Preview of the Week Ahead

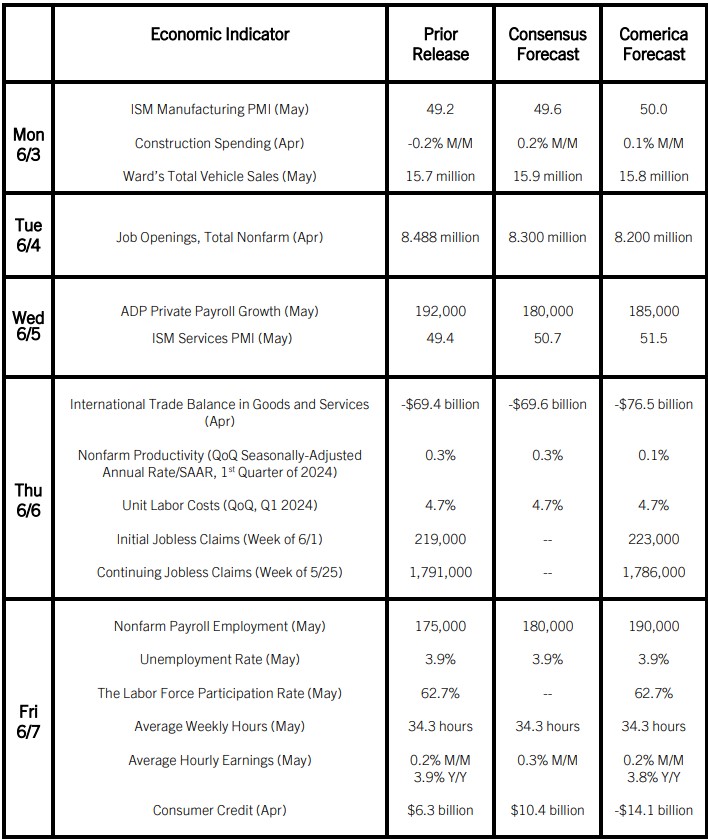

The May jobs report will likely show payroll employment growth holding under 200,000 for a second month in a row, with the unemployment rate holding steady at 3.9%. That’s not high, but you can see the difference between it and the half-century low of 3.4% reached in the first half of 2023 without your glasses on. Average hourly earnings growth likely moderated further in year-over-year terms. Job openings, released at a one-month lag to the level of employment, likely fell again in the latest release for April.

Other economic data will likewise point to an economy operating in lower gear, but still growing. The ISM manufacturing and services purchasing managers indexes (PMIs) are expected to rise in May, mirroring pickups in the flash estimates of the S&P Global PMIs released last week. Construction spending likely rose modestly in April after a dip in March. Car and light truck sales likely edged higher in May.

The Week in Review

First quarter economic growth was revised down from 1.6% annualized to 1.3% in the “second” estimate of GDP, primarily due to a sharp downward revision to consumer spending. The 2.0% annualized increase in consumer spending was driven solely by strong spending on services. Expenditures on goods fell sharply, almost solely pulled down by a large decline in motor vehicles and parts purchases. Residential investment was revised up to an annualized rate of 15.4%, the fastest in three years. Led almost entirely by strong spending in investments in intellectual property products like research and development in artificial intelligence, overall business investment was also revised higher to an annualized rate of 3.3%. Government spending rose at a slower pace than the prior quarter. Net exports and inventory destocking subtracted about 1.3% from growth.

The Gross Domestic Product Price Index – the broadest measure of price changes in the economy – rose 3.0% annualized last quarter, while the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, increased by 3.3%. Monetary policymakers are likely to be displeased by the acceleration of PCE services inflation, which jumped to 5.3% annualized last quarter.

Continuing a flurry of weak housing market data, pending home sales plunged by 7.7% in April and were down 7.4% from a year earlier. Pending home sales generally lead existing home sales by a month or two. Hence, existing home sales are likely to be weak in the important spring home buying season. The low inventory of houses for sale is propelling house prices higher despite multidecade low affordability. The S&P CoreLogic Case-Shiller National Home Price Index reached an all-time high in March and was up 6.5% from a year earlier. The Case-Shiller 20-City Composite Index of the 20 largest cities accelerated further to 7.4% year-over-year in March. The Federal Housing Finance Agency’s flagship Purchase-Only House Price Index report affirms the house price acceleration nationwide. House prices in the first quarter were 6.6% higher compared to the same quarter last year and were up in all 50 states and 97 of the 100 largest metropolitan areas.

For a PDF version of this publication, click here: Comerica Economic Weekly, June 3, 2024(PDF, 175 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.