Preview of the Week Ahead

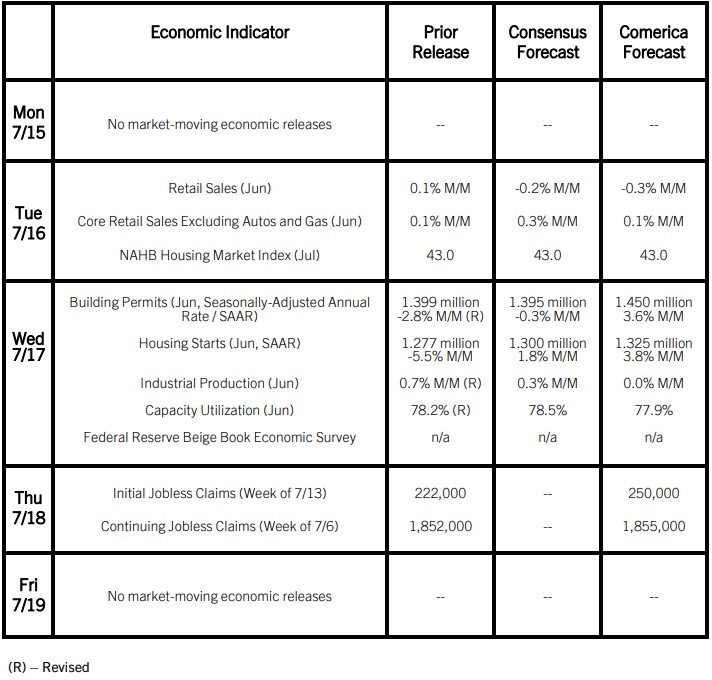

Retail sales and industrial production were likely cool in June. Retail sales likely fell on lower auto dealer and gas station sales: The CDK hack weighed on car dealers, and lower gas and diesel prices reduced spending at gas stations. Retail sales excluding these two categories likely grew, but at a slower pace than in May.

Industrial production was likely unchanged in June as utilities production rose further after big increases in April and May. Temperatures in the continental U.S. averaged 3.4°F above average in June after being 2.1° above average in May. Manufacturing production likely was flat from May, and mining output modestly lower. Building permits and housing starts likely rebounded slightly in June after depressed readings in May. Homebuilding is stuck in low gear due to high interest rates, but should recover in the late summer and fall as the Fed signals interest rate cuts are approaching.

The Fed’s Beige Book survey of economic contacts likely reported flat to modestly lower economic activity in the latest survey for June, with cooler inflation pressures. The survey is also expected to show more labor market slack and a continued slowdown in wage growth to rates more typical of the pre-pandemic economy.

The Week in Review

Inflationary pressures eased further in June. The Consumer Price Index (CPI) fell by 0.1% from May and was up 3.0% year-over-year. Core CPI rose by a modest 0.1% and was up 3.3% on the year. Both total and core inflation were below the consensus. Shelter costs, the single biggest contributor to inflation over the past few years, rose by 0.2% in June—the slowest pace in three and a half years—and were up 5.2% from a year earlier. Prices of services excluding shelter, which account for around a fourth of consumer purchases, were unchanged for a second consecutive month. Energy prices tumbled on the back of a nearly 4% decline in gasoline prices. Food prices rose 0.2%.

The Producer Price Index (PPI) rose 0.2% last month and was up 2.6% on the year. Core PPI was unchanged from May and up 3.1% from a year ago. Producer prices of final demand goods fell on lower energy prices, while final demand services rose 0.6%, mostly due to an increase in the volatile trade services component.

The federal government’s deficit shrank sharply from $347.1 billion in May to $66 billion in June due to calendar-related shifts in benefit spending and deferred tax receipts from states affected by natural disasters. The cumulative fiscal year-to-date (YTD) deficit is $1.3 trillion, down 9.0% from $1.4 trillion in the same period last year. The decline is largely due to higher revenues, with individual income tax receipts up 11.3% and corporate income tax receipts up 28.9%. Government expenditures are up 4.5%. Among the major expenditure categories, social security payments and defense spending are up 8.1% and 5.6%, respectively. Interest payments are up a staggering 38.1%.

For a PDF version of this publication, click here: Comerica Economic Weekly, July 15, 2024(PDF, 125 KB)

The articles and opinions in this publication are for general information only, are subject to change without notice, and are not intended to provide specific investment, legal, accounting, tax or other advice or recommendations. The information and/or views contained herein reflect the thoughts and opinions of the noted authors only, and such information and/or views do not necessarily reflect the thoughts and opinions of Comerica or its management team. This publication is being provided without any warranty whatsoever. Any opinion referenced in this publication may not come to pass. We are not offering or soliciting any transaction based on this information. You should consult your attorney, accountant or tax or financial advisor with regard to your situation before taking any action that may have legal, tax or financial consequences. Although the information in this publication has been obtained from sources we believe to be reliable, neither the authors nor Comerica guarantee its timeliness or accuracy, and such information may be incomplete or condensed. Neither the authors nor Comerica shall be liable for any typographical errors or incorrect data obtained from reliable sources or factual information.