Summary

- U.S. Dollar Index (DXY) declined sharply from 98.00 to test support at 97.56, driven by mixed economic data favoring Fed dovishness

- CPI inflation accelerated to 2.9% year-over-year in August (vs. 2.7% prior), moving further from Fed's 2% target

- Weekly jobless claims surged to 263,000 (+27,000 week-over-week), signaling labor market deterioration

- EURUSD broke above 1.17 on ECB hawkishness, with Lagarde declaring disinflationary process "over" and rate cuts likely concluded

- USDJPY weakened to 147.4 amid Japanese political uncertainty following PM Ishiba's resignation announcement

- USDMXN strengthened toward 18.6 as peso benefited from contained inflation (3.57% headline) and Banxico's measured policy approach

- Federal Reserve rate cut expectations increased as markets prioritized employment weakness over inflation concerns

The U.S. Economy and the dollar

The U.S. Dollar experienced significant volatility and broad-based weakness during the week, driven by mixed economic data that reinforced market expectations for more accommodative monetary policy in the U.S. in coming months. The release of August CPI data alongside deteriorating weekly jobless claims continue to provide a challenging and uncertain policy backdrop that currency markets interpreted as decisively dovish for Fed policy trajectory.

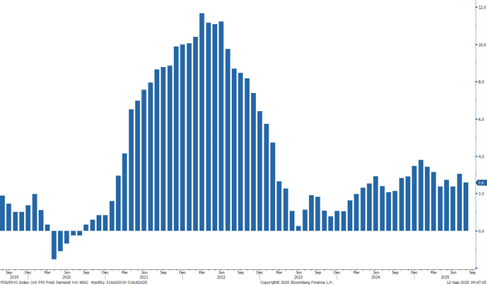

The latest release of the U.S. Producer Price Index (PPI) for August offered markets a softer inflation signal. The index of final demand declined by 0.1% on the month, reversing the sharp July gain, while the annual rate eased to 2.6% from 3.1%. Core PPI, which excludes food, energy, and trade services, registered a 2.8% year-over-year increase, pointing to moderating but persistent underlying pressures. Much of the weakness came from falling services costs, particularly trade margins, while goods prices showed a modest rise.

The downside surprise in headline PPI was amplified by downward revisions to July figures, emphasizing volatility wholesale price dynamics. Markets were anticipating a modest gain, making the contraction in services costs an unexpected drag on the headline figure. This could be pointing to producers facing tighter margins, which could translate into weaker consumer inflation or, if unsustainable, end up in an eventual price pass-through to end users.

U.S. PPI change YoY

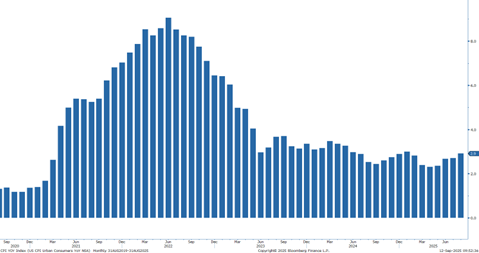

On the consumer prices front, August Consumer Price Index data released Wednesday showed annual inflation accelerating to 2.9% from July's 2.7%, representing the highest inflation rate since January and moving further from the Federal Reserve's 2% target. The 0.3% monthly increase, while in line with market consensus, highlights persistent underlying price pressures, especially if we consider that core CPI came at 3.1% and the trend in PCE inflation shows a similar trend.

U.S. CPI Change YoY

Regarding the labor market, Thursday's weekly jobless claims data provided a concerning signal with initial claims surging to 263,000 for the week ending September 6; a 27,000 increase from the prior week's 236,000. This deterioration in labor market conditions seems to be point to a meaningful shift from the generally tight employment landscape that has characterized 2024 and the first half of 2025 and is providing markets with stronger evidence of economic deceleration.

The Dollar Index (DXY) exhibited pronounced intraday volatility, initially strengthening toward 98.00 following the CPI release before reversing lower as jobless claims highlighted labor market weakness. The index ultimately settled below its weekly pivot at 97.85, testing key support around 97.50. Markets clearly prioritized employment weakness over inflation concerns, viewing the jobless claims number as more indicative of the Federal Reserve's likely policy path forward.

The combination of rising inflation and weaker employment continues to present a challenge for the Federal Reserve. While CPI acceleration would typically point to restrictive monetary policy, the deterioration in jobless claims suggests labor market conditions may be softening more rapidly than previously anticipated, arguing for monetary accommodation.

Market pricing now reflects higher probability of Fed rate cuts in coming months, with currency markets positioning for a resumption of the easing cycle despite inflationary pressures.

