Key Takeaways:

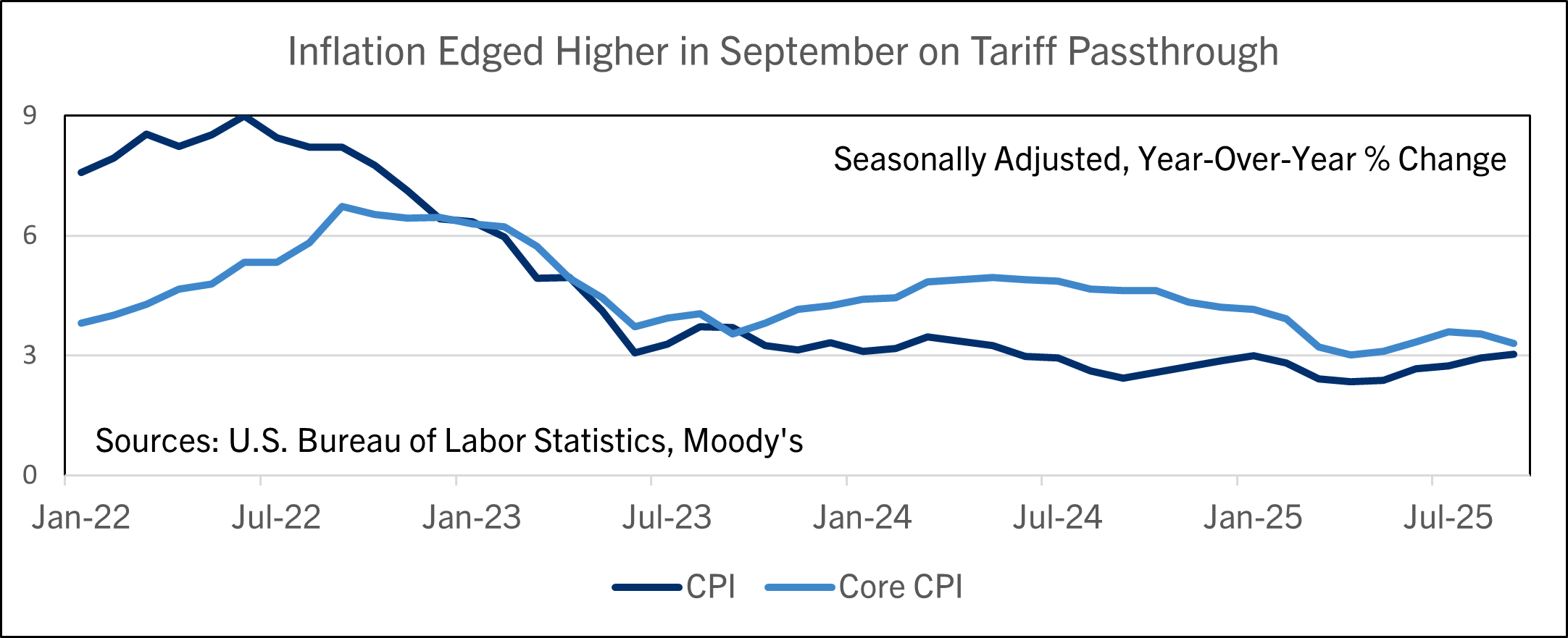

- The CPI rose 0.3% in September, a little less than expected.

- Total and core CPI were both up 3% on the year, also slightly less than expected.

- It’s easy to find effects from tariffs and immigration restrictions in the CPI report.

- However, cooling shelter inflation and lower used car and truck prices partially offset those inflationary pressures last month.

- In any case, concerns about the job market still outweigh frustrations with inflation for the Fed.

- Comerica continues to forecast quarter percent rate cuts at the Fed’s October and December decisions.

The CPI index rose 0.3% in September, below the 0.4% consensus forecast. Food prices rose 0.2%, with food at home up 0.3% and food away from home up 0.1%. Energy prices rose 1.5% on a 4.1% seasonally-adjusted jump in gasoline prices. From a year earlier, gasoline was down 0.5%, but electricity was up 5.1% and utility (piped) gas service up 11.7%.

Core CPI excluding food and energy rose 0.2% in September, undershooting the 0.3% consensus forecast. Core goods prices rose 0.2%, with new vehicles up 0.2%, used cars and trucks down 0.4%, and apparel up 0.7%. Medical care commodity prices edged down 0.1%. Core goods excluding food and energy rose 1.5% on the year, their highest increase since May 2023. Core services prices excluding energy services rose 0.2% on a 0.2% increase in shelter, a 0.3% increase in transportation services, and a 0.3% increase in medical care services. “Supercore” CPI service prices excluding energy and housing rose 0.4% on the month, and were up 3.2% from a year earlier for a third straight month.

In year-over-year terms, September saw notable price increases that reflect the impact of tariffs and immigration-related labor shortages. Coffee was up 19% year-over-year and motor vehicle repairs 12%. Gardening and lawncare service prices rose 14%, and in-home care of “invalids and elderly” (The BLS’s term) 12%. These increases contrast sharply with smartphone prices, which fell 15% in September; companies scrambled to build up inventories of phones early this year ahead of higher tariffs, then discovered the category would be exempt from tariffs, so prices have been falling as retailers run down inventories. While core goods prices averaged “just” a 1.5% year-over-year increase in September, that is still high in historical comparison—core goods prices were flat from 2000 to 2019. So, September’s increase is notably above the U.S. economy’s old normal, when stable goods prices were a channel through which consumers benefitted from technological progress and the competitive forces of capitalism. Less related to broader economic trends but still painful for consumers, beef prices rose 15% on the year in September. Cattle herds never recovered after the pandemic amid years of drought and livestock diseases, putting upward pressure on prices.

A cool housing market contained shelter cost inflation and helped offset some of the pain from higher goods prices last month. Rent of primary residence rose 0.2% and owners’ equivalent rent of primary residence rose 0.1%. In year-over-year terms, both rent of primary residence and owners’ equivalent rent rose the least since December 2021. Shelter comprises 35% of the CPI basket. Housing has been in a slump for nearly three years, and prices and rents are rising slower than wages across most of the country. Used car and truck prices were another source of inflation relief in September. Cox Automotive reported a sizeable monthly drop in used car sales last month, which likely reflects financial pressures on low- and middle-income consumers.

The CPI tends to run about a quarter percentage point above the Fed’s preferred measure of inflation, the personal consumption expenditures price index, so the September CPI report shows inflation is still trending above the Fed’s target. Even so, inflation in September was more of a frustration than an emergency for the U.S. economy. For the Fed, the job market looks like a more urgent problem than inflation. Since the shutdown began to delay the release of the monthly jobs report, the spotty information available from private data sources, Fed surveys, and state unemployment insurance claims show that the job market has held steady at best, and slightly deteriorated at worst.

Comerica continues to forecast for the Fed to cut the federal funds target a quarter percent at both their meeting in late October as well as the mid-December meeting. The Fed is forecast to end runoff of their balance sheet a.k.a. Quantitative Tightening / QT in January 2026.

For a PDF version of this publication, click here: CPI Up Slightly Less Than Expected (PDF, 126 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.