Summary

- Canadian dollar strengthens after U.S. jobs report in tandem with other currencies after the U.S. dollar’s strong rally this week.

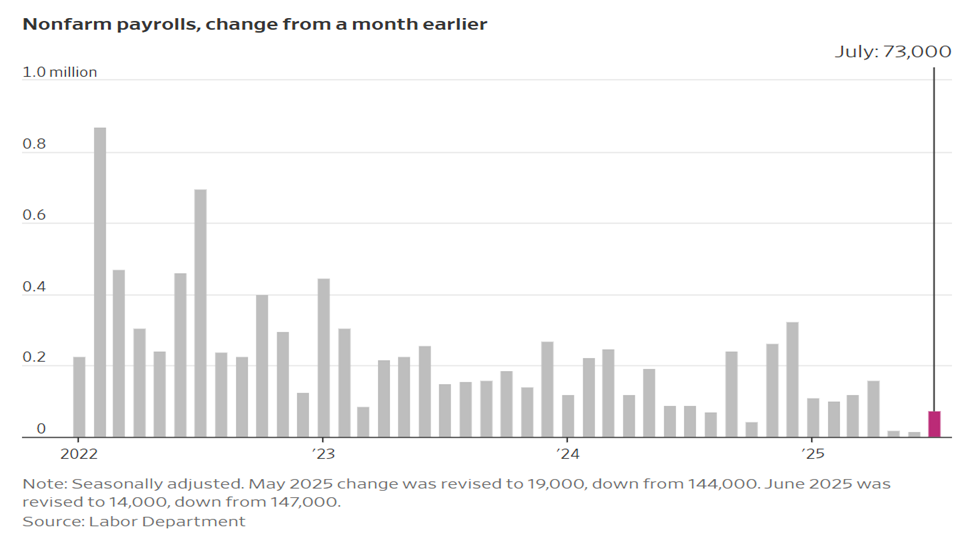

- U.S. payroll gains for May, June revised down sharply; July increase falls short of estimates by economists.

- U.S. dollar drops as traders price in two interest rate cuts for 2025.

- U.S. unemployment rate matches economists’ estimates at 4.2%.

- Euro moves more than 1.3% on release of U.S. data, revisions.

- U.S. Treasury yields sharply lower touching levels below 4.25% on the 10-year bond.

- German two-year bonds (bunds) rally, trailing Treasuries, after U.S. jobs data.

- U.K. pound sterling moves from mid $1.31 range to above $1.33.

- Japanese yen strengthens from 151 per U.S. dollar to 148.

- Swiss franc leads G-10 losses; hits 5-week low versus U.S. dollar prior to release of U.S. payroll report.

- President Trump keeps minimum reciprocal tariff at 10%: White House.

- China’s yuan remains pressured by the U.S. dollar; PBOC keeps fixing support.

Noteworthy

- U.S. Hiring Was Weak in July, with 73,000 New Jobs Added

- U.S. Dollar Gives Back Portion of Major Gains This Week

U.S. job growth slowed in July, a signal that pockets of weakness that had been marring the labor market are starting to take hold.

The U.S. added a seasonally adjusted 73,000 jobs in July, the Labor Department reported Friday, below the gain of 100,000 jobs economists polled had expected to see.

Revisions cut down the jobs growth originally reported for May and June by a combined 258,000. That left May as having added just 19,000 jobs and June just 14,000.

The unemployment rate rose slightly to 4.2% from 4.1%. The number of people unemployed for 27 weeks or longer increased to 1.83 million from 1.65 million in June. That increase in the ranks of the long-term unemployed could reflect an environment where layoffs have been low, but companies have been reluctant to hire, making it harder for people without work to find employment.

The health care and social assistance sectors accounted for a large share of the new jobs. Those sectors tend to do well no matter how the economy is doing. Federal-government layoffs continued to drag on payrolls, with the sector losing 12,000 jobs.

U.S. equities fell shortly after the opening bell. The weak jobs data is likely to fuel bets on Federal Reserve interest rate cuts, with two now expected.

July’s report comes as economists and policymakers are trying to figure out which of two competing narratives about the economy is more true.

One view is that of surprising resilience. Tariff threats, though they have started to seep into some prices, have yet to translate into pronounced inflation. Consumers, after holding back earlier in the year, are feeling a bit more confident.

Another perspective is that cracks are starting to appear and could deepen. Some companies are reporting that customers are becoming more sensitive to prices. Young consumers are cutting back on discretionary spending, and much of the economy’s growth is being driven by the wealthiest Americans.

Economists are paying particular attention to changes in the supply of workers. A dramatic decrease in border crossings is constraining the number of people from abroad coming into the labor force. High-profile immigration raids are keeping many workers at home. Meanwhile, the U.S. is aging, boosting retirements, and limiting the number of younger people joining the workforce.

A year and a half ago, the economy needed to add 166,000 jobs a month to keep the labor market steady. As of June, the needed number was only 86,000.

Economists attribute the steep drop to the tapering of the immigration surge from the last five years. In other words, a job creation number that might have looked lackluster a year and a half ago might actually be strong today.

Recently, the number of jobs created each month has been slowing, but the unemployment rate has risen only slightly.

“People are going to have to get used to employment gains that are meh that will not tell us on their own that the job market is weak,” said a noted economist. “That is a weird thing for people to get used to.”

Contact Comerica Foreign Exchange

This publication has been prepared for general educational/informational purposes only and should not be considered as investment advice or a recommendation for any particular security, strategy or investment product, or as personalized investment advice. The information contained herein has been obtained from sources believed to be reliable, but Comerica does not represent, or guarantee, its completeness or accuracy. The views expressed herein are solely those of the author(s) at the time of publication. Comerica will not be responsible for updating any information contained within this publication, and such information is subject to change without notice. Comerica does not assume any liability for any direct, indirect or consequential losses that may result from reliance upon this publication.