Key Takeaways:

- The July jobs report had soft headlines, and its details were even weaker.

- Job growth was slow, and big downward revisions to May and June made the trend look considerably worse than in prior reports.

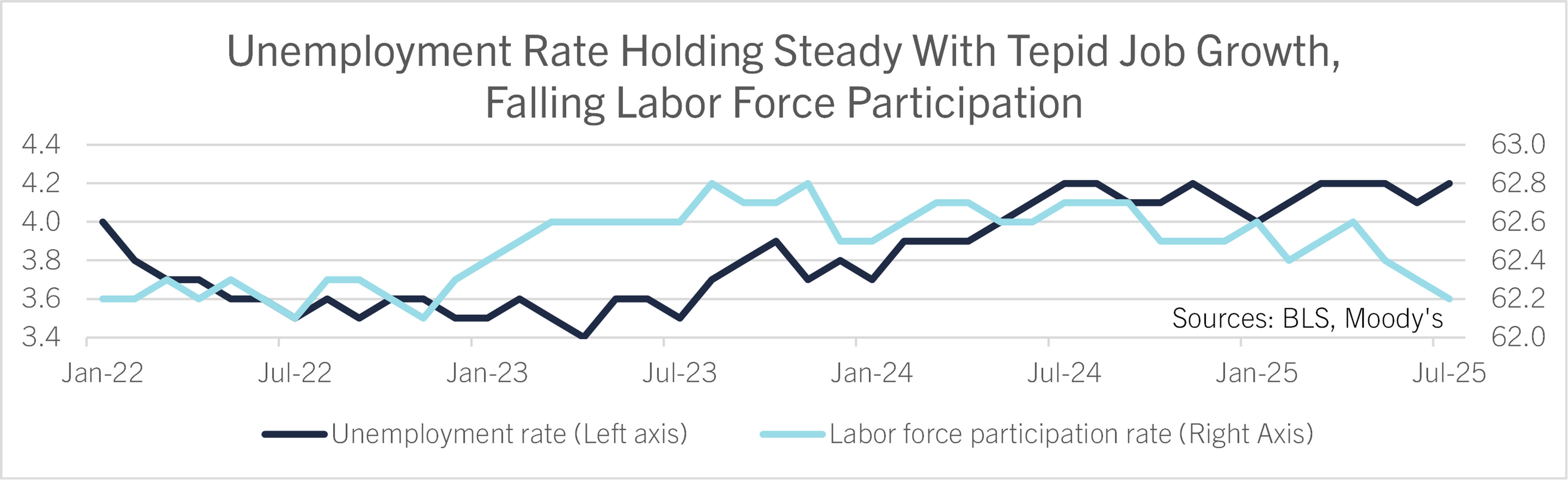

- The unemployment rate edged up to 4.2% from 4.1%, matching its second quarter average. Within that average, unemployment rates for younger workers reached post-pandemic highs.

- The labor force participation rate fell to the least since late 2022. Labor demand is weak, but labor supply isn’t so hot, either.

- The weak July jobs report will increase pressure on the Fed to cut rates at the September decision.

- However, a September cut is no slam dunk. If shrinking labor supply holds the unemployment rate steady in the next jobs report as inflation rises, the Fed will likely hold rates unchanged in Sept.

U.S. employers added 73,000 nonfarm payroll jobs in July, near Comerica’s forecast for a gain of 80,000 and below the 104,000 consensus forecast. There was a big 258,000 downward revision to job growth in May and June. May’s job growth was revised down to 19,000 from 144,000, and June’s was slashed to 14,000 from 147,000. Following revisions, payrolls averaged a tepid 35,000 increase over the last three months, much weaker than the 150,000 three-month average of the prior report.

By industry, private goods-producing employers shed 13,000 jobs in July, with manufacturing down 11,000, construction up 2,000, and mining and logging down 4,000. After revisions, manufacturing employment has fallen for three straight months. Private service-providing employers added 96,000 jobs, with healthcare and social assistance up 73,000, retail up 16,000, and financial activities up 15,000. Professional and business services cut 14,000 jobs, wholesale trade cut 8,000, and information cut 2,000. Government cut 10,000 jobs, with federal employment down 12,000, state government up 5,000, and local government down 3,000.

The unemployment rate edged up to 4.2% from 4.1%; that matched Comerica’s and the consensus forecasts and also matched the second quarter average. In the survey of households from which the unemployment rate is calculated, the labor force shrank 38,000, employment fell 260,000, and the number of unemployed rose 221,000. The unemployment rate was 4.2479% before rounding.

This is a bad summer for graduates looking for their first jobs, with multi-year high unemployment for college grads and teenagers. The unemployment rate for teenagers 16 to 19 rose to 15.2% from 14.4% and was the highest since December 2020. The unemployment rate for college graduates rose to 2.7% from 2.5% and was the highest since August 2021. The unemployment rate for workers ages 25 to 54 rose to 3.6% from 3.3%, matching its May level and near its average over the last 12 months. The unemployment rate for workers over age 55 edged down to 2.9% from 3.0% and tied for the lowest in a year. The unemployment rate for White Americans rose to 3.7% from 3.6%, for Black or African Americans to 7.2% from 6.8%, for Asian Americans to 3.9% from 3.5%, and for Hispanic or Latino Americans to 5.0% from 4.8%. The unemployment rate for Black or African American workers was the highest since October 2021.

The U-6 unemployment-and-underemployment rate, which includes the unemployed, people who want a job but haven’t looked recently, and people who work part-time but want full-time jobs, rose to 7.9% from 7.7% and was a hair under its cyclical peak of 8.0% reached in February; prior to that, the last time it was higher was in October 2021. The labor force participation rate pulled back to 62.2% from 62.3% and was the least since November 2022. It was lower across age groups except for workers 55 and up, for which it edged up. Average hourly earnings picked up to a 0.3% monthly increase from 0.2% in May. From a year earlier, average hourly earnings rose 3.9% after an upwardly revised 3.8% increase in June. The average workweek rebounded to 34.3 hours from 34.2 hours in June.

To sum up, the jobs report was weaker than its headlines. After big downward revisions to May and June, the recent trend looks much weaker than in the prior report. The unemployment rate would have been higher except that the labor force participation rate fell to the least since late 2022.

The weak jobs report increases pressure on the Fed to cut rates later this year. The decision isn’t a slam dunk, though. Labor supply fell in July, the third straight decline. Immigration restrictions are a big part of this; the foreign-born labor force registered its first year-over-year decline since March 2021 in July. The Fed might have a clearer view of the job market before their next decision, since the August jobs report will be out by then. If it shows labor supply declined again and held the unemployment rate steady, and inflation reports show tariffs continue to add to inflation, the Fed is likely to hold interest rates steady again.

For a PDF version of this publication, click here: July's Weak Job Growth(PDF, 114 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.