Key Takeaways:

- As expected, the Federal Reserve held their policy rate unchanged at their July meeting.

- While two members of the rate-setting committee dissented and voted for an immediate cut, most committee members are probably on the fence about a September cut.

- Real GDP rebounded to a robust increase in the second quarter, but details were weaker.

- Real final sales to households and businesses (A core measure of GDP) grew at a sluggish pace.

- With inflation running a bit above the Fed’s target and likely to pick up near-term due to tariffs, Comerica forecasts for the Fed to hold interest rates steady at their next decision in September.

As universally expected, the Federal Reserve held the target rate for the federal funds rate unchanged at a range of 4.25% to 4.50% at their July 30 decision. Also, they continue to reduce the size of their balance sheet (a.k.a. Quantitative Tightening) by allowing up to $5 billion per month in their Treasury holdings to mature, and allowing up to $35 billion in mortgage-backed securities to mature.

The decision was a nine-to-two split, the first time two FOMC members dissented from a decision since the early 1990s. The dissents were from Governor Bowman, who President Trump appointed in June as Vice Chair for Supervision, and Governor Waller, who is seen as a contender to replace Chair Powell when Powell’s term as Chair ends next year. Both supported an immediate quarter percentage point rate cut.

However, most FOMC members are probably on the fence about whether a cut will be appropriate at the next decision on September 17. When asked about September at the press conference following the decision, Chair Powell responded, “I think you have to think of this as still quite early days” of assessing the impact of tariffs on inflation. Powell repeatedly emphasized that the Fed will have two more months of jobs and inflation data in hand when they next meet in September, and so it is too early to pre-judge that decision: “We have made no decisions about September. We don’t do that in advance.” He wouldn’t be so noncommittal if a critical mass of FOMC members leaned toward a September cut.

The Fed’s monetary policy statement was mostly unchanged from the prior statement in June. One difference was that the July statement said that “growth of economic activity moderated in the first half of the year,” where the prior statement said, “growth of economic activity has continued to expand at a solid pace” (Our emphasis added). The downgraded language is a little odd on its surface: The second quarter GDP report, released the morning of the Fed decision, shows real GDP rebounded to a robust 3.0% annualized increase after the first quarter’s 0.5% annualized contraction. The weakness of core components of GDP is why the Fed downgraded its assessment of growth. Imports surged in the first quarter as businesses scrambled to front-run tariffs, then plummeted in the second quarter. The GDP report measures economy-wide economic activity by adding up aggregate spending. In the process, it subtracts U.S. spending on imports (and adds foreign spending on exports) to indirectly measure domestic production. Surging imports subtracted 4.7 percentage points from GDP growth in the first quarter, then falling imports added 5.2 percentage points to growth in the second quarter. A good measure of core GDP which avoids distortions from foreign trade, real final sales to private domestic purchasers, slowed to 1.2% annualized in the second quarter from 1.9% annualized in the first quarter and was the weakest since the fourth quarter of 2022. Its slowdown signals that underlying economic activity is not as rosy as the latest GDP headline.

Averaging out the volatile first two quarters of the year, real GDP averaged a sluggish 1.2% annualized increase in the first half of 2025, down from 2.8% annual growth in 2024. Consumer spending growth was slower in the first half of the year than in 2024, and construction—real residential investment and real nonresidential investment in structures—fell in both quarters amid high interest rates. The economy downshifted in the first half of 2025, but did not slip into a recession. Looking forward, a recession seems unlikely over the next 12 months, since headwinds from tariff increases will likely be offset by tailwinds from the tax cuts and increased government spending planned in the reconciliation bill that passed on July 4.

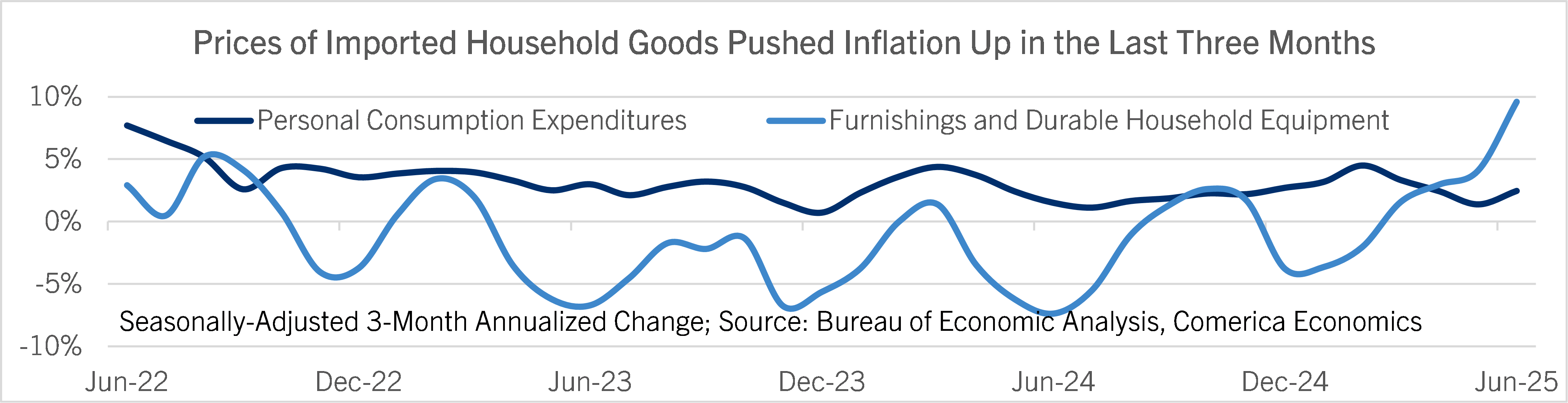

While the U.S. growth picture is okay, inflation still leaves something to be desired. The personal consumption expenditures price index picked up to a 2.6% year-over-year increase in June, and the core PCE index excluding food and energy was 2.8%, matching May’s upwardly-revised rate. Core PCE inflation has been between 2.6% and 2.9% since April 2024, picked up in the last two months, and is forecast to accelerate further as tariffs ripple through to consumer prices. June saw a 1.3% jump in prices of furnishings and durable household equipment, following outsized increases in April and May. The last three months saw the fastest increase since April 2022 in prices of this category of core goods, which are mostly imported. Job growth was slower in the first half of 2025 than in 2024, but the unemployment rate held mostly steady, with slower growth of the labor force amid reduced immigration and more workers retiring. If the unemployment rate holds steady and inflation picks up in the second half of the year, it will be tough for the Fed to justify interest rate cuts. Comerica forecasts for the Fed to hold the federal funds target unchanged at the next two decisions in September and October, then make a quarter percentage point cut at the last decision of the year on December 10, 2025.

For a PDF version of this publication, click here: Fed Held Rates Steady in July(PDF, 117 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.