Preview of the Week Ahead

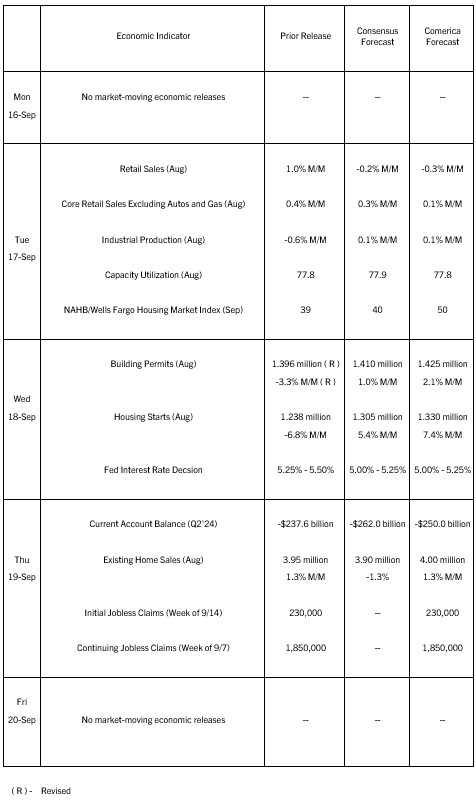

Comerica forecasts for the Fed to lower the federal funds target by a quarter of a percent at Wednesday’s decision and hold the pace of the balance sheet reduction (“Quantitative Tightening”) steady. Citing a cooling labor market and a balanced focus on their dual mandate for maximum sustainable employment and price stability, monetary policymakers’ forward guidance and forecasts are anticipated to signal this week’s easing will be the first in a series of cuts through 2025.

Retail sales likely declined in August on the back of a fall in unit auto sales and lower gasoline prices. The Beige Book—the Fed’s summary of anecdotal accounts of economic conditions—reported economic activity weakened in August, implying that core retail sales were soft last month, too. A recovery to trend probably lifted housing permits, starts, and existing home sales in August. Housing will likely begin a more sustained recovery this fall as rate cut headlines buoy homebuilder and homebuyer sentiment.

The Week in Review

The Consumer Price Index (CPI) matched the consensus and rose by 0.2% in August, and was up 2.5% from a year earlier, the smallest annual increase since February 2021. Core CPI excluding food and energy prices rose 0.3% on the month—slightly above expectations—and 3.2% from a year earlier, tying for the slowest increase since April 2021. Shelter costs rose 0.5% on the month and 5.2% on the year, accounting for over 70% of the annual increase in core CPI. Americans saw relief at the pump as gas prices tumbled, a trend which continues through mid-September. Food prices rose a tame 0.1%, with food at home flat. Food consumed away from home rose 0.3%. “Supercore CPI” (Services excluding energy and shelter, among the stickiest components of inflation) rose by 0.3%, following a 0.2% increase in July and flat readings in May and June. There were larger increases in some non-discretionary items in Supercore CPI, like homeowners’ and tenants’ insurance, up 0.8%, and car insurance, up 0.6%.

Inflation by the Producer Price Index for Final Demand (PPI) was a touch hotter than expected in August, rising 0.2% from July, but matched the consensus forecast for a 1.7% annual increase. Core PPI excluding food and energy rose 0.3% on the month and an unchanged 2.4% on the year. Led by a sizeable drop in energy prices, prices of final demand goods were unchanged on the month. Final demand service prices rose 0.4%, largely due to an increase in volatile wholesale and retail trade margins, which fell in July. The unchanged annual increases in core CPI and PPI inflation in August caused financial markets to price in less likelihood of a larger-than-expected rate cut this week, but markets still price in expectations for at least a quarter percent in cuts at each of five Fed meetings after this one.

In the penultimate month of the current fiscal year, the federal fiscal deficit ballooned to $380.1 billion from $243.7 billion in July. The fiscal year-to-date (YTD) deficit reached $1.9 trillion, up considerably from $1.7 trillion in the 2022/23 fiscal year. Federal revenues are up 10.6% fiscal YTD, largely due to sharp increases in personal income taxes, up 11.3%, and corporate income taxes, up 29.9%. Among the largest expenditure items, Social Security rose 8.0%, defense rose 8.4%, and Medicare rose 16.4%, while net interest ballooned by 33.8% to $843 billion.

For a PDF version of this publication, click here: Comerica Economic Weekly, September 16, 2024(PDF, 147 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.