Preview of the Week Ahead

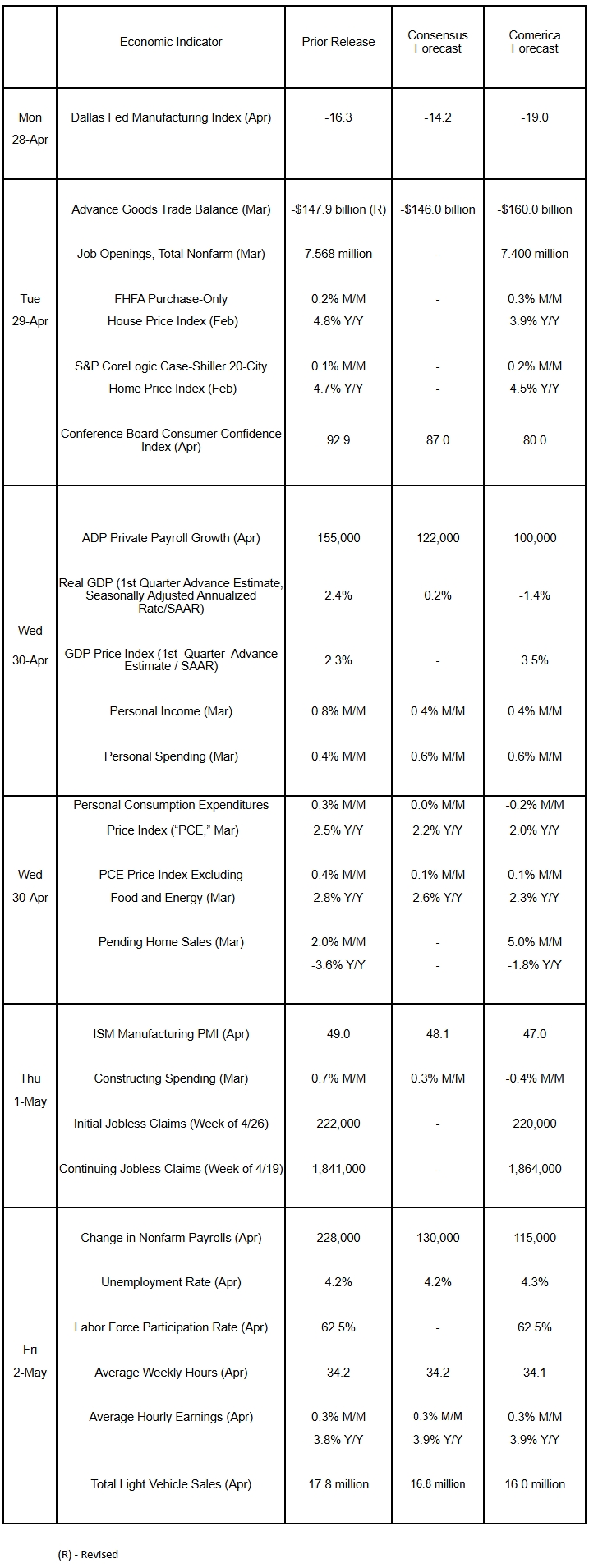

The economy likely contracted in the first quarter on the back of a record trade deficit in goods as importers front-ran tariff hikes. The labor market probably softened in April, with a lackluster increase in employment and an uptick of the unemployment rate. Job vacancies likely fell in March. The ISM Manufacturing PMI is expected to show the sector in contraction for the second consecutive month. House price growth likely moderated in February, easing annual increases. The Conference Board will probably report a big decline in consumer confidence in line with other household surveys. Vehicle sales are anticipated to take a breather in April after March’s jump to the highest sales in four years.

The Week in Review

The Beige Book, a summary of anecdotal information collected by the Federal Reserve from various contacts across the nation, reported the economy nearly stalled in recent weeks. Tariff policy uncertainty weighed on the outlook in many parts of the country. While vehicle sales rose solidly, non-auto purchases were weaker. Employment was essentially unchanged, with businesses taking a wait-and-see approach to staffing decisions. Most businesses saw their input costs climb in recent weeks and expect to pass on higher costs to customers.

The housing market was mixed last month. Existing home sales, which account for most of the homes sold in the U.S., plummeted by 5.9% to an annualized rate of 4.020 million and were down 2.4% from a year earlier. Inventory of homes for sale continued to rise steadily, with 1.330 million units available for sale last month, nearly 20% higher than in March 2024. The median sale price of an existing home rose by 2.7% from a year earlier to $403,700. New home sales soared by 7.4% to an annualized rate of 724,000 units in March and were handsomely above the consensus. The median price of a new home of $403,600 in March was around $33,000 lower than the same month of last year. The number of new homes for sale has steadily increased in the past two years, with 503,000 new homes available for purchase last month, equivalent to 8.3 months of supply at March’s rate of sales.

New orders for durable goods skyrocketed by 9.2% in March on the back of a 27.0% increase in transportation equipment orders. Orders for civilian aircrafts and parts jumped by a staggering 139% due to airlines around the world racing to buy ahead of higher tariffs. Motor vehicle and parts orders rose strongly for the second consecutive month, as dealerships accelerated purchases ahead of impending tariffs. Orders of nondefense capital goods excluding aircraft—a widely-watched indicator of business spending on equipment—edged up a modest 0.1%, a sign of businesses’ cautious outlook on investment.

Consumer sentiment fell to the lowest since the summer of 2022 in April, according to the University of Michigan’s final survey release for the month. Households’ expectations have plunged particularly hard since January, posting the largest three-month drop since the 1990s recession. Consumers’ year-ahead inflation expectations were the highest since the early 1980s, while long-term inflation expectations were the highest since the early 1990s.

For a PDF version of this publication, click here: Comerica Economic Weekly, April 28, 2025(PDF, 166 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.