Preview of the Week Ahead

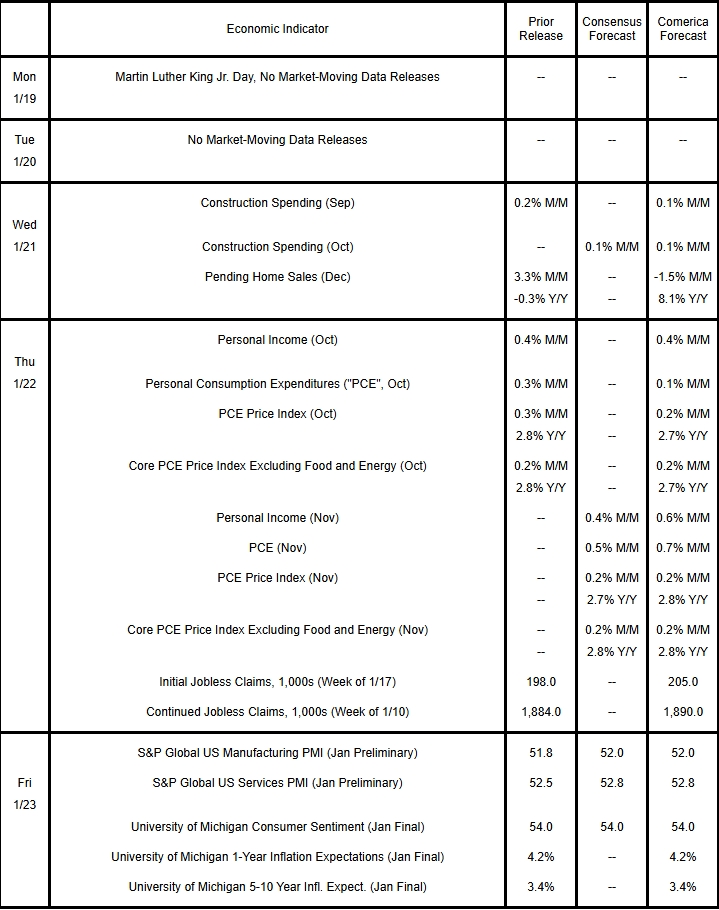

Delayed personal income and outlays reports will likely show that inflation held a solid notch above the Fed’s 2% target in October and November. Personal consumption expenditures were likely soft in October during the government shutdown, then bounced higher in November as the shutdown’s headwind abated. Personal income likely grew solidly in October and November. Delayed construction spending data will likely show that building activity began to recover in September and October, supported by the Fed’s rate cuts. Construction spending likely was still down from its recent peak in mid-2024.

The Week in Review

Retail sales, industrial production, and housing data for the fourth quarter showed the economy closed 2025 with better momentum than expected. Retail sales jumped 0.6% in November as the holiday shopping season kicked into high gear. The end of the government shutdown boosted spending. October’s sales were revised down to a 0.1% decline. Core sales excluding autos and gas rose 0.4% for a second month in a row in November. Industrial production rose 0.4% in December as the cold pushed utilities output up 2.6%. Manufacturing rose 0.2% on the month. In year-over-year terms, industrial production rose 2.0% with manufacturing also up 2.0%, mining up 1.7%, and utilities up 2.3%. The motor vehicle assembly rate receded to 9.68 million at a seasonally-adjusted annualized rate (SAAR) from 9.72 million SAAR in November and was the weakest since early 2025. The assembly rate averaged the lowest in the fourth quarter since the first quarter of 2022. Carmakers are making the difficult adjustment to the end of EV subsidies. Aerospace production is going gangbusters, by contrast, with the IP component for aerospace and miscellaneous transportation equipment up 1.5% on the month and 17.2% on the year.

New home sales jumped 3.8% on the month in September after an 11.3% surge in August, then held nearly unchanged at that strong level in October, edging down 0.1%. September and October’s sales were nearly the strongest since early 2022, helped along by ample listings and the Fed’s rate cuts. The median price of a new home sold fell 8.0% on the year in October to $392,000 and was the lowest since mid-2021 as builders shrank floorplans and discounted to keep units moving. Existing home sales are beating expectations, too, up 5.1% on the month in December to 4.35 million units SAAR; December’s seasonally-adjusted pace of sales was the strongest since early 2023, but seasonal adjustment overstates the existing market’s recovery since December is the low season for sales. The median price of an existing home sale rose 0.4% on the year to $405,000. Median prices for existing homes have been higher than new homes since June, a historical rarity. Existing homes are almost always cheaper than new builds, but this relationship is now reversed since new home sales are concentrated in the lower-cost Sunbelt, while more existing sales are in older metros where inventories are tighter and prices higher.

The CPI matched expectations with a 0.3% increase in December and was up 2.7% from a year earlier. Core CPI rose 0.2% on the month and 2.6% on the year, both a tenth of a percent below the consensus. The government shutdown caused gaps in data that make the CPI run cooler than it otherwise would have. The PPI rose 2.8% on the year in December, while core PPI excluding foods and energy rose 2.9%.

For a PDF version of this publication, click here: Comerica Economic Weekly, January 19, 2026(PDF, 153 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.