Michigan Economy to Grow Faster Than in 2023

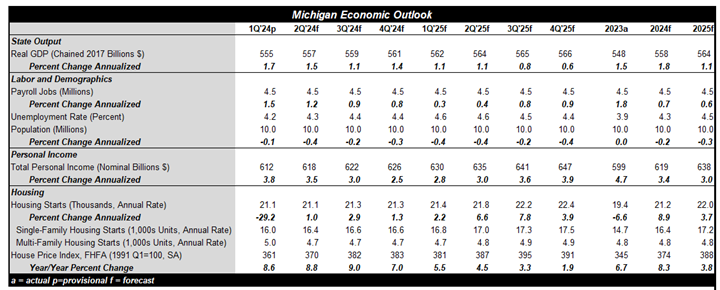

Michigan’s economy is anticipated to grow by 1.8% in 2024, above last year’s growth, but slightly below the national economy’s. High interest rates and consumer prices continue to weigh on the Great Lake State’s economy, as do negative spillovers from national and global headwinds. The auto sector will be a bright spot for Michigan, with production averaging comfortably above 2019’s pace as supply chains normalize further and the COVID-19 disruptions fade.

Payroll growth is expected to slow to around 0.7% in 2024, well below last year’s rate. Michigan’s unemployment rate, which fell notably as auto production normalized, is set to increase and average 4.3% this year, somewhat higher than the 3.9% national unemployment rate. Subdued employment growth and higher unemployment rates are expected to weigh on total personal income, which is projected to rise at a moderate pace of 3.4%, a tad above inflation.

Housing construction and sales are rebounding in 2024 after precipitous declines last year. Single-family construction is anticipated to lead the recovery, with 16,400 units projected to be added to housing supply this year. A sharp increase in vacancy rates last year will weigh on the multifamily segment, resulting in multifamily construction holding steady at around 5,000 units. Reflecting demand and supply imbalances in the housing market, house prices are forecast to rise sharply this year by around 9%. As more residential units are built in 2024 and 2025, house price inflation is projected to ease, especially in the latter quarters of 2025.

For a PDF version of this publication, click here: 2024 Michigan Mid-Year State Economic Outlook(PDF, 118 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.