California’s Economy to Expand at a Slower Pace in 2025

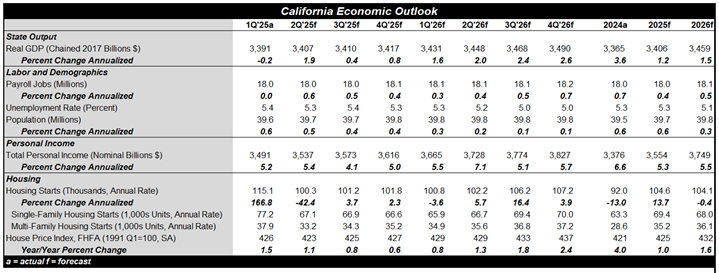

Following robust growth of 3.6% in 2024, the Golden State’s economy is forecast to expand at a more moderate rate in 2025. Positive spillovers from the highly-productive tech sector, fueled by the accelerating adoption of artificial intelligence technologies both in the U.S. and globally, are anticipated to partially offset the effects of a cooling main street economy and headwinds from slower population growth, soft labor demand, trade frictions, high interest rates, and high inflation. Tax changes enacted in the One Big Beautiful Bill Act (OBBBA), especially the increased State And Local Tax (SALT) deduction, will be a very big positive for California, which has one of the highest proportion of high income households in the country. Geopolitical and trade disputes with key tourist source countries, including Mexico, Canada, and China, are additional headwinds for growth this year.

Tougher immigration enforcement is expected to weigh on population growth in 2025 and 2026. However, fewer job opportunities out of state and difficulties selling homes will make moving elsewhere less appealing to Californians, providing an offsetting support to the state’s population. Payrolls are projected to grow by a moderate 0.4% in 2025 and expand by 0.5% next year. The Golden State’s unemployment rate is expected to hold steady in the current year and then fall in 2026. A cooler labor market will limit total personal income growth in 2025. Disposable personal incomes (DPI) of Californians—incomes adjusted for taxes—will see a boost next year, as tax changes enacted in the OBBBA raise after-tax incomes and spur consumer spending.

California’s housing market is rebounding this year from 2024’s sharp contraction, as limited supply spurs residential construction. Around 70,000 single-family units are anticipated to be constructed in the state in 2025 and again in 2026. Multi-family housing is forecast to rise, following a jump in projects launched earlier this year. Vacancy rates in the state, among the lowest in the nation, will be a key driver of multifamily construction. House price increases are forecast to moderate amidst housing affordability challenges, insurance market disruptions, and higher supply as more existing homes are listed. Home prices are projected to rise, especially in the second half of next year, as California’s economy gains momentum.

For a PDF version of this publication, click here: 2025 California Mid-Year State Economic Outlook(PDF, 135 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.