Texas Maintains Its Position Among the Country’s Best Performing State Economies

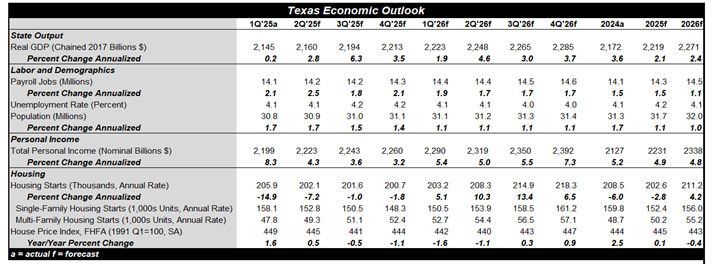

Following very strong economic growth of 3.6% in 2024, nearly a percentage point above the national rate, Texas’ economic expansion is set to moderate in 2025, but still outpace the national economy’s. More stringent immigration enforcement and slower interstate migration are leading to less labor force growth in Texas. Energy trade deals, such as the agreement with the European Union, which pledged to purchase $750 billion of U.S. energy over the next three years, will boost the Lone Star State’s energy industry and support employment. Texas’ defense manufacturers will also get a notable lift from increased defense spending legislated in the One Big Beautiful Bill Act (OBBBA) as well as from rearmament spending by NATO allies. Job growth is expected to rise at around last year’s pace, while the unemployment rate is expected to hold roughly steady in both 2025 and 2026. Total personal incomes of Texan households are projected to increase by around 5% in 2025 and 2026, a solid notch faster than inflation.

Trade deals will have cross-cutting effects on Texas’s economy. Manufacturers who compete against imports will benefit from tariffs; Texas will likely win an outsize share of reshoring investment in coming years. Manufacturers that are tightly integrated into global supply chains face big transition costs. Construction and service-providing businesses will pay higher prices for inputs, pressuring margins.

Residential construction is anticipated to decline again in 2025 as high mortgage rates and high home prices strain affordability. A sharp uptick in existing home listings, especially in Texas’ major population centers, is another headwind for builders. Homebuilders are anticipated to break ground on around 150,000 single-family houses and 50,000 multi-family units in 2026. House prices are forecast to fall modestly in year-over-year terms in the second half of 2025 and first half of 2026, then begin to rise again in the latter half of next year as falling mortgage rates bring homebuyers off the sidelines.

For a PDF version of this publication, click here: 2025 Texas Mid-Year State Economic Outlook(PDF, 123 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.