2024’s Job Growth Likely to Be Revised Down in Preliminary Benchmark Revision;

Fed Forecast to Cut in September; Political Pressure Is a Wildcard for Rates in 2026

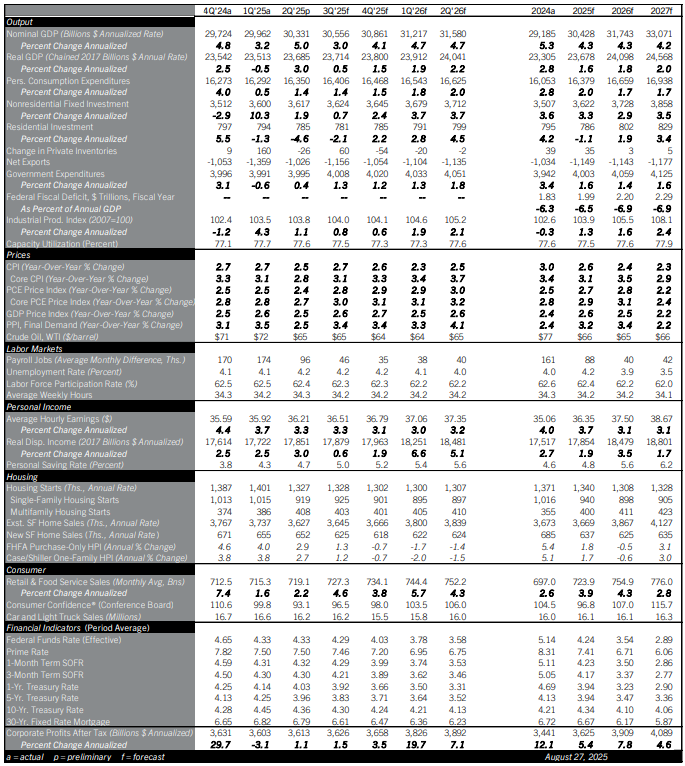

Job growth downshifted in mid-2025, with payrolls registering a sluggish 35,000 monthly increase between May and July. The job market will likely look even weaker when the Preliminary Benchmark Revision of payrolls is published on September 9. This revision will use data sourced from the Quarterly Census of Employment and Wages (QCEW) to revise the payrolls data produced by the monthly survey of workplaces a.k.a. establishments (Formally called the Current Employment Statistics Program, or CES). The CES receives about 50,000 responses per month, and is inevitably less accurate than the slower-to-collect QCEW, which gathers data on 11 million workplaces. The QCEW’s detail lets it directly measure jobs added at newly-opened workplaces and lost at closing ones, which account for several millions of employment churn each year. The statisticians who run the monthly CES survey can’t measure job churn directly. They can only start surveying a newly-opened workplace once they receive notice it has opened. They need to check if a business that stops responding to the survey has moved, ignored them, or closed before tallying jobs lost in a closure. The CES estimates employment churn each month using statistical techniques, then updates with actuals during benchmark revisions twice each year. Comerica forecasts for this Preliminary Benchmark Revision to revise down job growth in the 12 months through March 2025 by 775,000. That will reduce 2024’s job growth from about 165,000 per month in the pre-revision data to about 100,000 per month.

Inflation has picked up since the spring as tariff costs worked their way from port to warehouse to checkout aisle. The Fed is pulled in opposite directions by rising inflation on the one hand and weak job growth on the other. In an August 22 speech, Fed Chair Powell signaled he thinks inflation from tariffs will most likely be transitory, and made a case for the Fed to put the job market ahead of controlling inflation near-term. Following Powell’s speech, Comerica forecasts for the Fed to cut short-term rates by a quarter percent in both September and December, 2025.

The political pressure on the Fed to cut interest rates complicates the interest rate outlook for 2026 and beyond. The Federal Reserve system is set up by law to insulate interest rate decisions from the influence of elected officials, who will always have incentives to lower rates ahead of elections and juice the economy, even if it means higher inflation down the line. Both the political pressure and macro data point the Fed toward rate cuts near-term, so it will be hard to quantify whether political pressure is compromising the Fed’s independence. Financial markets seem to be assuming the pressure campaign is Greenland redux and are taking it in stride. In the long run, if the Fed does lose independence, the U.S. economy would see higher and more volatile inflation and interest rates, like foreign economies that took the same path. Turkey is a recent poster child for the consequences of forgoing central bank independence. This July, Turkish CPI inflation was 33%, and the 10-year government bond yielded 29%.

For a PDF version of this publication, click here: August 2025 U.S. Economic Outlook(PDF, 200 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.