The continuation of current USD weakness will depend largely on whether economic data continues to support the narrative of labor market deterioration. On the other hand, persistent inflationary pressures could eventually force a reassessment of Fed policy.

Going forward the market also needs to pay attention to the growing structural risk to dollar stability given a potential for fiscal dominance. A scenario where the current trend of U.S. government debt starts to constrain monetary policy and the Fed independence. With federal debt at elevated levels relative to GDP and fiscal deficits remaining structurally high, the Federal Reserve will likely face higher pressure from the Trump Administration to maintain accommodative policies to ensure manageable debt service costs.

ECB Hawkishness Amplifies Dollar Weakness

The euro rallied above $1.17 on Thursday, benefiting from European Central Bank hawkishness and broad U.S. dollar weakness. The ECB's decision to hold rates unchanged for a second consecutive meeting was accompanied by notably hawkish rhetoric from President Christine Lagarde, who declared the disinflationary process "over" and highlighted that growth risks are now more balanced—clear signals that the interest rate cutting cycle has likely concluded.

The ECB's updated economic projections provided further support for euro strength, with eurozone GDP growth forecasts revised higher to 1.2% for 2025 (from 0.9% in June), before moderating to 1.0% in 2026 and 1.3% in 2027. Inflation projections were shown marginally higher across the forecast horizon: 2.1% in 2025 (versus 2.0% previously), 1.7% in 2026 (from 1.6%), and 1.9% in 2027 (unchanged from 2.0%).

This combination of better growth prospects and the ECB's hawkish pivot creates now a more compelling fundamental scenario for Euro strength, particularly when contrasted with the Federal Reserve's increasingly dovish positioning.

Japan’s Political Uncertainty and Policy Divergence Drive Volatility

The Japanese yen weakened to approximately 147.4 per dollar on Friday, surrendering prior session gains following a joint U.S.-Japan statement emphasizing that exchange rates should remain market-driven while excessive volatility remains undesirable. Japanese Finance Minister Katsunobu Kato acknowledged the statement's significance in the context of new US tariff policies, though he confirmed no discussions occurred with US Treasury Secretary Scott Bessent regarding specific currency level targets.

The yen's trajectory remains complicated by domestic political turbulence, with Prime Minister Shigeru Ishiba announcing his resignation amid mounting pressure from last year's election defeat and increasing divisions within the ruling party. This political uncertainty increases the challenge for investors attempting to gauge the Bank of Japan's policy direction given mixed economic signals.

The combination of U.S. monetary policy expectations favoring deeper Federal Reserve rate cuts and Japan's political instability continues to create a complex trading environment for USDJPY.

Peso Strength Reflects Favorable Fundamentals

The Mexican peso strengthened toward 18.6 per USD, capitalizing on broad Dollar weakness while benefiting from Mexico's relatively stable domestic economic backdrop. The peso's advance was supported by diminished external pressure as weaker U.S. labor data and lower Treasury yields reduced the carry differential that had previously weighed on the currency.

Mexico's contained inflation profile provided additional fundamental support, with headline inflation moderating to approximately 3.57% in August while core inflation remained steady at 4.23%. This benign price dynamic reinforces market expectations that Banco de México (Banxico) will maintain its cautious easing approach.

Minutes from Banxico's August meeting confirmed the board's 25 basis point reduction to 7.75%, with a majority of members favoring continued gradual reductions and another 25bps cut potentially taking place later in the year. The central bank's recently upgraded growth projections lifting 2025 GDP forecasts to 0.6% and 2026 to 1.1%. This signals an improving economic landscape that supports the peso's relative outperformance against a weakening U.S. dollar.

The peso's trajectory may soon face headwinds given this week’s announcement related to a tariff increase on Asian imports, with Chinese products particularly impacted.

Economy Secretary Marcelo Ebrard confirmed plans to raise tariffs on vehicles from China to 50% which is the maximum allowed by law. The measures require Congressional approval and will take effect 30 days thereafter. The tariff proposal aims to strengthen national production and protect an estimated 325,000 at-risk industrial and manufacturing jobs, aligning Mexico more closely with U.S. protectionist policies ahead of potential USMCA renegotiations. While these measures may provide domestic industrial support, they could introduce inflationary pressures and complicate Mexico's trade relationships, potentially creating volatility for the peso as markets assess the economic implications of reduced trade openness.

Contact Comerica Foreign Exchange

This publication has been prepared for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice. The information contained herein has been obtained from sources believed to be reliable, but Comerica does not represent, or guarantee, its completeness or accuracy. The views expressed herein are solely those of the author(s) at the time of publication. Comerica will not be responsible for updating any information contained within this publication, and such information is subject to change without notice. Comerica does not assume any liability for any direct, indirect or consequential losses that may result from reliance upon this publication.