Key Takeaways:

- New and existing home sales were weaker than expected in June. The housing market is in a funk.

- New home listings rose to the highest since 2007, while existing listings were the highest since 2020.

- New home prices fell from a year earlier, while existing home prices rose modestly.

- Housing is a downside risk to economic growth in the second half of 2025.

- Shelter costs are rising much slower than in the recent past. Muted shelter inflation will offset some of the inflationary pressures of tariffs on the PCE and CPI in the second half of 2025.

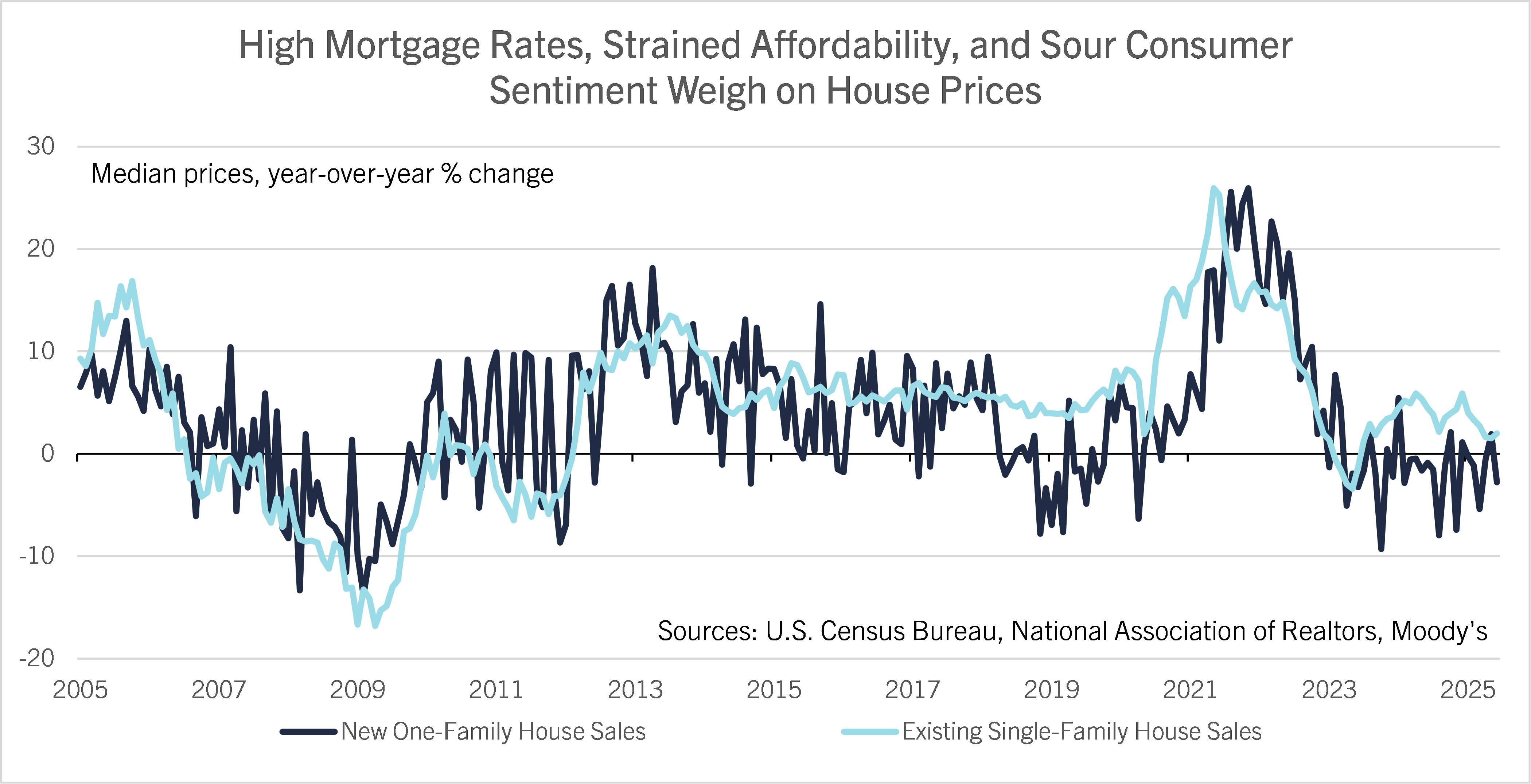

New single-family house sales rose 0.6% to 627,000 in June from 623,000 in May. While this was an increase, it undershot the 650,000 consensus and Comerica’s forecast of 635,000. The median price of a new home sold fell 2.9% on the year to $402,000 and was the second-lowest since September 2021. New one-family homes listed for sale rose to 511,000 units, the highest since October 2007. That is equivalent to 9.8 months’ supply at June’s rate of sales, near where months’ supply peaked in 2022 (When house prices fell modestly).

Existing home sales fell 2.7% in June to a 3.93 million seasonally-adjusted annualized rate, down from 4.04 million in May. Like new home sales, existing sales undershot the 4.00 million consensus forecast and Comerica’s forecast of 3.98 million. Existing listings, which are not adjusted for seasonal variations, stood at 1.53 million in June, little changed from May and up 16% from a year earlier; they are around the highest since 2020. Existing listings were equivalent to 4.7 months’ supply in June, the highest months’ supply since mid-2016. The median existing home’s sale price was $435,000 in June, up 2.0% on the year, following increases of 1.6% in May and 1.8% in April.

In a separate data release, initial jobless claims fell to 217,000 in the week ended July 19 from 221,000 in the prior week and were the lowest since April, while continued jobless claims were little changed at 1,955,000 in the week ended July 12 after a downwardly-revised 1,951,000 in the prior week.

