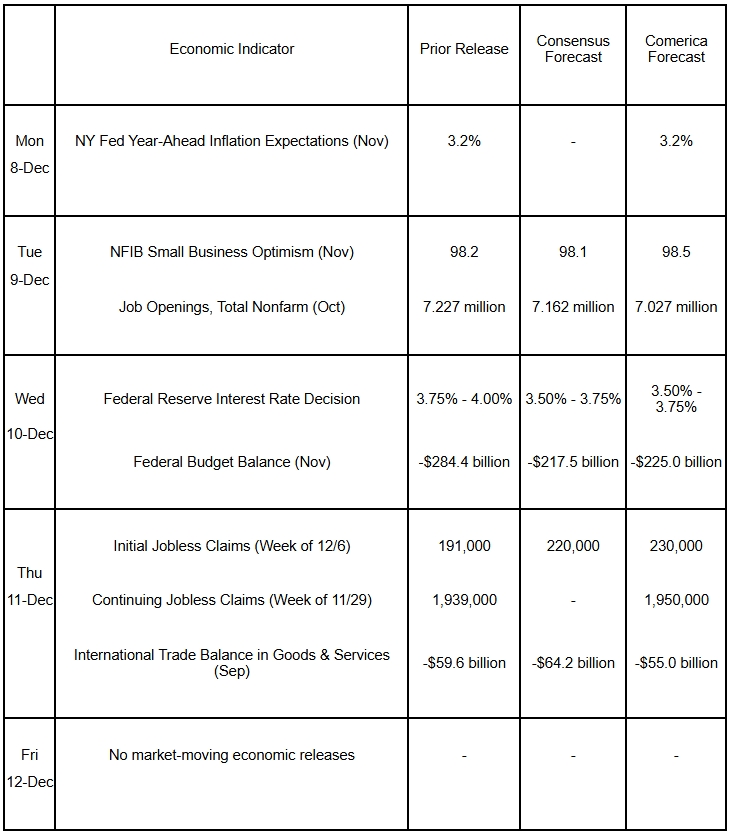

Preview of the week ahead

Comerica Economics forecasts for the Federal Open Market Committee (FOMC) to cut the federal funds target a quarter of a percentage point to a range of 3.50% and 3.75% at its last decision of the year this Wednesday. Several FOMC members will likely dissent again. The Fed will likely be tight-lipped about the outlook for rates in 2026 given conflicting views among FOMC members. The FOMC probably will signal measures to support short-term funding markets after signs of tight liquidity in them in recent months. Job openings likely fell again in October. The federal government is expected to have run a smaller deficit in November after a very large monthly deficit in October. The trade deficit likely narrowed in September as import demand cooled; importers front-loaded purchases earlier in 2025 to avoid tariffs and so felt less need to buy imports this fall.

The week in review

The “alternate” sources of labor market data drew more scrutiny than usual since the shutdown delayed the BLS’s release of the November jobs report until December 16th. These data generally point to a weaker job market in November. The private payroll processor ADP reported employers reduced headcount by 32,000 in the month. ADP’s data show employment fell in four of the last six months, and has been about flat since July. November’s job cuts were concentrated in smaller businesses. By industry, losses were largest in professional and business services, information, and manufacturing, partially offset by gains in education and health services and in leisure and hospitality. Pay increases from a year earlier decelerated for both job-stayers and job-changers, according to ADP. The message from labor market data aggregator Revelio Labs’ jobs data was similar: They estimated that payrolls fell 9,000 in November after a downwardly-revised 15,000 decline in October. Unlike ADP, Revelio’s estimates include public employment. Outplacement firm Challenger, Gray, & Christmas reported employers announced plans for 71,000 job cuts in November, up 24% from the same month last year. They cited restructuring, market and economic conditions, and Artificial Intelligence as key reasons for layoff announcements.

Personal incomes rose by 0.4% in September on an equal increase in wages and salaries. Adjusted for taxes, Social Security, and Medicare contributions, disposable incomes were up by a softer 0.3%. Adjusted for inflation as well, real personal incomes edged up 0.1% for a second month running. Personal consumption expenditures increased by 0.3%. Real spending was flat in September as real goods expenditures fell, a soft end to the third quarter. The total and core Personal Consumption Expenditures Price Indexes rose by 0.3% and 0.2%, respectively. Both rose 2.8% from a year earlier. Food and energy costs rose notably in September and made a sizeable contribution to inflation.

Manufacturing contracted for a ninth consecutive month in November, according to the ISM Manufacturing PMI. The survey’s details were largely negative. New orders and employment fell for the third and tenth month, respectively, while prices rose for the 14th consecutive month. Production was a bright spot, expanding after contracting in October. The ISM Services PMI edged higher and indicated expansion of service-providing businesses. Service-provider business activity improved and input price increases slowed, but service-providing orders growth slowed and employment was reported lower.

For a PDF version of this publication, click here: Comerica Economic Weekly, December 8, 2025(PDF, 180 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.