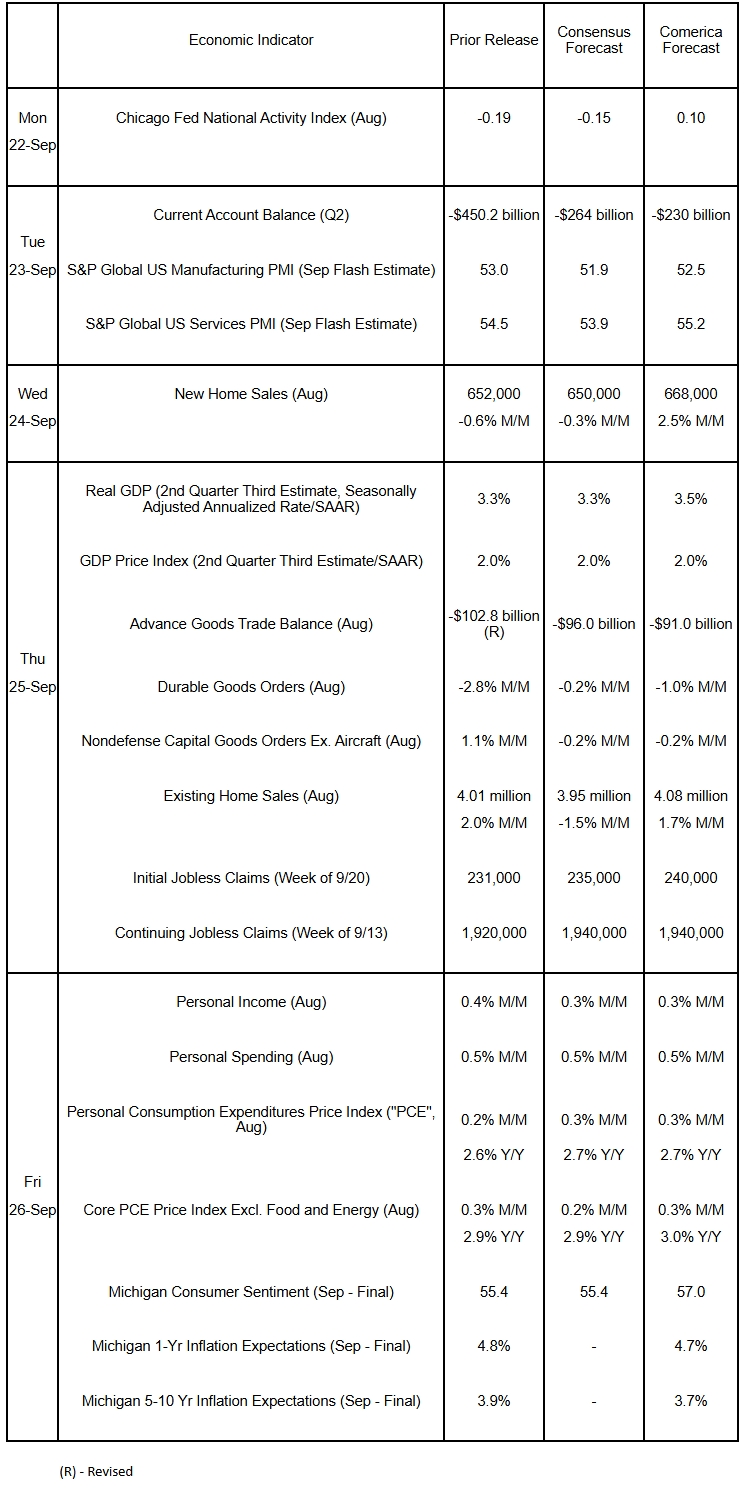

Preview of the Week Ahead

Real GDP growth in the second quarter of 2025 will probably be revised higher in the third estimate on upward revisions to consumer spending. Personal incomes are forecast to have risen moderately in August, and spending likely jumped on the back of stronger purchases of goods. The Personal Consumption Expenditures (PCE) Price Index will probably show annual inflation edging higher. Lower mortgage rates and ample supply probably pushed existing and new home sales higher. S&P Global’s preliminary PMI releases will likely show continued expansion of the private sector in September.

The Week in Review

As expected, the FOMC cut the federal funds target rate by 0.25 percentage point to a range of 4.00% to 4.25% at its September 17 decision, in a 11-1 vote. Newly appointed Governor Miran dissented, preferring a half-percent cut instead. While the median FOMC member believes two more rate cuts will by appropriate by the end of 2025, there was an unusually large divergence in views among members. The median member expects to cut rates just a quarter percent more in 2026 and again in 2027, less than they projected when the FOMC last published its Summary of Economic Projections (“Dot Plot”) in June. Annual economic growth in the fourth quarter of 2025 and 2026 were both revised up 0.2 percentage point, to 1.6% and 1.8%, respectively. The median forecasts for total and core PCE inflation in the fourth quarter of 2025 were unrevised at 3.0% and 3.1%, respectively. The forecasts for both in 2026 were revised up 0.2 percentage points to 2.6%. The median forecast has the unemployment rate peaking at 4.5% in the fourth quarter of 2025, then gradually to 4.2% by 2028. In the press conference following the decision, Chair Powell characterized the September decision as a “risk-management cut,” which markets interpreted as signaling limited appetite for more cuts near term.

Consumer spending on goods has been strong in recent months. Sales at retailers and food service and drinking establishments rose by a solid 0.6% in August, double the 0.3% consensus forecast. Sales in June and July were revised higher, to 1.0% and 0.6%, respectively, Tariff frontrunning by households and higher prices probably accounted for some of the recent strength. Increases were broad based, with sales higher in nine out of thirteen retail subsectors. Sales at nonstore retailers, including online retailers, rose sharply for a fourth consecutive month. Core retail sales, used in computing nominal spending on goods in the GDP report, expanded solidly again, pointing to a sizeable contribution from consumer spending to economic growth in the third quarter.

The NAHB/Wells Fargo Housing Market Index (HMI) held steady at a very low level in September. Current conditions and prospective buyer traffic were essentially unchanged, while future sales expectations rose on optimism that rate cuts will spur demand in coming months. In reaction to anemic housing demand, four in ten homebuilders cut prices to boost sales, a post-Covid period high, while nearly two-thirds offered sales incentives. August’s housing starts and building permits are another sign of weak residential construction, with starts cratering by 8.5% on the month and down 6.0% from a year earlier. Issuance of permits to build homes, a leading indicator of future residential construction, dropped by 3.7% and fell 11.1% from a year earlier.

For a PDF version of this publication, click here: Comerica Economic Weekly, September 22, 2025(PDF, 207 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.