Key Takeaways:

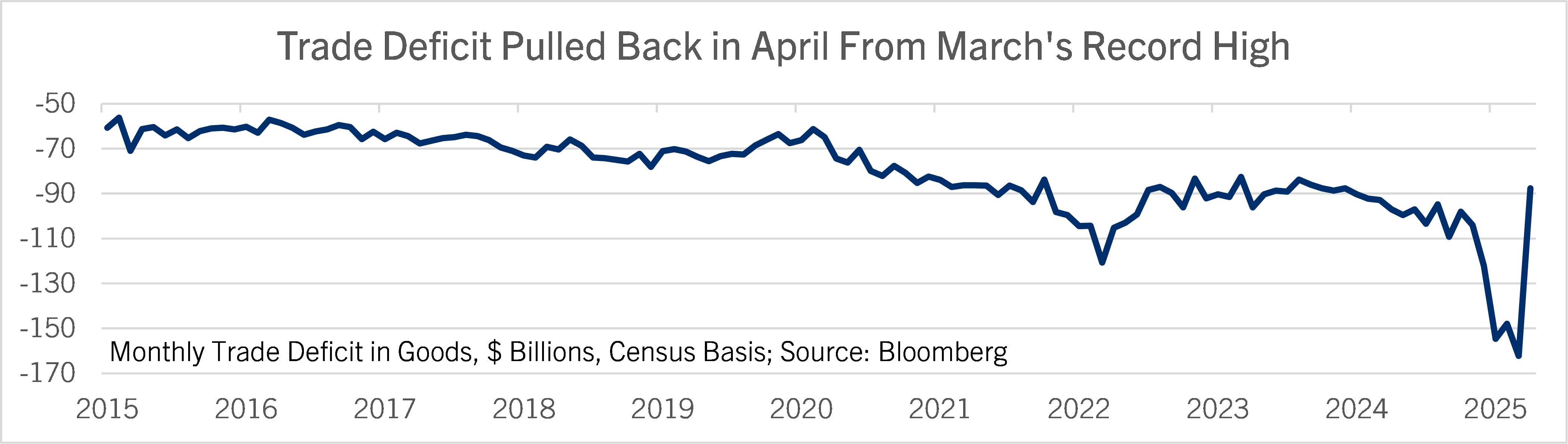

- After a record trade deficit in March, the deficit shrank to the least since January 2024 in April. Imports plunged 20%, while exports held up. The trade deficit will be a tailwind to GDP in the second quarter.

- Personal income jumped in April on a one-off boost to Social Security benefits from the Social Security Fairness Act. Consumer spending growth was modest. The saving rate jumped as consumers' spending grew more slowly than incomes.

- PCE inflation slowed as expected. Inflation is near the Fed’s target, with slightly higher core inflation.

- However, consumers expect inflation to pick up sharply in the year ahead, according to the latest survey data. Consumer sentiment held at the lowest since 2022 in May.

- Comerica forecasts a cool jobs report for May in next Friday’s release, with the unemployment rate holding steady and a modest increase in payroll employment.

The trade deficit in goods shrank by nearly half to $87.6 billion dollars in April from the record-high $162.3 billion in March, and was much smaller than the $143.0 billion consensus forecast. Goods exports rose 3.4% on a 15.5% jump in industrial supplies shipments, the category that includes gold and petroleum products. Imports plunged 19.8% as consumer goods purchases fell 32.3%, industrial supplies dropped 31.1%, and automotive vehicles and parts fell 19.1%. Inventories edged lower in April as businesses bought fewer imports. Wholesale inventories were flat after rounding, and retail inventories edged down 0.1% on the month. Within wholesale, durable goods inventories fell 0.2% and nondurable goods inventories rose 0.4%. In retail, motor vehicle and parts inventories fell 0.9%, while other categories rose 0.3%.

The trade deficit will be much less of a drag on GDP in the second quarter than the first. American businesses scrambled to buy imports in the first quarter ahead of higher tariffs, then cut purchases in April. Exports held up better than imports mostly due to a jump in the category of exports that includes petroleum products and gold. But even excluding that category, exports were stronger than imports. The trade deficit will likely be larger in May than April, since businesses are likely to ramp up imports in May in case tariffs rise again. Even so, the trade deficit will likely be smaller in the second quarter than the first, which will be a tailwind to GDP in the quarter.

Personal income jumped 0.8% in April on a 6.9% increase in Social Security receipts as the Social Security Fairness Act increased benefits. Other categories of income grew 0.4%, including a 0.5% increase in wages and salaries. Personal consumption expenditures rose more modestly, up 0.2%. Spending on durable goods pulled back 0.3% after jumping 3.7% in March’s rush to buy cars ahead of higher tariffs; giveback after March’s strength was unsurprising. Spending on nondurable goods was flat, and spending on services rose 0.4%. With incomes up more than spending, the personal saving rate rose to 4.9% from 4.3% and was the highest since May 2024.

The personal consumption expenditures price index edged up 0.1% on the month, matching the consensus. Food prices fell 0.3%, mostly offsetting a 0.5% increase in energy prices. Core PCE excluding food and energy rose 0.1%. Core PCE services excluding energy and housing, sometimes called Supercore PCE, was flat on the month. From a year earlier, the PCE price index slowed to a 2.1% increase from 2.3% in March, core PCE slowed to 2.5% from 2.7%, and Supercore PCE slowed to 3.0% from 3.3%.

Consumer sentiment held unchanged in May at the lowest since July 2022, according to the University of Michigan’s final survey release. This was an upgrade from the initial release which showed a drop in the month. The Current Economic Conditions index pulled back to the weakest since November 2022, and the expectations index edged up slightly from April but was still the second-weakest since July 2022. Year-ahead inflation expectations were the highest since November 1981. Five-to-ten-year-ahead inflation expectations pulled back a little from April but were still near the highest since the early 1990s. In the University of Michigan’s survey, fears of job losses and rising unemployment were around levels seen in 2003, 2009, and 2020, when the unemployment was peaking around the end of a recession.

Weak consumer sentiment is a downside risk to discretionary consumer spending near-term. The relationship between consumers surveys and spending has been weak in recent years, but there are other signs of a pullback in discretionary spending; sales of autos and other durable goods will likely be cool in the second quarter. The recent cautious turn in consumer and business surveys suggests the May jobs report will be cool. Comerica forecasts for the report’s release June 6 to show payrolls up a modest 125,000, the unemployment rate steady at 4.2% and average hourly earnings up 0.2% on the month and 3.6% from a year earlier.

The latest economic data don’t change the interest rate outlook. Despite cooler inflation in the rearview, the Fed won’t feel comfortable cutting rates while surveys of consumers and businesses show higher inflation expected ahead. Comerica forecasts for the Fed to hold interest rates unchanged at their next decision on June 18.

For a PDF version of this publication, click here: Tailwind For Second Quarter GDP(PDF, 115 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.