Key Takeaways:

- CPI rose slightly less than expected in July, but core CPI was a little hotter than expected.

- Prices of gasoline and other energy goods fell, offset by higher prices for services excluding energy services and housing (“Supercore services”).

- Tariffs raised inflation in household furnishings and auto parts, but the effect is small so far.

- The report makes the Fed slightly less likely to cut the target rate in September, since July’s hotter-than-expected core inflation was from sticky service prices rather than tariff-affected goods.

- Jobs data scheduled for release in early September will have more sway over the Fed’s next decision than this inflation report.

The CPI rose 0.2% in July after a 0.3% increase in June and matched expectations. Food prices were flat, with food at home down 0.1% and food away from home up 0.3%. Energy fell 1.1% on a 2.2% decline in gasoline. Core CPI excluding food and energy rose 0.3%, up from 0.2% in June and also matching the consensus forecast. Core goods prices rose 0.2%, unchanged from June. New vehicle prices were flat. Used car and truck prices rose 0.5% after larger declines in the prior three months. Apparel and medical care commodities both rose 0.1%.

There was higher inflation in some categories where tariff impact was expected due to large shares of imports, but the overall effect is small so far. Household furnishings were up 0.7% on the month and 2.4% on the year; this category includes blinds, furniture, appliances, and kitchenware. Motor vehicle parts and equipment rose 0.9% on the month and 2.9% on the year. Toys rose 0.6% on the month and 1.8% on the year. But information technology commodities, which include computers, peripherals, and smartphones, were down 1.3% on the month and 4.3% on the year, largely due to smartphone prices, which were flat on the month and down 14.7% on the year. Apple was widely reported to frontload big imports of smartphones in early 2025 ahead of the tariff hikes, which may have kept a lid on smartphone price increases this summer.

July’s upside surprise in core inflation was from service prices. Shelter services were cool as expected, rising 0.2% on the month. Rent of primary residence rose 0.2%, owners’ equivalent rent rose 0.3%, and lodging away from home (mostly hotels and motels) fell 2.9%.

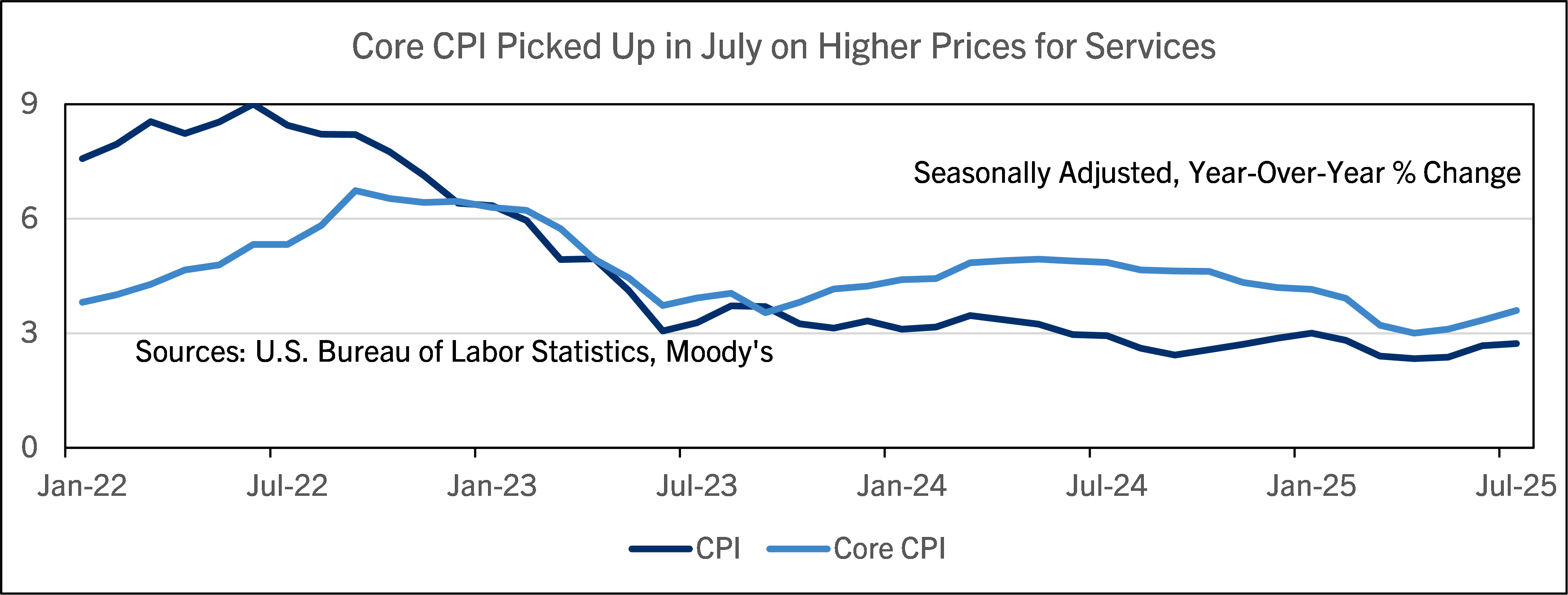

Services excluding energy services and housing, also called Supercore CPI, rose a hotter 0.5% on the month. Medical care services rose 0.8%. Transportation services rose 0.8%, with motor vehicle maintenance and repair up 1.0%. Airline fares rose 4.0% after declines in prior months. From a year earlier, the CPI rose 2.7%, unchanged from June and a little below the 2.8% consensus forecast. Core CPI rose 3.1%, up from 2.9% and a little above the 3.0% consensus forecast. Supercore CPI rose 0.5% on the month and 3.2% on the year after a 3.0% increase in June. Core and Supercore CPI were the highest since February.

The Fed will likely see the July CPI report as a pebble on the scales against a rate cut in September. July’s faster core inflation was largely driven by hot increases of core services prices. The Fed believes services prices are a better metric of inflation’s trend than goods prices, where they are expecting a temporary pickup in inflation from tariffs. Tariffs have had limited effects on inflation so far. But since tariff rates are up one day, down the next, then up even more the day after, it is too early to say how large their effect on prices will ultimately be. Some businesses are probably holding off on price increases while they wait to see where tariff rates settle out. But nobody goes into business to lose money, and companies will eventually pass on price increases one way or another.

For the interest rate outlook, the CPI report is an incremental argument against a cut in September, but the jobs data to be released early next month will hold more weight in the Fed’s deliberations. The Fed is getting different signals from payrolls growth, which has been anemic recently, and from the unemployment rate, which has held largely steady over the last year. If the unemployment rate is stable or lower in the next release, that could keep the Fed on hold. On the other hand, if there’s a decline in payrolls in the August report, or big downward revisions in the preliminary benchmark revisions (to be released September 9th), that could tip the scales toward a rate cut.

Comerica’s forecast is for the Fed to hold rates unchanged at the September decision, but it’s a close call. Another downside surprise from jobs data could easily tip the Fed’s balance of opinion toward a cut. Financial markets, on the other hand, are pricing substantially higher odds of a rate cut in September after the CPI report’s release; markets seem to price in a view that the CPI report isn’t bad enough for the Fed to focus on their inflation objective rather than the downside risks to employment.

For a PDF version of this publication, click here: Hotter-Than-Expected Core CPI(PDF, 115 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.