The housing market is in a funk. Housing was a big beneficiary of low interest rates and remote work in the recovery from the 2020 recession, but these tailwinds are played out. High mortgage rates, high prices, weak hiring, and sour consumer sentiment are big headwinds to housing demand. On the supply side, homebuilding boomed in the post-pandemic era, and supply chain disruptions inflated the pipeline of units under construction. As supply chains returned to normal, a wave of housing supply came to market. Muted demand and rising supply have capped home price increases. Trends are similar in new leases for renting households, which have been flat to down in most private surveys for well over a year.

The housing market subtracted from economic growth in the second quarter. On a quarter-over-quarter annualized basis, new home sales fell 1.8% in the second quarter and existing sales fell 12.6%. In the same terms, housing units under construction fell 8.3%. Employment in residential construction and residential specialty trade contracting fell in the first and second quarters of the year.

Housing is a downside risk to economic growth in the second half of the year, too. The Fed is holding interest rates steady near-term, with concerns about inflation from tariffs offsetting concerns about the job market. The big tax and spending bill passed July 4 will increase the fiscal deficit in 2026, prolonging upward pressures on longer-term interest rates that influence mortgage rates.

Housing costs are set to contribute much less to inflation in the second half of the year than in the last few years. Housing supply is rising faster than demand, slowing the increase of shelter costs as measured by the CPI and PCE indexes, and offsetting some of the inflationary pressures from tariffs. Housing-related inflation was a big driver of the post-pandemic inflation surge, and now it’s pushing inflation in the opposite direction. In the second half of the year, muted housing cost inflation will likely make overall inflation rise less than predicted by the consensus of private economic forecasters.

Comerica does not see the labor market catalyzing a federal funds rate cut near-term, since initial jobless claims remain low amid tepid growth of labor supply. However, the housing cycle’s influence on inflation could be a catalyst for a federal funds rate cut late this year. Comerica forecasts for the next change in the Fed’s monetary policy rate to be a quarter percentage point cut at the Fed’s December decision.

For a PDF version of this publication, click here: New and Existing Home Sales Weaker(PDF, 115 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.