Arizona’s Economic Growth to Rebound in 2026

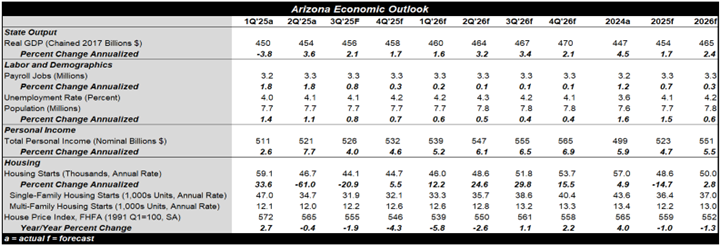

Arizona’s economy was on a rollercoaster in the first half of 2025, with a deep contraction in the first quarter followed by a sharp rebound in the second. The Artificial Intelligence boom (AI) and a combination of fiscal and monetary stimulus will be tailwinds to the state’s economy in 2026, which are forecasted to fuel a rebound in growth that will outpace the rest of the nation. The state is a natural destination for AI investment with its burgeoning talent pool, cost competitiveness, supportive government incentives, and stable weather. Even so, employment growth is forecast to soften, as critical sectors, such as healthcare, tourism, and government take a breather after strong hiring in recent years. Employment in construction, however, will likely buck this trend, as investment in data centers and power generation infrastructure picks up. Matching national trends, Arizona’s unemployment rate will probably edge higher to a peak in the second quarter of 2026 before gradually retreating during the remainder of next year. Population growth probably will moderate in 2026 as softer labor demand weighs on inward migration. Stringent immigration enforcement and fewer Canadian snowbirds will be further headwinds to population growth. Income growth, particularly disposable income growth, is expected to be boosted next year, as the One Big Beautiful Bill Act raises exemptions and deductions for seniors, tips, and state and local taxes.

As in most other parts of the country, residential investment faced mounting challenges in 2025 from stretched affordability, high mortgage rates, and rising construction costs. Residential construction is projected to rebound in 2026, as the Fed’s rate cuts bring down mortgage rates. Trade disputes look likely to reach settlements next year. This should reduce costs and uncertainties for homebuilders, since Canada is a key source for building materials like lumber and steel. Overall, around 50,000 units are anticipated to be added to Arizona’s housing supply in 2026. Arizona’s rental vacancy rates are the highest in several years, a significant headwind limiting multifamily construction. As Arizona’s housing market comes into better balance, house prices will likely give back a bit more of recent years’ big increases, but a major correction seems unlikely.

For a PDF version of this publication, click here: 2026 Arizona Annual State Economic Outlook(PDF, 140 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.