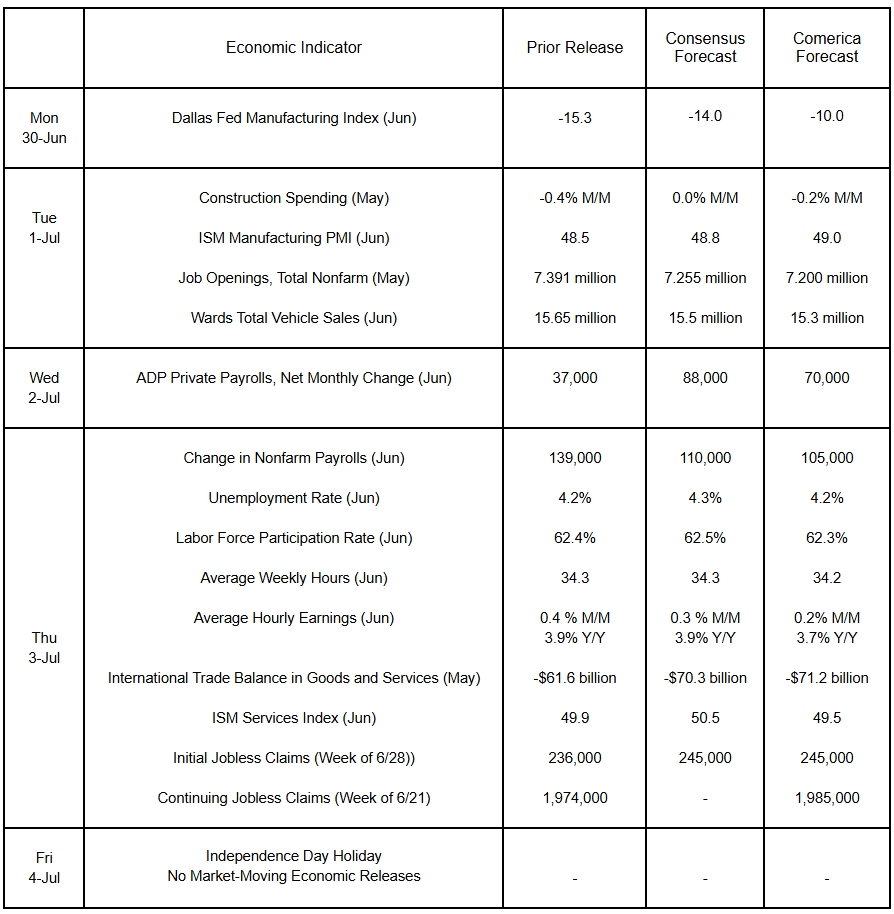

Preview of the Week Ahead

Employment growth likely slowed to a modest pace in June. The unemployment rate likely held steady, but the labor force participation rate probably edged lower from May. Lower demand for labor probably translated into modest increases in wages and a slightly shorter workweek. Job postings, released at a lag to employment, likely edged down in May. Construction spending probably declined again due to a pullback in residential and non-residential investment. Geopolitical tensions are anticipated to have weighed on business sentiment, holding both the ISM manufacturing and services PMIs in the red. The trade deficit in goods and services likely widened in May.

The Week in Review

The Economy hit an air pocket in the first half of 2025. The Bureau of Economic Analysis revised down real GDP in the first quarter in the third estimate to a 0.5% annualized contraction from a 0.2% annualized contraction in the second estimate. Following revisions, consumer spending rose a paltry 0.5% annualized in the quarter, the weakest in five years. The GDP price index and personal consumption expenditures (PCE) price index, the Fed’s preferred inflation gauge, were both revised up by a tenth of a percent to annualized rates of 3.8% and 3.7%, respectively.

Personal income and spending were weaker than expected in May. Incomes declined 0.4%, undershooting the median forecast for a 0.3% gain. Spending declined by 0.1%, while the consensus forecast expected a 0.1% gain. On an inflation-adjusted basis, consumer spending tumbled by 0.3%, the third decline in the first five months of the year. Real expenditures on goods were down 0.8% while real spending on services was unchanged. Headline PCE prices rose by 0.1% and were up 2.3% from a year earlier, matching expectations. Core PCE inflation was a tad hotter than expected, up 0.2% on the month and 2.7% on the year. The saving rate declined by 0.4 tenths of a percent to 4.5%.

Housing data are also fairly weak. Strongest were existing home sales, up by 0.8% to an annualized rate of 4.03 million in May. But that is still down 0.7% from a year earlier. Houses listed for sale rose to 1.540 million, up 20.3% from May 2024. With listings sharply higher and sales subdued, listings were equivalent to 4.6 months of supply at last month’s rate of sales, the highest in nearly a decade. New home sales cratered by nearly 14% in May to an annualized rate of 623,000 from a downwardly revised 722,000 pace in April. Lower sales and more inventories pushed new home supply to nearly 10 months. House prices are softening too. The Case-Shiller 20-City house price index declined by 0.3% in April, resulting in its annual increase slowing to 3.4% from 4.1% in March. The FHFA Purchase-Only House Price Index declined by 0.4%, pulling the annual comparison down to 3.0% from 3.9% in March. Trends are similar in sale prices, with the median price of an existing home up 1.3% on the year in May, while the sales price of a new home rose 3.7%.

May was a month to forget for the economy, but June might be better. The University of Michigan’s Consumer Sentiment Indicator was revised up to 60.7 in the June final release and was the highest since February, with better views of the inflation outlook and the job market than in May.

For a PDF version of this publication, click here: Comerica Economic Weekly, June 30, 2025(PDF, 154 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.