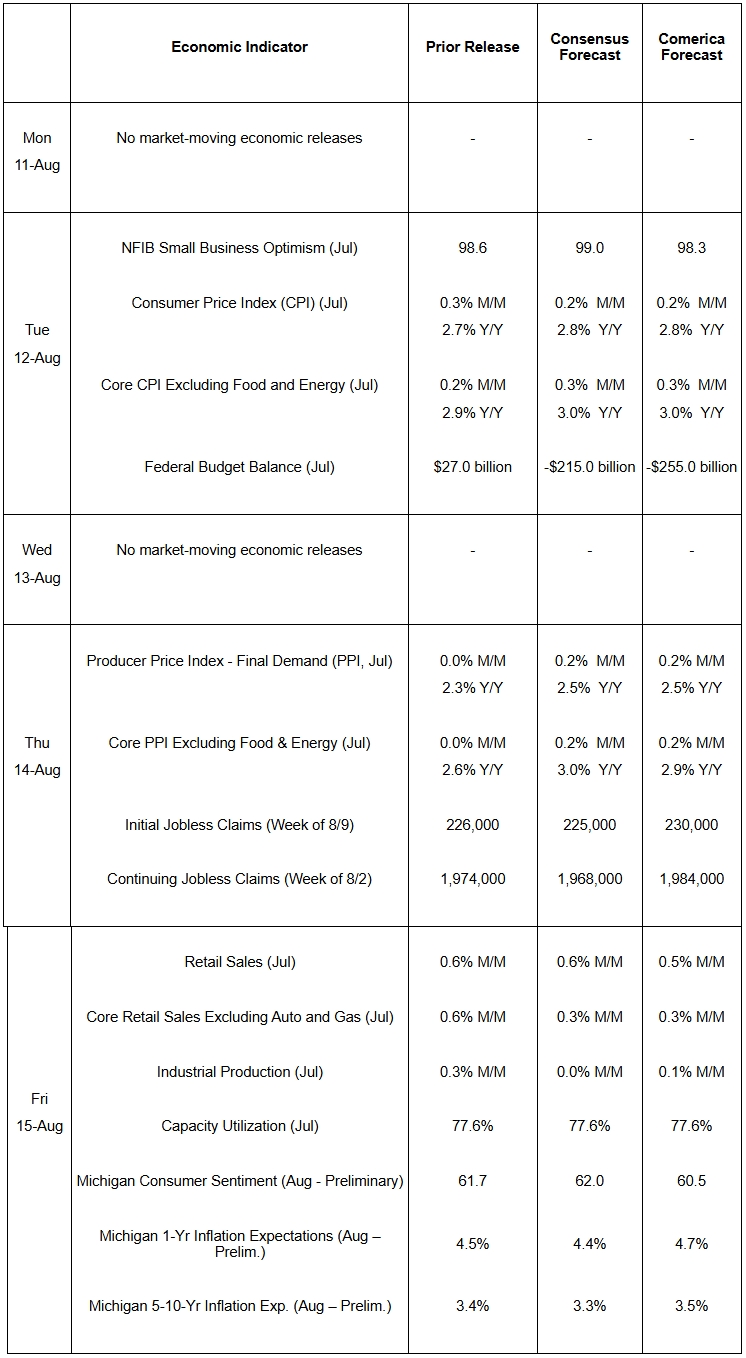

Consumer and producer price indexes are forecasted to rise modestly in their July releases on stable energy prices. Core consumer prices likely rose faster than in June due to tariff passthrough. Inflation is expected to pick up slightly in year-over-year terms, which most Fed policymakers will see as a pebble on the scales against an interest rate cut at the September meeting.

Retail sales likely rose solidly on higher vehicle sales and nonstore retail sales (primarily e-commerce). Industrial production probably rose at a modest pace, as utilities production eased after a surge in June. Industrial capacity utilization likely held steady. Small business optimism probably edged down in July, but held above its long-run average.

The federal government’s budget balance in July probably swung into the red following a surplus in June. The University of Michigan’s survey of households will probably show new tariffs weighed on consumer sentiment again in August. The survey will likely show another increase in inflation expectations, particularly for the near-term (year-ahead period).

The Week in Review

The economic calendar was light last week. The trade deficit in goods and services dropped 16.0% in June, matching Comerica Economics’ forecast and market expectations. Exports fell 0.5%, while imports tumbled 3.7%. Imports of goods from America’s four largest trade partners have diverged since the president imposed sweeping reciprocal tariffs on April 2nd, with purchases from Mexico and the European Union up by 4.0% and 1.9%, respectively, from a year earlier in the second quarter. Imports of goods from China and Canada, on the other hand, have cratered and are down 35.5% and 14.7%, respectively. The US raised tariffs on imports of Indian goods to 50% from 25% in early August to penalize India for buying Russian oil; pharmaceuticals and electronics may be exempted. Tariffs on Swiss imports were raised to 39%; pharmaceuticals were reported to be temporarily exempted from the tariff hike, and there was uncertainty as to whether they would apply to trade in physical gold.

Growth of the services sector slowed in July, with the ISM Services PMI falling to 50.1% from 50.8% in June. The July ISM Services PMI was slightly below Comerica Economics’ 50.3% forecast and well below the 51.5% median expectation. The underlying details were soft, with business activity (production) and new orders both lower. Employment shrank at a faster pace among surveyed businesses. Prices paid rose at the fastest pace since October 2022 in July.

Consumer credit rose by $7.4 billion in June. The increase was driven solely by non-revolving credit—consisting mostly of student and auto loans—which increased by $8.4 billion. Non-revolving credit has increased four months in a row. Revolving credit—mostly credit card loans—declined by $1.1 billion. Revolving credit outstanding continued to decline for a seventh consecutive month, and was 2.5% lower than a year earlier.

For a PDF version of this publication, click here: Comerica Economic Weekly, August 11, 2025(PDF, 154 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.