Summary

- Canadian dollar strengthens markedly touching C$ 1.3635 in today’s trading from above C$1.40 earlier this week.

- Euro currency strengthens this week nearly breaching $1.15 despite giving back some of its gains after U.S. data.

- U.K. pound sterling pulls back from three-year high; gilts edge up.

- U.S. Treasury yields edge back up to 4.47% on the 10-year bond after slightly stronger than expected U.S. employment data.

- U.S. May unemployment rate steady at 4.2%; matching forecasts.

- Japan’s yen in broad range of 142 to 148 this week.

- Mexico’s peso remains bid strengthening to nearly nineteen per one U.S. dollar after trading above 19.66 earlier this week.

- AUD/NZD drops as rising New Zealand yields woo funds; RNBZ to cut in August, not July with terminal OCR still at 3% says Toronto Dominion.

- Polish zloty caps its worst week since early April.

- Navarro: Meeting with China officials expected within seven days. President Trump says he will be going to China.

- China’s yuan hovers near highest level since November.

Noteworthy

- U.S. Dollar Holds onto Gains After U.S. Payrolls; Canada Outperforms

- U.S. May Nonfarm Payrolls rise 139,000 Versus 126,000 Estimate

Commentary

U.S. job growth slowed slightly last month, a sign employers remained cautious about hiring amid uncertainty over tariffs and the nation’s economic outlook.

The U.S. added 139,000 jobs in May, the Labor Department reported Friday, above the gain of 125,000 – 127,000 new jobs economists had expected to see.

The unemployment rate, which is based on a separate survey from the jobs figures, held steady at 4.2%.

The May payrolls number compared with a revised 147,000 jobs added in April. Revisions showed employers added a combined 95,000 fewer jobs in March and April than previously estimated.

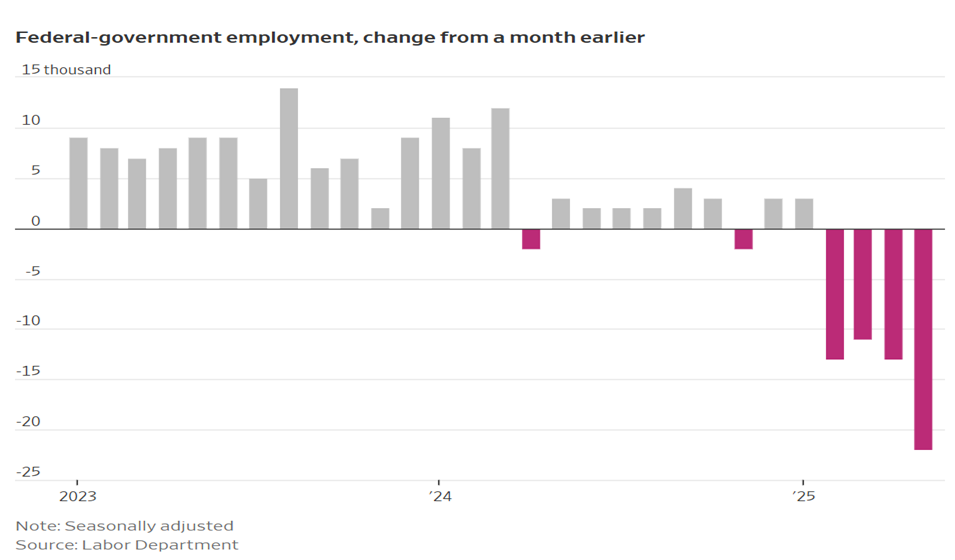

Federal-government employment shrank by 22,000 jobs, the fourth consecutive month of such declines.

Trump has made slashing the federal workforce a centerpiece of his agenda, but only a fraction of those cuts were reflected in the May data. Many such workers remain on paid leave or are receiving severance pay, which means they don’t show up as unemployed. Lawsuits and court orders have also led to delays in federal job cuts.

Stock futures rose after the report was released.

Recent months have been roiled by the Trump White House’s efforts to slash federal jobs and spending, as well as the launch of an aggressive raft of tariffs—and their on-again, off-again application.

Businesses say the tariffs whiplash has damped profits and weighed on their ability to plan for the future or make new investments.

May was an especially eventful month for tariff announcements. China and the U.S. brokered a 90-day tariffs détente. President Trump threatened big tariffs on the European Union starting in June, then backed off, giving both sides additional time to negotiate. A federal trade court ruled last week to vacate the lion’s share of Trump’s tariffs, but an appeals court temporarily reinstated them.

The tariff back-and-forth has continued in June. This week, Trump ratcheted up tariffs on imported steel and aluminum, increasing them to 50% from the current 25%.

In recent weeks, companies have lowered their outlook, citing tariff costs and slowing consumer demand.

The closely watched University of Michigan consumer sentiment index stabilized in May after falling for four consecutive months, though it remains at one of its lowest levels ever recorded in data going back to 1952. Personal spending rose by just 0.2% in April, though that was in line with a forecast of economists.

Though survey data reflects a gloomy mood among American consumers, hard economic data has held up relatively well for much of this year, with only modest rises in inflation and no large upticks in layoffs or unemployment. Economists caution that the impact of tariffs will likely be felt later this year.

The job market has likewise been buffeted from such instability, said Peter Sidorov, senior economist at Deutsche Bank. American companies entered the year with strong cash reserves and are generally well-positioned to wait out some of the uncertainty regarding Trump’s tariffs without resorting to layoffs, he said.

Contact Comerica Foreign Exchange

This publication has been prepared for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice. The information contained herein has been obtained from sources believed to be reliable, but Comerica does not represent, or guarantee, its completeness or accuracy. The views expressed herein are solely those of the author(s) at the time of publication. Comerica will not be responsible for updating any information contained within this publication, and such information is subject to change without notice. Comerica does not assume any liability for any direct, indirect or consequential losses that may result from reliance upon this publication.