Preview of the Week Ahead

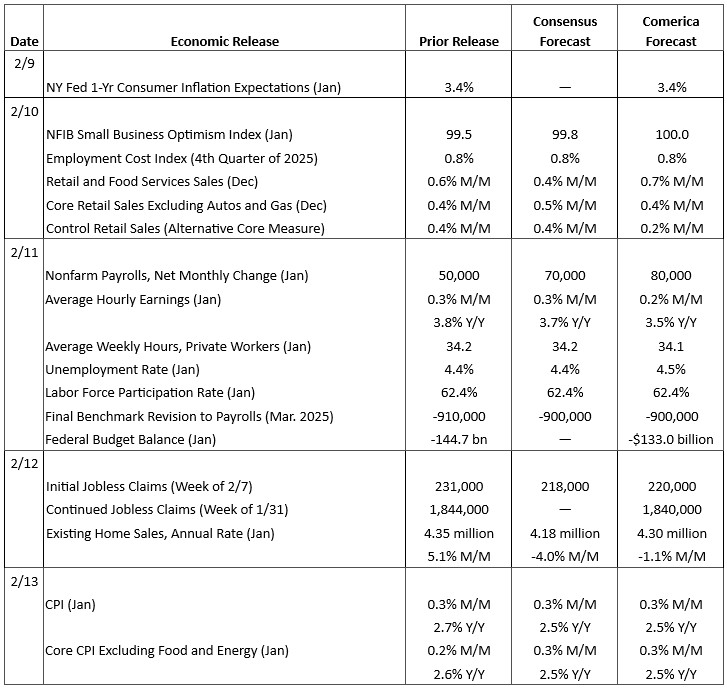

Payrolls growth likely picked up in January after disappointing during last year’s holiday season. Downward revisions in the annual “benchmark revisions” will probably dominate this week’s economic headlines, but are largely old news—the revisions are to job growth between March 2024 and March 2025, and provide no new information about more recent trends. The unemployment rate likely edged higher in January. Retail sales likely grew solidly in December as new car sales rose; consumers sound ornery in surveys, but are still spending.

CPI inflation likely slowed in January, but the improvement should be read with a grain of salt: The 2025 government shutdown interrupted collection of some price surveys, making CPI look unrealistically low now. The CPI will likely move a notch higher in April when the government’s statisticians fill the gaps in the data.

The Week in Review

Benchmark business surveys delivered mostly good news in January. The ISM Manufacturing Purchasing Managers Index (PMI) jumped to 52.6 from 47.9 and was the strongest since 2022, fueled by a surge in new orders and higher production. The ISM Services PMI held steady at the strongest since late 2024. Employment continues to be a soft spot in the surveys: Manufacturers reported a net decline in payrolls for the 28th month running, and service-providing businesses reported modest hiring. Inflation is an ongoing pain point as well: Both PMIs report input prices are rising faster than in 2024, which purchasing managers attributed to tariffs.

Consumer surveys were weaker in January. The University of Michigan’s Consumer Sentiment indicator rose to the strongest since last August but was still well below its long-run average. More concerning, The Conference Board’s Consumer Confidence Index® plunged to the lowest since 2014—worse even than during the 2020 lockdown. Turmoil in Minneapolis and harsh winter weather across much of the nation likely contributed to volatility in the surveys. The winter storms also dragged on new car and light truck sales, which fell to a 14.85 million seasonally-adjusted annual rate in January—the lowest since 2022.

Ahead of the January employment report, other data show the job market is still in low hire, low fire mode. Private hiring was modest in January according to payroll processing company ADP, with 22,000 jobs added on the month. ADP estimates that job growth averaged 23,000 per month in the last 12 months. ADP also reports that pay growth has held roughly steady in the last few months, and is near the lowest since the post-pandemic recovery took off. Job openings fell to the lowest since 2020 in December, and are down nearly a million (13%) from a year earlier. Quits, hires, layoffs and discharges are better, and largely unchanged in recent months. Consumers’ assessments of the job market improved in University of Michigan’s survey, but deteriorated in The Conference Board’s.

For a PDF version of this publication, click here: Comerica Economic Weekly, February 9, 2026(PDF, 301 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.