Preview of the Week Ahead

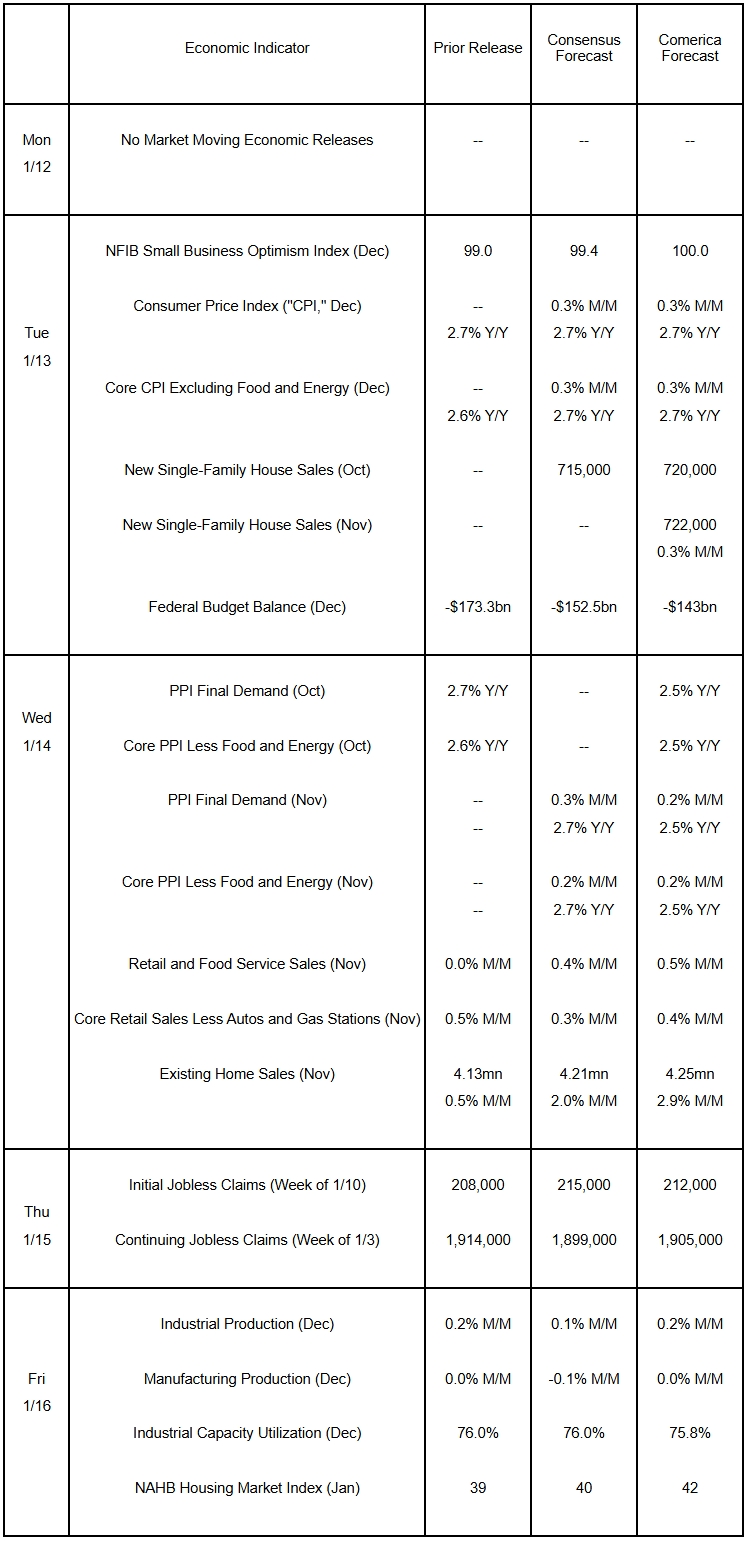

The CPI likely held steady in December after decelerating in November; the government shutdown seems to have caused issues with the measurement of inflation in late 2025 that likely overstate the recent improvement. Those same measurement issues will likely contribute to lower PPI inflation in the delayed reports for October and November. Retail sales were likely solid in November after a cool October, helped by auto sales starting to recover from October’s sharp declines. Brisk holiday season spending likely boosted core retail sales. Existing home sales likely rose in November as unseasonably strong listings brought buyers off of the sidelines; the median price of an existing home sold likely rose modestly in year-over-year terms. Industrial production likely rose in December as frigid weather boosted utilities production; manufacturing production was likely flat in the month.

The Week in Review

The Department of Justice announced an investigation into testimony Fed Chair Powell delivered to Congress earlier in 2025, the latest front in the executive branch’s campaign to pressure the Fed to lower interest rates. Congressional leaders restated their support for Powell after the probe’s announcement; pressure on the Fed likely will make Powell more willing to stay on the FOMC as a governor after his term as Chair ends in mid-May, and raise the bar for the Fed to cut interest rates near-term.

The December jobs report capped a disappointing year for American workers, with 50,000 jobs added on the month, a 22,000 monthly decline in the fourth quarter, and only 49,000 added per month in the year. The annual data make clear how last year’s main economic headwinds restrained job growth: The federal government shed 274,000 jobs and private scientific R&D employment fell another 20,000 amid DOGE cuts. Margin pressure from tariffs contributed to manufacturers cutting 68,000 jobs, while wholesale, retail, transportation, and warehousing shed another 74,000. AI adoption showed up in a 54,000 decline in various IT service providing industries. Health care and social assistance added 713,000 jobs in 2025, accounting for all the year’s net job gains. The December jobs report did not incorporate the 911,000 cut to employment in March 2025 reported in the Preliminary Benchmark Revision announced in September, so the final Benchmark Revision will likely make 2025’s job growth look even weaker when it is released in the next jobs report. The unemployment rate closed 2025 at 4.4%, down a hair from 4.5% in November but up from 4.1% in December 2024. The unemployment rate for Black or African American workers rose 1.4 percentage points over the year, and the unemployment rate for teenagers rose 3.4 percentage points; these demographics tend to see unemployment rise ahead of broader weakness in the job market, so these increases are a concerning signal for the outlook for early 2026.

Business activity was mixed in December. The ISM Manufacturing PMI fell to 47.9 from 48.2 in November, while the ISM Services PMI rose to 54.4 from 52.6. The excerpts from purchasing managers’ responses to the manufacturing survey mentioned tariffs ten times. Service-providing employers reported job gains in December, but a majority of manufacturers reported further job cuts. Input-price increases moderated slightly for service-providers and held steady for manufacturers.

For a PDF version of this publication, click here: Comerica Economic Weekly, January 12, 2026(PDF, 200 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.